This blog is part of a new series on Institutional Investor entitled Global Market Thought Leaders , a platform that provides analysis, commentary, and insight into the global markets and economy from the researchers and risk takers at premier financial institutions. Our first contributor in this new section of Institutionalinvestor.com is AllianceBernstein, who will be providing analysis and insight into equities.

Fundamental analysis goes to the heart of stock selection, but when the market is driven by macroeconomic or political considerations—the situation today—it works less well.

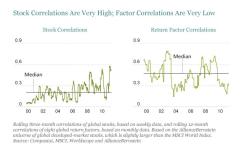

Most stocks continued to rise and fall in tandem in October, whether they were newly discovered traditional bargains or casualties of the European sovereign-debt crisis and US fiscal woes. Stock-pair correlations among global stocks were in the 0.5 range at the end of October, versus a norm of less than 0.2 (Display).

But dig down a layer, and you’ll find that the returns for certain stock characteristics—such as their valuations, price trends, earnings-growth trajectories, analysts’ earnings revisions and profitability—were weakly correlated.

During the early days of the 2008 financial crisis, these so-called return factors, like the stock correlations themselves, tended to march to the same tune. But over the past couple of years, these factors have instead been marching to their own drummers—meaning they have been far less correlated than usual.

This may seem to suggest that there is ample opportunity to outperform by selecting the best-performing factors. But such an endeavor is fraught with risk, because factor leadership can change abruptly—as it did this year.

Investors were so anxious during the first nine months of the year that most of the stock characteristics that over the long term have presaged outsize performance had perverse results: Stocks with bargain prices, superior earnings growth, and even strong price momentum, underperformed. On the other hand, stocks with below-market volatility, rich dividend yields and high profitability were being rewarded far more than usual.

The situation did not totally reverse in the October rally, but return factors behaved more normally, as hopes grew—at least for a time—for political and policy solutions to the European sovereign-debt crisis.

Similarly, some of the worst-performing sectors in the earlier part of the year—almost all of them economically sensitive, such as industrials and materials—were the winners in October. Meanwhile, September’s “safe havens,” such as utilities and consumer staples, lagged.

Perhaps, you might say, the prized and shunned factors (and sectors) simply switched places, and if so, investors should concentrate on stocks with the factors that have traditionally done best.

Not so fast. October may have produced a red-letter rally, but volatility remains disconcerting, with markets rising and falling in response to various US and European political developments. How many investors are confident that the market has found its footing again? Not many, as the market volatility in November shows. Count us in the ranks of the less than confident.

In our view, it is wiser to diversify your holdings to gain exposure to stocks with a wide range of characteristics, including some that are paying off meagerly now. This is a time to embrace diversification—by sector, geography, style and stock characteristics. It’s a time to tread carefully when it comes to taking risk.

When conditions and sentiment improve, stock return factors are likely to behave more normally. But perhaps the biggest lesson of the past few years is that even in more normal times, investors should diversify their overall portfolios broadly across risk and return factors.

The views expressed herein do not constitute research, investment advice, or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-managerment teams.

Andrew Y. Chin is Global Head of Quantitative Research and Investment Risk Management at AllianceBernstein portfolio-management teams.