The real estate landscape has undergone dramatic shifts in recent years, with rising capital costs, lingering challenges in the office sector, and the rapid ascent of alternative property types reshaping investor strategies. Against this backdrop, institutional investors are rethinking how to position portfolios for resilience and growth.

Institutional Investor sat down with Brooks Monroe, Managing Director, Client Portfolio Manager at Invesco, sharing insights into the evolving market cycle, the increasing role of real estate debt, and the secular themes driving opportunities across demographics, technology, and global diversification. From navigating risks to capturing modern tenant demand, Monroe offers a forward-looking perspective on real estate’s place in institutional portfolios.

Institutional Investor: Given the slow recovery in core real estate, particularly due to challenges in the office sector, what sectors or strategies within real estate do you see as most attractive for institutional investors in the coming years?

Brooks Monroe: Real estate has re-priced, and we appear to be in the early stages of a new market cycle. The real estate down cycle that we've experienced over the last few years was largely driven by capital markets as the cost of capital sharply increased. Outside of office, real estate supply and demand fundamentals have actually remained reasonably healthy. Values are bottoming out and beginning to recover in most sectors. Although it's impossible to time the market, I think real estate should be in an attractive position moving forward for institutional investors with long-term investment horizons. Starting yields are much higher today than they were a few years ago. Fundamentals appear to be supportive of healthy cash flow growth and liquidity within the market has improved meaningfully. So, the foundation for a recovery is in-place, which provides a potentially compelling opportunity to take advantage of secular growth trends that are impacting a variety of different property sectors.

II: How are you positioning your portfolio to capitalize on opportunities in alternative real estate sectors, such as data centers, life sciences, or logistics, and what are the key risks to watch in these areas?

Brooks Monroe: Although alternative real estate sectors are now beginning to get more broad-based attention, we've been focused on several of those sectors for quite some time. A significant amount of our firm's global investment activity over the last several years has been outside of the traditional property types. Secular trends within demographics and tech have driven several of our high conviction themes regionally, such as manufactured housing in the US, student housing in Europe and senior living in Asia Pacific to highlight a few. These are areas where we've forecasted and ultimately observed very favorable supply demand dynamics and at times an under representation of capital. Operational expertise is routinely critical to business plan execution in many of these alternative sectors. Importantly for us, we're often investing in these opportunities and alternative sectors through specialty operating companies that we've integrated into our firm's platform. Many of those are owned directly by our commingled funds, so that our clients are benefitting from the enterprise value that their capital is helping to create.

II: With private credit gaining traction as an alternative investment, how does real estate—particularly real estate debt—compare in terms of risk-adjusted returns and diversification benefits for institutional portfolios?

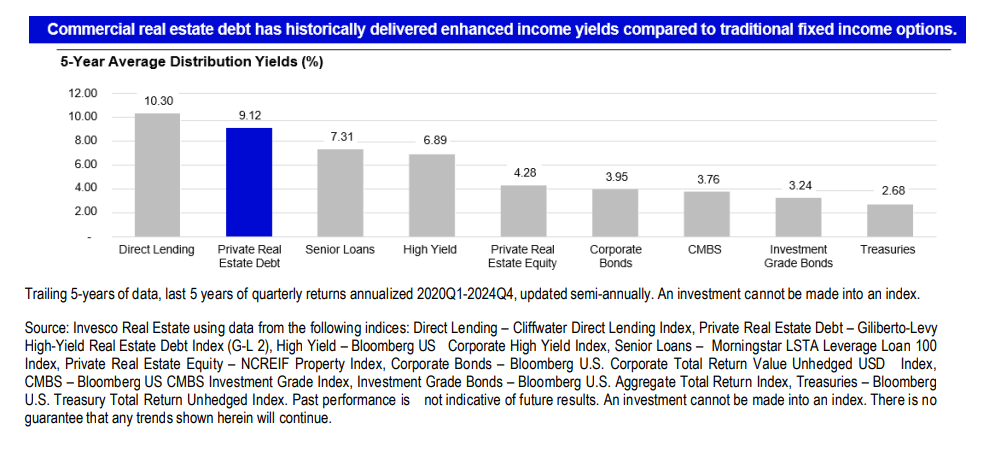

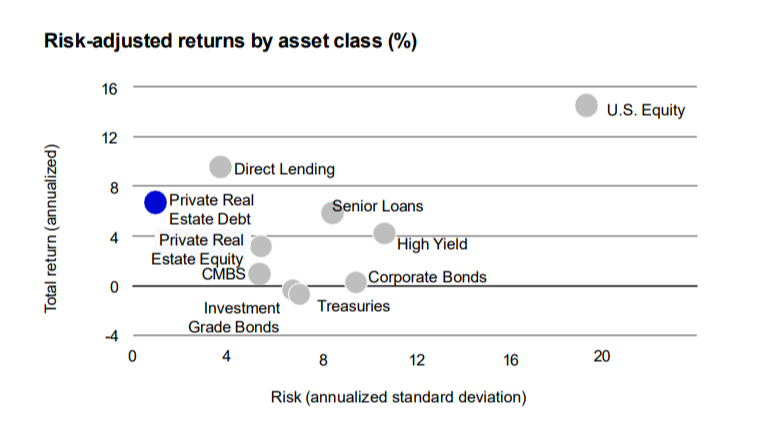

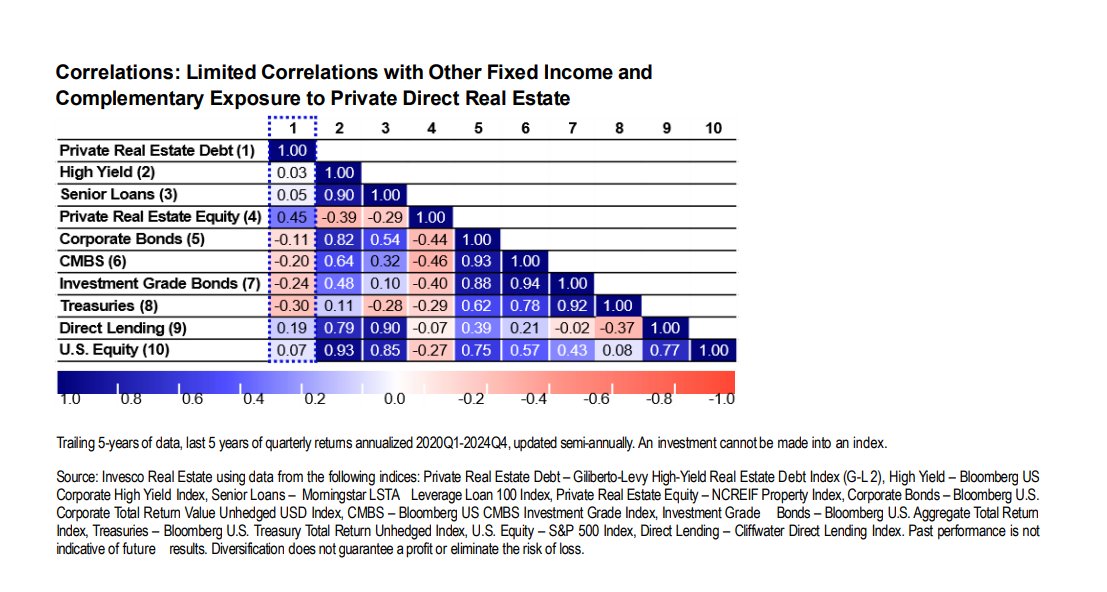

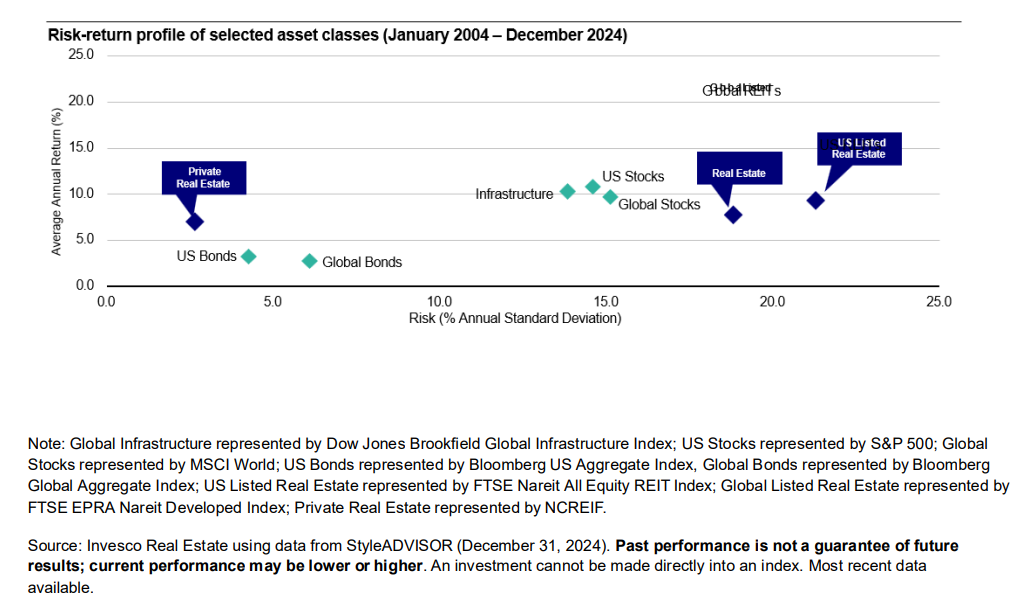

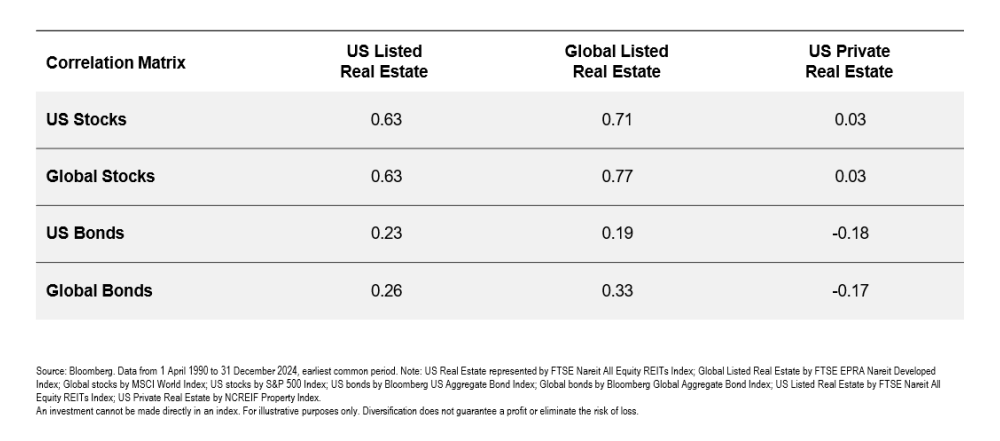

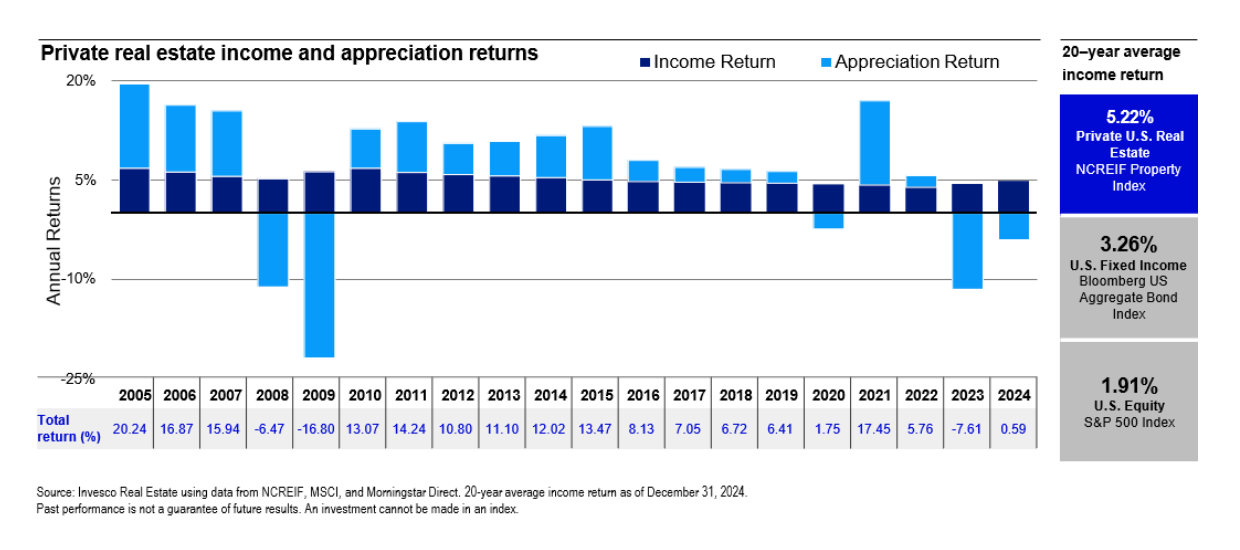

Brooks Monroe: Historical performance data for real estate debt actually screens very well on a risk-adjusted basis relative to other asset classes, including direct lending. Real estate debt can provide attractive and complementary performance characteristics for institutional portfolios, such as premium yields, attractive Sharpe ratios, and limited correlations with other traditional FI sectors1. Real estate debt, however, has not quite received the adoption velocity that private credit has in recent years, despite the fact that the commercial real estate debt sector is the 4th largest income asset class globally 2. However, many institutional investors are increasingly open to learning about real estate debt and how it can provide day one income yields that could meet or potentially exceed their plan’s expected rate of return with potentially significant value insulation, low volatility and low correlations to their real estate equity and broader credit portfolios.

II: What trends are you seeing in real estate debt markets and how can institutional investors take advantage of dislocations or distress in the space?

Brooks Monroe: The last few years have been a great time to be a real estate lender. The combination of regulation induced retrenchment from traditional lenders, increased base rates, valuation resets, and record loan maturities has delivered incredible deal flow and attractive relative value. Although some refer to the recent environment as the golden age of credit, we view real estate debt as a strategic allocation within institutional portfolios rather than purely tactical.

Additionally, there are current improvements that are well underway in terms of benchmarking quality, investor access and optionality that are helping to remove some of the historical barriers for institutional investors in this space.

II: In light of evolving tenant preferences and technological advancements, how are you assessing the long-term viability and value creation potential of non-core real estate assets?

Brooks Monroe: A disproportionate amount of tenant demand and capital demand is commanded by high quality, highly differentiated real estate assets that are specifically curated for modern demand. That's not a new trend, but accelerations in demand evolution and tech advancement have certainly raised the bar in terms of tenant expectations. It’s also created a tremendous opportunity for assets that meet modern space requirements, including an evolving and expanding set of physical, locational and experiential attributes. When we evaluate value creation potential, we focus on business plan execution strategies that ultimately produce modern core assets. We aggressively avoid assets with incurable obsolescence, current or future. Sometimes we hear institutional investors overgeneralize the use and risk association of broad terms like “development” and “repositioning”. The inherent risk profiles are deeply nuanced and sometimes casually misinterpreted. We would advocate that appropriately structured positions within development can represent a better risk adjusted return profile than a large scale renovation project with a long dated business plan. Our firm's 30 plus years of development experience supports that thesis, and we will continue to lean into unique development opportunities that produce high quality modern assets and ultimately create real value.

II: What role do you see real estate playing in institutional portfolios as a hedge against inflation and market volatility, especially as traditional core assets face headwinds?

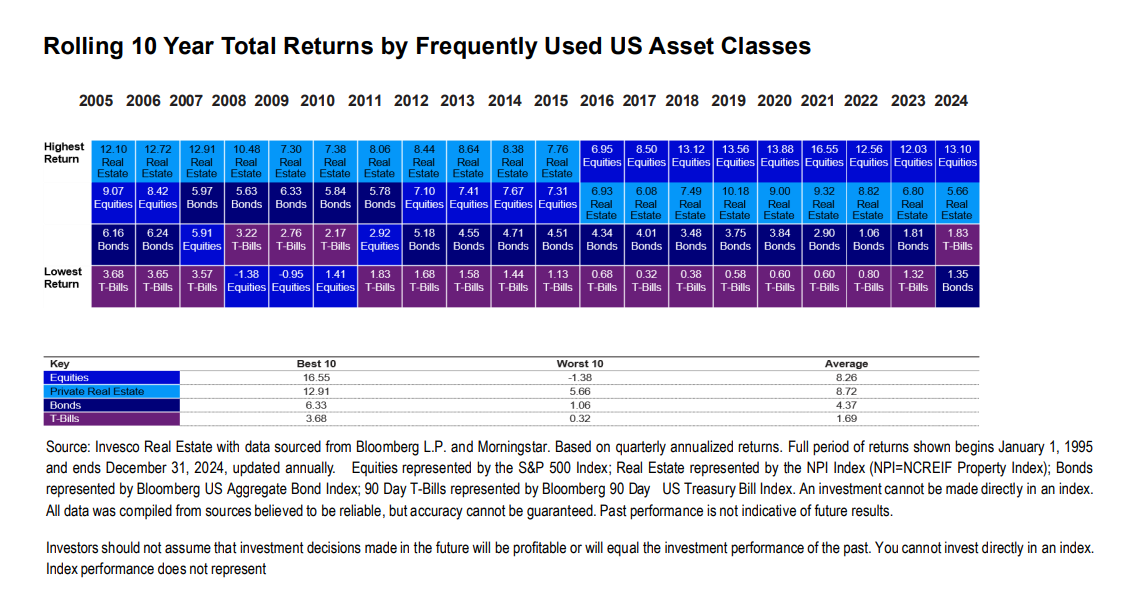

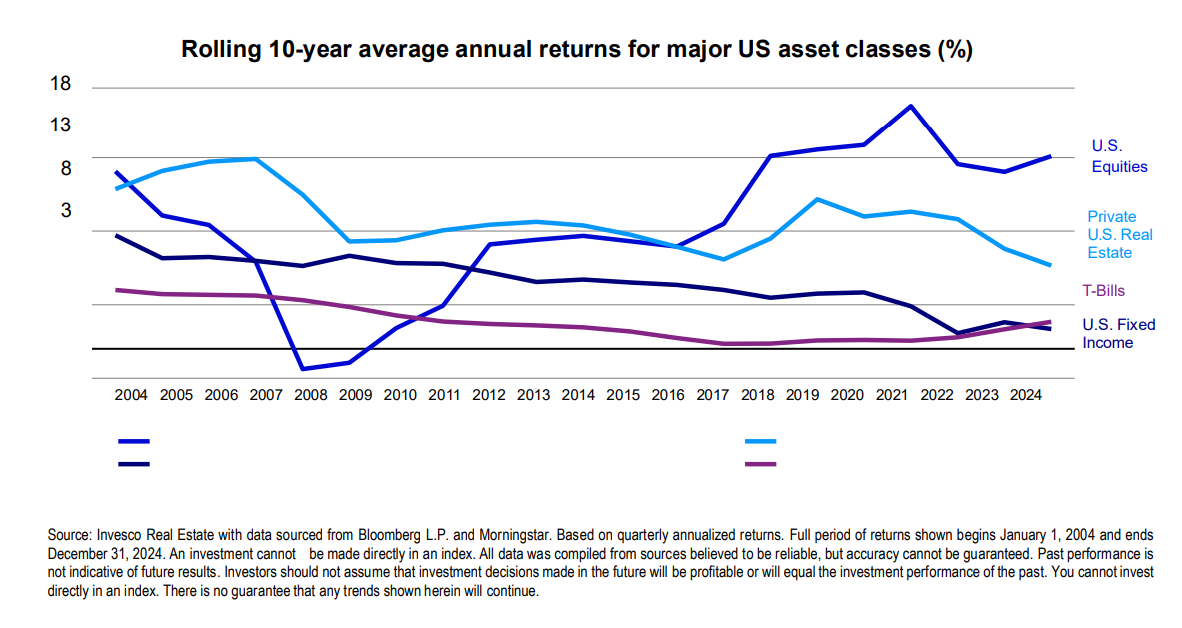

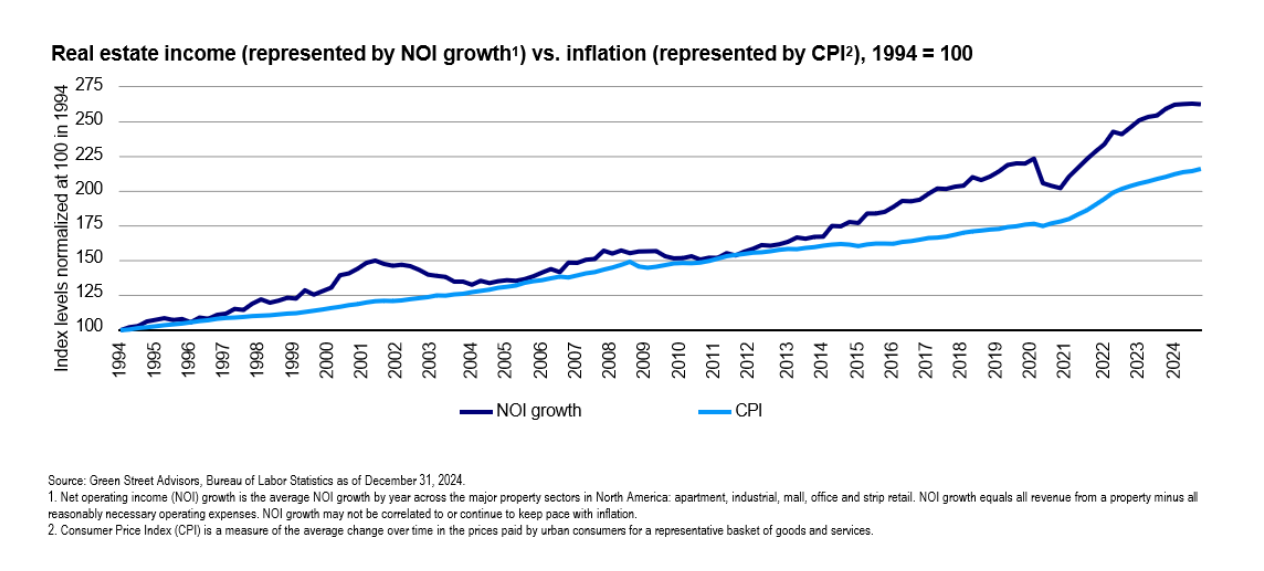

Brooks Monroe: Over the last 30 years, real estate net operating income growth has consistently maintained or exceeded the pace of CPI growth, and it's generated a .03 correlation to U.S. equities and a negative correlation to U.S. bonds 3. I think private real estate is well positioned today to continue to play the same roles that it has for institutional investors for the last few decades, providing premium income yields, very low correlations, effective inflation hedging and total returns that fall somewhere between equities and fixed income over long time periods4. What's slightly different today is that investors have an expanded toolbox of options to build a real estate portfolio that appropriately serves the specific goals underpinning their real estate allocations, and each investor is slightly unique. What's also different today is that the underpinnings of secular demand themes have evolved and modernized, and it's critical that your real estate investments are positioned accordingly.

1 Please see the support under the “Supporting figures” section in the disclosures.

2 Source: SIFMA Q3 2024 for Treasury, Corporate, Municipal $’s Outstanding. U.S. Board of Governors of the Federal Reserve System (Z.1 Financial Accounts of the United States) Q3 2024 for US MBS $’s Outstanding and Commercial Real Estate Loans $’s Outstanding (as of March 31, 2025, most recent data available).

3 Source: Invesco Real Estate and Bloomberg as of December 31, 2024. Most recent data available from April 1, 1990 to December 31, 2024, earliest common period.

4 Please see the support under the “Supporting figures” section in the disclosures.

Investment risks

Invesco and Institutional Investor are not affiliates.

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested. Property and land can be difficult to sell, so investors may not be able to sell such investments when they want to. The value of property is generally a matter of an independent valuer’s opinion and may not be realized. Generally, real estate assets are illiquid in nature. Although certain kinds of investments are expected to generate current income, the return of capital and the realization of gains, if any, from an investment will often occur upon the partial or complete disposition of such investment. Investing in real estate typically involves a moderate to high degree of risk. The possibility of partial or total loss of capital will exist.

Investing in commercial real estate assets involves certain risks, including but not limited to: tenants' inability to pay rent; increases in interest rates and lack of availability of financing; tenant turnover and vacancies; and changes in supply of or demand for similar property types in a given market.

Supporting figures

Important information

The marketing communication is intended only for Professional Clients in Continental Europe (defined below) Dubai, Guernsey, Jersey, Ireland, Isle of Man and the UK; for Sophisticated or Professional Investors in Australia; for Institutional Investors in the United States; for Institutional Investors and/or Accredited Investors in Singapore; for Qualified Clients/Sophisticated Investors in Israel; for Professional Investors in Hong Kong; for Qualified Institutional Investors in Japan; for certain specific Qualified Institutions and/or Sophisticated Investors only in Taiwan; for Wholesale Investors (as defined in the Financial Markets Conduct Act) in New Zealand. In Canada this document is for use by investors who are (i) Accredited Investors and (ii) Permitted Clients, as defined under National Instrument 45 106 and National Instrument 31 103, respectively. It is not intended for and should not be distributed to, or relied upon, by the public or retail investors.

For the distribution of this communication, Continental Europe is defined as Andorra, Austria, Belgium, Croatia, Czech Republic, Denmark, Finland, France, Germany, Italy, Luxembourg, Netherlands, Norway, Spain, Sweden and Switzerland.

By accepting this document, you consent to communicate with us in English, unless you inform us otherwise.

This document contains general information only and does not take into account individual objectives, taxation position or financial needs. Nor does this constitute a recommendation of the suitability of any investment strategy for a particular investor. Investors should consult a financial professional before making any investment decisions if they are uncertain whether an investment is suitable for them. Neither Invesco Ltd. nor any of its member companies guarantee the return of capital, distribution of income or the performance of any fund or strategy. This document is not an invitation to subscribe for shares in a fund nor is it to be construed as an offer to buy or sell any financial instruments. As with all investments, there are associated inherent risks. This document is by way of information only. This document has been prepared only for those persons to whom Invesco has provided it. It should not be relied upon by anyone else and you may only reproduce, circulate and use this document (or any part of it) with the consent of Invesco. Asset management services are provided by Invesco in accordance with appropriate local legislation and regulations.

Further information on our products is available using the contact details shown. This is marketing material and not financial advice. It is not intended as a recommendation to buy or sell any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. Views and opinions are based on current market conditions and are subject to change.

These materials may contain statements that are not purely historical in nature but are “forward-looking statements.” These include, among other things, projections, forecasts, estimates of income, yield or return, future performance targets, sample or pro forma portfolio structures or portfolio composition, scenario analysis, specific investment strategies and proposed or pro forma levels of diversification or sector investment. These forward-looking statements can be identified by the use of forward looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” “target,” “believe,” the negatives thereof, other variations thereon or comparable terminology. Forward looking statements are based upon certain assumptions, some of which are described herein. Actual events are difficult to predict, are beyond the Issuer’s control, and may substantially differ from those assumed. All forward-looking statements included herein are based on information available on the date hereof and Invesco assumes no duty to update any forward-looking statement.

Data as of August 21, 2025, unless otherwise stated.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

Australia

This document has been prepared only for those persons to whom Invesco has provided it. It should not be relied upon by anyone else. Information contained in this document may not have been prepared or tailored for an Australian audience and does not constitute an offer of a financial product in Australia.

You may only reproduce, circulate and use this document (or any part of it) with the consent of Invesco.

The information in this document has been prepared without taking into account any investor’s investment objectives, financial situation or particular needs. Before acting on the information the investor should consider its appropriateness having regard to their investment objectives, financial situation and needs.

You should note that this information:

- may contain references to dollar amounts which are not Australian dollars;

- may contain financial information which is not prepared in accordance with Australian law or practices;

- may not address risks associated with investment in foreign currency denominated investments; and

- does not address Australian tax issues.

Issued in Australia by Invesco Australia Limited (ABN 48 001 693 232), Level 26, 333 Collins Street, Melbourne, Victoria, 3000, Australia which holds an Australian Financial Services Licence number 239916.

New Zealand

This document is issued only to wholesale investors (as defined in the Financial Markets Conduct Act) in New Zealand to whom disclosure is not required under Part 3 of the Financial Markets Conduct Act. This document has been prepared only for those persons to whom it has been provided by Invesco. It should not be relied upon by anyone else and must not be distributed to members of the public in New Zealand. Information contained in this document may not have been prepared or tailored for a New Zealand audience. You may only reproduce, circulate and use this document (or any part of it) with the consent of Invesco. This document does not constitute and should not be construed as an offer of, invitation or proposal to make an offer for, recommendation to apply for, an opinion or guidance on Interests to members of the public in New Zealand. Applications or any requests for information from persons who are members of the public in New Zealand will not be accepted.

Issued in New Zealand by Invesco Australia Limited (ABN 48 001 693 232), Level 26, 333 Collins Street, Melbourne, Victoria, 3000, Australia which holds an Australian Financial Services Licence number 239916.

Singapore

This advertisement has not been reviewed by the Monetary Authority of Singapore.

This document may not be circulated or distributed, whether directly or indirectly, to persons in Singapore other than (i) to an institutional investor under Section 304 of the Securities and Futures Act (the “SFA”), (ii) to a relevant person pursuant to Section 305(1), or any person pursuant to Section 305(2), and in accordance with the conditions specified in Section 305 of the SFA, or (iii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA.

This document is for the sole use of the recipient on an institutional offer basis and/ or accredited investors and cannot be distributed within Singapore by way of a public offer, public advertisement or in any other means of public marketing.

Issued in Singapore by Invesco Asset Management Singapore Ltd, 9 Raffles Place, #18-01 Republic Plaza, Singapore 048619.

Hong Kong

This document is only intended for use with Professional Investors in Hong Kong.

Issued in Hong Kong by Invesco Hong Kong Limited 景順投資管理有限公司, 45/F, Jardine House, 1 Connaught Place, Central, Hong Kong.

Japan

This document is only intended for use with Qualified Institutional Investors in Japan. It is not intended for and should not be distributed to, or relied upon, by members of the public or retail investors.

Issued in Japan by Invesco Asset Management (Japan) Limited, Roppongi Hills Mori Tower 14F, 6-10-1 Roppongi, Minato-ku, Tokyo 106-6114; Registration Number: The Director-General of Kanto Local Finance Bureau (Kin-sho) 306; Member of the Investment Trusts Association, Japan and the Japan Investment Advisers Association, and/or 2) Invesco Global Real Estate Asia Pacific, Inc., Roppongi Hills Mori Tower 14F, 6-10-1 Roppongi, Minato-ku, Tokyo 106-6114. Registration Number: The Director-General of Kanto Local Finance Bureau (Kin-sho) 583; Member of the Investment Trusts Association, Japan and Type II Financial Instruments Firms Association.

Taiwan

This material is distributed to you in your capacity as Qualified Institutions/Sophisticated Investors. It is not intended for and should not be distributed to, or relied upon, by members of the public or retail investors.

Issued in Taiwan by Invesco Taiwan Limited, 22F, No.1, Songzhi Road, Taipei 11047, Taiwan (0800-045-066). Invesco Taiwan Limited is operated and managed independently.

United States

Issued in the US by Invesco Advisers, Inc., 1331 Spring Street NW, Suite 2500, Atlanta, GA 30309 USA.

Canada

In Canada this document is for use by investors who are (i) Accredited Investors and (ii) Permitted Clients, as defined under National Instrument 45 106 and National Instrument 31 103, respectively. It is not intended for and should not be distributed to, or relied upon, by the public or retail investors. All material presented is compiled from sources believed to be reliable and current, but accuracy cannot be guaranteed. Issued in Canada by Invesco Canada Ltd., 16 York Street, Suite 1200, Toronto, Ontario M5J 0E6.

Continental Europe, Dubai, Guernsey, Jersey, Isle of Man, Israel, Ireland and the UK

This is marketing material and not financial advice. It is not intended as a recommendation to buy or sell any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. Views and opinions are based on current market conditions and are subject to change.

Israel

This document may not be reproduced or used for any other purpose, nor be furnished to any other person other than those to whom copies have been sent. Nothing in this document should be considered investment advice or investment marketing as defined in the Regulation of Investment Advice, Investment Marketing and Portfolio Management Law, 1995 (“Investment Advice Law”). Neither Invesco Ltd. nor its subsidiaries are licensed under the Investment Advice Law, nor does it carry the insurance as required of a licensee thereunder.

Further information is available using the contact details shown. Issued in:

Andorra, Austria, Belgium, Croatia, Czech Republic, Denmark, Dubai, Finland, France, Germany, Guernsey, Italy, Ireland, Isle of Man, Israel, Jersey, Luxembourg, Netherlands, Norway, Spain, Sweden, Switzerland and The United Kingdom by Invesco Management S.A., President Building, 37A Avenue JF Kennedy, L-1855 Luxembourg, regulated by the Commission de Surveillance du Secteur Financier, Luxembourg; Invesco Asset Management Limited, Perpetual Park, Perpetual Park Drive, Henley-on-Thames, Oxfordshire RG9 1HH, UK. Authorised and regulated by the Financial Conduct Authority; Invesco Asset Management (Schweiz) AG, Talacker 34, 8001 Zurich, Switzerland. Invesco Asset Management Limited, Index Tower Level 6 - Unit 616, P.O. Box 506599, Al Mustaqbal Street, DIFC, Dubai, United Arab Emirates. Regulated by the Dubai Financial Services Authority.

GL4834675