Blu Putnam, CME Group

AT A GLANCE

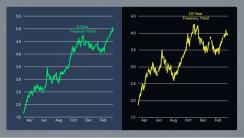

- Inverted yield curves have typically been good recession indicators because they’ve been associated with something big breaking in the financial system

- The largest banks in the system today are much better capitalized than those in the 2008 sub-prime crisis

In 1990, it was the bankruptcy of the savings and loan industry. The S&L business model was to borrow short term from depositors and lend long term for mortgages and to corporations, involving considerable interest rate risk that could not survive an inverted yield curve.

In 2000, it was the “Tech Wreck” on Wall Street. In the 1990s, tech was an emerging sector, and many companies did not yet have reliable earnings, with valuations based as much on hope as anything else. Meanwhile, in 2008, it was the sub-prime mortgage crisis with the breakdown of credit risk analysis in the financial system that triggered the recession.

Now that something has broken – that is, the failure of Silicon Valley Bank, triggered by their large exposure to rising interest rates and their concentration of depositors in the emerging tech sector – recession risk has probably risen, but a recession is not inevitable. The Federal Reserve and the FDIC moved rapidly to contain any domino effect within the financial system. The largest banks in the system are much better capitalized than those during the 2008 sub-prime crisis. Overall, the financial system appears to be managing its interest rate risk quite well.

On net, the job market is still robust. And while the follow through from the SVB episode may lead to slower growth in technology companies with further layoffs, a recession may still be avoided. We should not underestimate the resilience of the U.S. economic system.