The world’s emergence from a historic pandemic hasn’t been a panacea for economic growth or stability. With war still raging in Ukraine, China-U.S. relations still unnervingly icy, and recession fears still escalating in many areas of the globe, analysts are watching closely for signs of eroding investor confidence in stock markets. Indeed, it would be logical to assume that most institutional investors are harboring a gloomy outlook for equities through 2024 and beyond, even if actions to grab lingering upside still lean bullish.

But a recent survey of more than 300 global CIOs, portfolio managers, and other investment decision makers strongly suggests the opposite. Their responses fortify the perspective that many institutional investors are broadly optimistic about equity performance over the next 18 months.

The survey – Global Equity Markets: The Near-Term and Mid-Term Outlook Amid Inflation, Rising Rates, Global Conflict, and Pandemic Recovery – was conducted by Institutional Investor’s Custom Research Lab and equities-based financing firm, EquitiesFirst, in February and March, fielding responses from investment decision makers at asset-owning institutions in North America, Europe, and the Asia-Pacific region on a variety of issues involving their expectations, strategies, and fears for equity investing going forward.

While this article will highlight key findings, the full survey report provides a more detailed examination of why institutional investors feel their equity holdings are poised to perform well amid the formidable economic and geopolitical challenges that dominate headlines daily.

As shown in the charts taken from the survey report, the respondents were separated into six subgroups based on their investment regions of focus, which include global, North American, European developed, European emerging, Asia-Pacific developed, and Asia-Pacific emerging markets. Naturally, the specific geographic zones that the respondents invest in tended to influence their survey responses – and often significantly so.

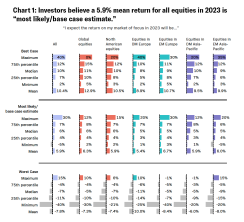

Investors expect 5.9% equities return in 2023

Perhaps most saliently, the survey shows that most equity investors expect to recover a healthy portion of the double-digit losses they endured in 2022. The respondents (who collectively manage an estimated $8.5 trillion in assets) believe, in the aggregate, that the developed markets of North America, Europe, and Asia-Pacific will see equities deliver mean returns of 5.9% in 2023 (with an upside average of 8.9% to 10.5% and downside of -6% to -10%; see chart 1). Not surprisingly, they see somewhat greater potential in the emerging markets of Europe and Asia-Pacific, where they expect stock returns to average 6.7% (with an upside of 10.7% and -downside of -8.4%) and 6.0% (with an upside of 9.9% and downside of -8%), respectively.

Bullish on tech and health care

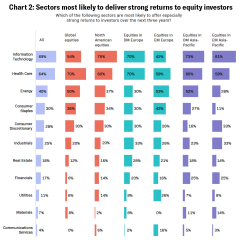

When asked about sectors they view as most promising, the investors surveyed are clear in their favor of information technology and health care. More than two-thirds of all respondents (69% and 64%, respectively) cite these two industries as “most likely to offer especially strong returns to investors over the next three years.” (See chart 2.)

Only investment decision-makers focusing on global equities and European emerging markets differ noticeably in their enthusiasm for I.T., with lower-but-still-considerable percentages (of 54% and 42%, respectively) citing the tech sector as offering the best return potential over the next 36 months.

Perhaps predictably, investors in those two subgroups expect the energy sector to prove especially strong in the coming years. In fact, the percentage of respondents in each subgroup that cite this sector as most promising roughly equal and exceed (respectively) the percentages that agree with their peers worldwide that I.T. stocks are the top choice.

Investors in two other subgroups, developed markets and emerging markets in Asia-Pacific, also voice a clear fondness for energy stocks – though their greater zeal for the I.T. and health care sectors is consistent with the consensus that equities in these two industries are poised to outperform all others through early 2026.

“Health care is going to be a big sector because of demographic shifts and expanding access in developing countries,” says the head of equities at an Australian pension interviewed for the study report. “Indeed, some parts of the health care segment are likely to outperform the IT sector.”

The survey also identifies the equity sectors that most institutional investors think will stagnate or flop clearly over the next three years. Specifically, chart 2 shows that comparatively few survey respondents believe stocks in real estate, financials, utilities, materials, and communication services will deliver attractive returns in that timeframe.

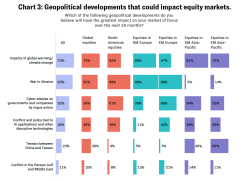

Biggest worries: Climate, war, and cyber-attacks

Institutional investors remain wary of the severe risks and hurdles that world economies face in the coming years. When asked which geopolitical issues would have the greatest impact on equity performance in the next 18 months, a majority of investors named “impacts of global warming/climate change” (70%), “war in Ukraine” and (65%), and “cyber-attacks on governments and companies by rogue actors” (52%) as their greatest concerns. (See chart 3.)Secondly, when asked which macroeconomic factors would be most likely impact stocks in the same period, most respondents’ chose the expected culprits. Across all investors, 63% cited inflation, the same percentage (63%) identified “interest rates/cost of capital,” and 47% named “trade relations and tariffs.”

“The depth of the economic slowdown in the U.S. and Europe and how interest rates affect earnings is the big issue now,” says a CIO in Asia-Pacific, one of six sources at asset management firms, pensions, and insurers for the survey report. “How aggressive the U.S. Federal Reserve needs to be to bring inflation under control will be a key macro-driver. It’s a growth slowdown, particularly in earnings, versus monetary control of inflation.”

As for investor worries regarding trade relations and tariffs, the relationship between China and the U.S. assuredly looms large in these concerning. “We are watching very closely how the U.S. and China are each building their own ecosystems around themselves,” says a portfolio manager at an asset management firm in Hong Kong interviewed for the survey report. “The U.S. is seeking markets in Western Europe, Japan, Korea, and elsewhere. Likewise, China is doing the same thing in the Middle East, Russia, and Iran.” However, he adds, even if relations between the two countries continue to deteriorate, he doesn’t foresee a “full decoupling” due to mutual need to continue trading with each other. “The U.S. needs China for the cheap goods, and China needs American technology,” he says.

On the plus side, investors are also keenly aware that the same geopolitical and macroeconomic factors that pose the biggest risks to their stock holdings can also be powerful allies, when they create disruption and open opportunities that the savviest (or best positioned) companies can capitalize on to gain competitive advantages.

The specific disruption and opportunities – even those stemming from common factors – will vary by markets and regions, of course. Climate change provides one example. As Europe aggressively transitions to sustainable energy sources, investors are hoping that many companies in the developed European markets “will emerge with a first-mover advantage as a source of products and services to serve an increasingly environmentally conscious global economy,” the survey report notes. Of course, companies that fail to make a successful transition, fall behind rapidly evolving ESG standards, or manage to gain reputations as bad actors will be at risk of watching competitors vault past them.

“I think investors [are] going to react to individual companies improving their earnings by becoming more sustainable over time, or a successful transition of a company from dirty to clean, or the development of a really innovative offering or management practice,” says the head of equities at the Australian pension. “I think that the reaction to the climate crisis will be based on individual company activity and performance rather than anything else.”

Strategies: Smart-beta, active in EMs, and growth all the way

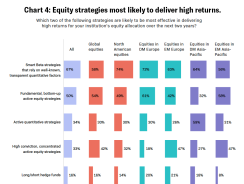

Regarding the specific strategies that institutional investors believe will seize the best opportunities and achieve the highest returns in equities over the next two years, the survey reveals several interesting points. First, 67% of all survey respondents cite a preference for smart beta strategies, or a tilted passive approach which, according to the survey report, is “a hybrid of broad index strategies that have been tuned to market expectations by over-weighting some assets or investment characteristics and under-weighting others.” (See chart 4.)Investment decision-makers that focus on developed markets in North America and Europe are most likely to endorse smart beta strategies, with 74% and 72% citing a preference for them, respectively. Additionally, a clear majority (64%) of respondents that focus on developed Asia-Pacific markets prefer to use smart beta strategies. This tracks with the opinions of investors interviewed for the survey report, who note that tilted-passive approaches can provide low-cost exposure to well-developed markets in these geographies that are highly efficient and see a large trading volume.

In emerging markets, however, the investors surveyed prefer to use active strategies that can better allow them to capitalize on mispriced assets, disruption due to volatility, and other opportunities EMs offer for outsized growth. In fact, almost half (47%) of investors focusing on emerging markets chose “high conviction, concentrated active equity strategies” as their favored approach over the next two years.

“It’s hard to add value in large-cap equities in developed markets with an active stock picking strategy,” says a foundation portfolio manager in North America interviewed for the survey report. “The formula generally for the last ten years has been to invest passively in large-cap equities to keep up with your benchmark, and to invest in satellite positions in small caps and especially in emerging markets.”

As a sign of the optimism and confidence that institutional investors feel for potential equity performance in the coming years, however, one of the most telling findings may be their strong preference for growth strategies. A full 73% of investors believe that growth approach will deliver the strongest returns in the next three years, while less than a quarter (21%) have faith in “index/passive strategies” and just 6% think that value strategies will prevail.

As investors generally flock toward value strategies when they believe economic growth will be lackluster and opportunities scarce, the wide support for growth strategies may be a clear indication of the positive sentiment these respondents have for equity markets through the mid 2020s. More specifically, the survey report notes that the investors’ enthusiasm for growth strategies “may well be tied to optimism about the prospect of a period of sustained economic growth,” as well as the emergence of “new high-growth companies or offerings from well-established innovators that are well positioned to prosper in the years ahead.”

“Remember, value stocks are, by definition, cheap…and one reason they’re underpriced is because they’re over-leveraged [with too much debt],” says a foundation portfolio manager in New York interviewed for the survey report.

Ready to thrive again?

Institutional investors across the globe are bracing for a rocky road ahead, with most economic analysts predicting a nasty slowdown or recession (albeit with varying timing and severity) to strike in the next several quarters. Given these predictions, it is not surprising that nearly half of all survey respondents (48%) say they expect volatility to increase in the next 18 months – and more than a quarter (26%) expect it to increase substantially.However, the survey reveals a strong sentiment among institutional investors that they are not looking to simply endure harsher economic conditions ahead, but rather expect to keep achieving historically attractive stock returns, especially in the I.T. and health care sectors. To attain this, they intend to employ a combination of popular strategies – involving tilted passive approaches in established markets, active management in emerging markets, and a strong penchant for growth investing overall. Several of these approaches will demand methodical allocations to alternatives – including vehicles providing the advantages of equities-based financing – to add stability and diversification, and increase returns while managing risk.

Advantages of equities-based financing

Experience has also proven that volatility can generate attractive investment opportunities – and the survey strongly suggests that equity investors expect to seize these opportunities in 2023 and beyond, using a variety of strategies to gain significant upside amid the stormy conditions widely predicted to be drawing closer. This is just one of the forces driving the growing demand for greater capital and alternative financing among institutional investors.In particular, equities-based financing is a cost-effective, flexible form of capital that many institutional investors utilize to add diversification and stability to their portfolios during volatile periods, as it allows them to monetize long-term holdings and establish minimum valuations (while often returning more than government bonds). For two decades, EquitiesFirst has partnered with investors seeking to gain the benefits of equities-based financing, increasing both their liquidity and income while allowing institutional investors to be nimbler – which can be vital to move into new positions quickly when markets shift.

Learn more about investment opportunities in equities-based financing.