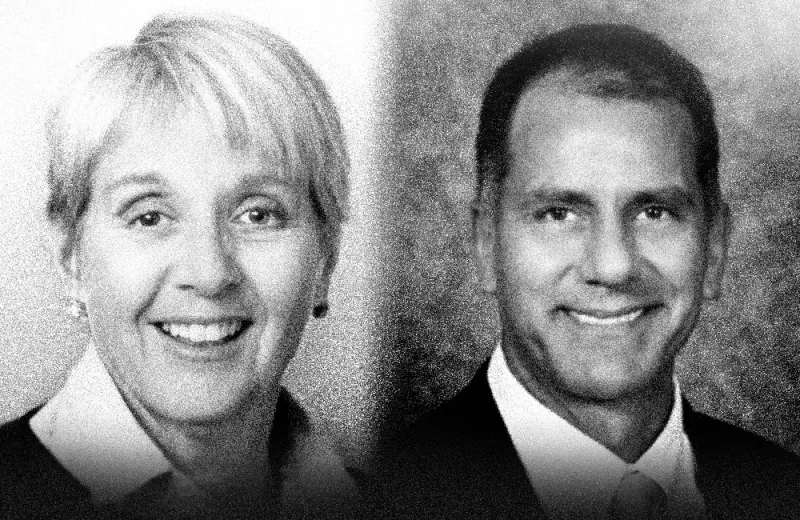

Long-time industry leaders Cynthia Steer and Rip Reeves have been named co-chairs and senior advisors to both the Institutional Investor Institute and the Alternative Investor Institute. The two institutes are flagship memberships featuring live events that bring together the world’s leading asset allocators, asset managers, and consultants. III and AII are curated by Institutional Investor.

Steer is a director and investment chair at MissionSquare Partners and currently serves as a director at ICMA-RC, a financial services company focused on public employees. She is also a senior advisor to Hancock Natural Resources Group, a subsidiary of Manulife focused on forestry, biomass, and agricultural investing. In 2014, she retired from BNYMellon Investment Management, where she was an executive vice president responsible for performance oversight, due diligence, and analysis of investment performance across BNYMellon Investment Management.

Reeves has been chief investment officer and treasurer at AEGIS Insurance Services since 2011. He is retiring from that role in December. Previously, Reeves was the chief investment officer at Argo Group International Holdings. He also worked for 10 years as a senior portfolio manager and asset allocation specialist for insurance at Standish Mellon Asset Management. Prior to that role, Reeves was a senior portfolio manager at Scudder, Stevens & Clark and J.P. Morgan Asset Management.

“Cynthia and Rip bring III and AII deep and expansive knowledge of the asset management business, as well as a broad range of well-established connections within the allocator community — Rip most notably with insurance funds and corporate plans, and Cynthia with endowments and foundations,” says Steve Olson, managing director at Institutional Investor. “They will be employing their reputations as thought leaders, connectors, and expert investors to further engage with allocators and our members on a truly peer-level basis. This double appointment is the latest step forward in our commitment to remain the industry leader in bringing differentiated insights and powerful connections to our most-recognized institutional events businesses.”