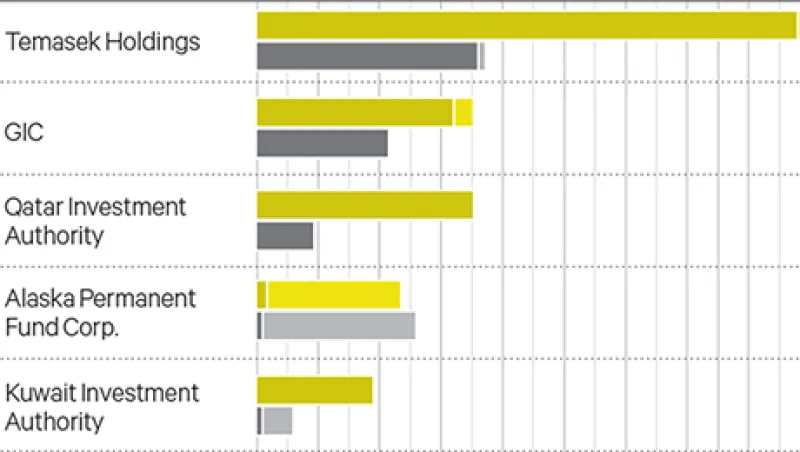

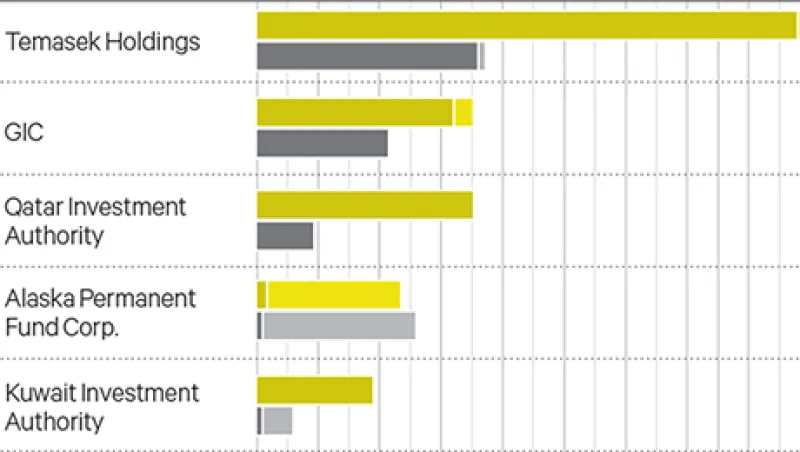

Do Sovereign Fund Direct Private Investments Deliver Value?

As sovereign funds boost direct private equity and venture capital investment, new research suggests that they may be missing out on returns.

Jess Delaney

March 24, 2015