33

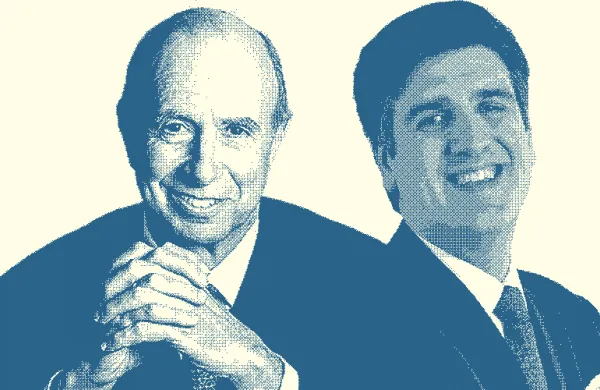

Andrew McCormack

General Partner

Valar Ventures Management

Five-year-old Valar Ventures Management takes its name from Middle-earth (home to the Valar, the godlike creatures in The Lord of the Rings), but it is an occupant of what general partner Andrew McCormack calls the Peterverse — the sphere of high-tech investing icon Peter Thiel, whose claims to fame include co-founding PayPal in 1998 and data analytics pioneer Palantir Technologies in 2004. Thiel also co-founded and remains a close adviser to New York–based Valar. “Because of a lot of the things that he’s done, we end up seeing a lot of fintech,” says McCormack, 39, who left Yahoo in 2000 for PayPal ahead of its IPO and 2002 sale to eBay. After helping to launch Thiel’s Clarium Capital Management hedge fund firm and taking a side trip into the restaurant business, McCormack in 2008 joined holding company Thiel Capital, whose chief operating officer and general counsel, former Skadden, Arps, Slate, Meagher & Flom attorney James Fitzgerald, is Valar’s other founding partner. Valar seeks out technology innovators that McCormack describes as “undervalued by their geography” — meaning, they are outside Silicon Valley. The firm’s first investment, in 2010, was in New Zealand accounting-software-in-the-cloud service Xero. More-recent ones include peer-to-peer currency marketplace TransferWise, also backed by Andreessen Horowitz (see Marc Andreessen, No. 12); Berlin mobile bank Number26; and, outside fintech, photography site EyeEm Mobile. Along with Citi Ventures (see Vanessa Colella, No. 17), Valar in September closed a $4 million seed round for Trading Ticket, an enabler of stock trades through websites and apps, whose CEO, Nathan Richardson, is a former general manager of Yahoo Finance. “What they’re doing is particularly timely in this world of ad blockers and diminished ability to monetize content through advertising,” McCormack says.

The 2015 Fintech Finance 35

& James Robinson IV RRE Ventures

Evercore Partners

Bain Capital Ventures

Financial Technology Partners

General Atlantic |

Brad Bernstein FTV Capital

Anthemis Group

Goldman Sachs Group

Ribbit Capital

Nyca Partners |

Partnership Fund for New York City

Andreessen Horowitz

Digital Currency Group

Banco Bilbao Vizcaya Argentaria

Santander InnoVentures |

AXA Strategic Ventures

Citi Ventures

Credit Suisse NEXT Fund

SenaHill Partners

Bill & Melinda Gates Foundation |

Accion International

Marlin & Associates

CME Ventures

Illuminate Financial Management

Life.SREDA |

Innotribe SWIFT

Barclays

UBS

& Vincenzo La Ruffa Aquiline Capital Partners

REDI Holdings |

Startupbootcamp FinTech

Bloomberg Beta

Valar Ventures

Innovate Finance

FinTech Hong Kong |

| |