There’s a new buzz sweeping through emerging markets. Fundamentals are improving, and valuations look attractive. Returns and flows are showing signs of life. For investors who have been underweight, emerging-markets assets now look very tempting.

From Peru to the Philippines, today investors can find an array of countries, companies and currencies that offer promising return potential. Before jumping back in, however, it’s important to consider what has changed after several tough years.

In the past, investors could succeed by riding the so-called beta trade, as emerging-markets equities and fixed income delivered powerful returns over time. Today, though, without a rising tide to lift all boats, investors can no longer rely on a broad market recovery to drive returns. As a result, we at AB think it’s essential to stay active in emerging markets and take a highly selective approach to creating portfolios that can deliver long-term outperformance. It’s also important to move away from emerging-markets benchmarks, which are backward-looking and don’t reflect the most promising future investment opportunities.

Stocks and bonds have both recovered sharply in 2016. During the first eight months of the year, the MSCI emerging-markets index advanced by 14.8 percent, outpacing developed equities. In fixed income, the J.P. Morgan emerging-market bond index rose by 14.6 percent over the same period. After the large net outflows in 2015, investors have been adding money to emerging-markets funds again in 2016. Asset allocation funds have started to gradually increase their exposure to emerging markets — and for good reasons. They are:

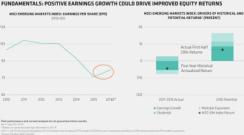

• Overall GDP growth across emerging markets has slowed from the breakneck pace of several years ago but appears to have stabilized. Commodity prices have started to rebound, helping support more resource-dependent countries. Corporate earnings are forecast to grow by 6 percent in 2016 (see chart 1), according to consensus estimates, versus flat or negative growth in many developed markets. Earnings growth is already playing a big role in this year’s equity rebound.

• Inflation remains well contained in most emerging economies, and the recent stabilization of exchange rates could provide room for additional stimulus.

• Current-account positions are improving from the lows seen in 2013.

• Political risks can’t be overlooked, but there are encouraging changes taking place in various countries, such as Brazil, Argentina and India, that should further boost investor sentiment.

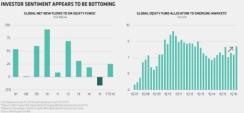

Investors are paying attention to these improvements. Following the outflows in 2015, new capital has started to flow back to both stock and bond funds that focus on the developing world. Still, most global investors remain underweight, after reducing their allocation to emerging equities in recent years (see chart 2).

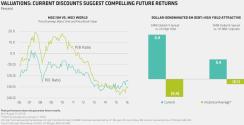

Attractive valuations are providing another catalyst to boost exposure. Emerging-markets stocks are trading at a 24 percent discount to global developed stocks based on price-earnings value (see chart 3). Credit spreads for high-yield debt in emerging markets are now 0.9 percent higher than spreads for U.S. high-yield, and the spread on investment-grade emerging-markets debt is now 0.4 percent more than it is for U.S. triple-B-rated corporates.

For investors seeking to capitalize on the long-term growth and dynamism of emerging markets, we believe that equities offer the best return potential. At the same time, emerging-markets debt also offers solid excess return potential and can play an important role in investor allocations, given the challenges facing developed-market sovereign debt and investment-grade credit.

In equities, investors can choose from a spectrum of strategies. Low-volatility strategies can help investors generate long-term outperformance by mitigating the downside in falling markets, enabling them to stay invested over the long term through turbulent episodes. Strategies that focus on high-growth companies can provide powerful earnings compounding benefits by positioning to profit from tomorrow’s growth drivers — while avoiding stocks and countries that were beneficiaries of yesterday’s growth. And a multiasset approach can make active trade-offs between stocks, bonds and currencies, generating attractive risk-adjusted returns over time by tapping into the widest opportunity set.

No matter which approach an investor chooses, we believe that it’s important to focus on high-conviction managers who aren’t constrained by a benchmark. For bond investors, the best results come when a portfolio’s horizons are expanded beyond traditional benchmark limits to allow global multisector investing across the rating spectrum and across currencies.

In equities, the MSCI emerging-markets index is dominated by countries that are growing slower than average. South Korea and Taiwan — two fairly mature economies — together account for more than one quarter of the total benchmark. Benchmarks of countries including Brazil, China and Russia are heavily skewed toward state-owned companies, which often suffer from poor corporate governance and heavy government intervention. We believe that moving away from the benchmark can afford investors the opportunity to identify the most promising holdings among thousands of diverse investment candidates, from a Colombian bank to a South African media group to a Chinese education company.

Emerging markets present exciting opportunities for investors today. Investing success requires that asset managers develop unique macroeconomic, industry and country insights based on an understanding of how developing economies and countries fit into an increasingly integrated global economy. With these guiding principles in mind, we believe that investors can gain the confidence to increase their exposure to emerging markets — and maximize the potential benefits of a developing recovery.

Morgan Harting is the lead portfolio manager for multiasset income strategies, Shamaila Khan is portfolio manager of emerging-markets corporate debt, Laurent Saltiel is CIO of international large-cap growth and emerging-markets growth, and Sammy Suzuki is portfolio manager for emerging-markets core equities; all at AB in New York.

See AB’s disclaimer.

Get more on emerging markets.