Even after massive selloffs in the first half of 2022, some asset managers argue the U.S. is still not the best destination for growth equity investments.

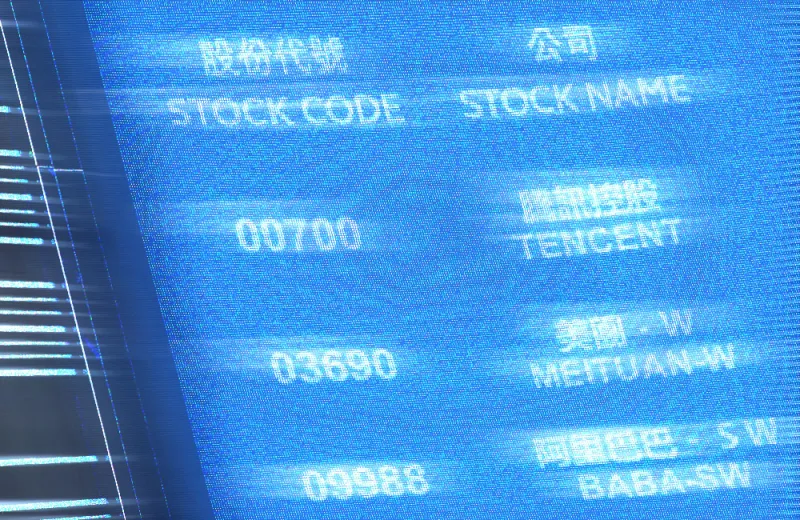

According to New York-based KraneShares, the tech giants are trading at even lower prices in China. The asset manager said the average price-to-earnings ratio of Chinese internet stocks was 17.1 at the end of June. Meanwhile, U.S. internet stocks were trading at an average of 27.6 times earnings.

Neil Desai and Di Yao, portfolio managers at Putnam Investments, have a similar take. “At today’s level, technology valuations [in the U.S.] are close to their long-term average, but in our view, they are not screamingly cheap yet,” they wrote in a July newsletter. The two men added that the true growth opportunities in the second half of 2022 could be Chinese internet stocks.

Their confidence largely stems from the recent easing of the country’s regulatory clampdown, which has contributed to polarizing views of the country on the part of foreign investors. From late 2020 to early 2022, the government enacted sweeping regulation of China’s technology, property, and online education industries, resulting in massive layoffs and a halt in initial public offerings overseas. Short sellers of U.S.-listed Chinese companies made $8 billion in July 2021 alone. In April, however, the Chinese government began to roll back some of those policies after investor redemptions from China funds hit a pandemic high.

“It is true that many high-quality, large-cap internet platform companies [in China] have seen their market valuations halved, and [that these are] arguably trading in value territory,” Desai and Yao wrote. “That said, China is loosening monetary policy, contrary to most other global markets, and could potentially enter an economic expansion cycle in the second half of 2022.”

Desai told II that he doesn’t agree with the view that China has become “uninvestable” due to regulatory reform. “Our exposure [to China] has been increasing,” he said, adding that the internet companies subject to the brutal bloodbath of the past 18 months are “important companies that will survive.” Some of these firms, such as TikTok’s parent company ByteDance, have been even more innovative than their U.S. counterparts, he said.

Brendan Ahern, chief investment officer at KraneShares, sees signs that the regulatory pressures on China’s tech sector have eased significantly. Ant Group, for example, was approved to become a financial holding company in June, almost two years after its failed IPO attempt in October 2020. Sixty video games were also granted publishing licenses last month, although the two biggest mobile game developers — Tencent and NetEase — were excluded from the batch. Still, this trend “is counter to the idea that China is still going through a significant regulatory oversight of internet companies,” Ahern said at a webinar on Tuesday.

But Desai cautions that even as the crackdown abates, there are still risks for investors in China. “The speed and the magnitude of some of the regulatory crackdown took a lot of people by surprise, including us,” he said. It has caused a trust crisis and “an overarching fear” that the same thing might happen to other companies in the future.