By K.T. Arasu, CME Group

AT A GLANCE

- Plans to relocate manufacturing operations to a second or third country could prove costly and complex in face of realities of the pandemic era

- Reshoring of operations needs to consider a variety of challenges from infrastructure to availability of skilled workforce and rising wages in emerging markets

We will look at some of the top factors driving this change.

Tariffs, Russia and Ukraine

Let’s start with the tariffs that were initiated by the U.S. in 2018 that led to businesses and consumers paying more for products imported from countries where the duties were applied. What started out as a trickle with tariffs on $8.5 billion on imports of solar panels and $1.8 billion in washing machines from China snowballed into tariffs on $350 billon of Chinese imports. Tariffs were then imposed on imports of steel and aluminum mostly from Canada, EU, Mexico and South Korea.What we have learned from the tariffs imposed by the different countries – U.S., China, the European Union, Canada, Japan, Mexico and others – is that such measures, once introduced, can remain in place even when the political climate changes. For instance, the Biden administration has yet to remove all of the tariffs that went into effect during the Trump years, although some of the tariffs are being removed in the wake of Russia’s invasion of Ukraine to help reduce inflation pressures.

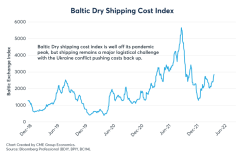

Russia is a major exporter of oil, and food products like wheat. The U.S. ban on Russian oil imports helped rally futures prices to over $100 per barrel and gasoline prices at the pump to over $4 a gallon. The EU, which gets 26% of its oil and 40% of its natural gas from Russia, is considering banning Russian oil imports. The war has also elevated shipping costs that were on their way down after the big spike during the pandemic when demand for manufactured goods surged.

Shipping costs tick higher but are well below pandemic highs

Lessons from the Pandemic

The pandemic has taught us that different approaches to managing COVID-19 have led to very different challenges for supply chains, depending on the location. Specifically, there are vast differences between China’s Zero-Covid policy and the less stringent approaches taken in the U.S. and Europe.Millions of people in China are in lockdowns or have their movements restricted while hundreds of businesses have halted operations as the government tries to contain a new wave of the pandemic. The restrictions come at a time when China’s economic growth has slowed since the last quarter of 2021. By contrast, in the U.S., the mask mandate when traveling in public transportation has been struck down by a U.S. court, and attendance at open events is rising as spring weather coaxes people into going out more - although attendance at public venues still remains far behind pre-pandemic levels.

Strategy is easier than Logistics

From a strategy perspective, companies all over the world are re-thinking their supply chains. Yet, from a logistical perspective, companies are rapidly realizing that shifting supply chains can be arduous. Two important points companies consider when reshoring are maintaining or improving market share, and managing operational costs effectively while trying to improve supply-chain resiliency.Some companies may feel confident they can pass on the extra costs to their clients, but others could be concerned that if a major competitor stays with its old low-cost model, they can grab market share with lower costs. That is, shifting supply chains involves some game theory in terms of what one’s competitors might do.

The Organization of Economic and Co-operation and Development (OECD) said in a report that greenfield investments in emerging markets and developing economies in 2021 were below 2019 levels by 43%. Greenfield is a form of foreign direct investment where a parent company builds its operations from the ground up in another country. The decline in this type of investment reflects the difficulty of moving supply chains.

Challenges to Reshoring Operations

Let’s look at some of the cost and complexity considerations in uprooting a production center from one country to the next, or in setting up a parallel manufacturing center in a second or third country.Input supply: In moving to another country to manufacture a product, a company needs to make sure the country it is relocating to has the raw materials to produce its product. For instance, if you are in the business of making furniture, you’d need to pick a country that has the relevant type of materials to build your furniture. The raw material typically has to be close to where your plant is located, and you’d need to ensure there are proper modes of transportation to get the raw materials into the plant. There also has to be a relatively low-cost workforce to ensure your competitiveness.

Output delivery: How do you get the finished product delivered to your clients? The company needs access to proper roads, rail lines and ports from the new manufacturing site to deliver the products to customers in other countries. Shipping costs from the point of manufacturing to destination markets could also play an important role in setting up new operations in a second or third country.

Dependency on highly specific and single source inputs: Some key inputs to certain manufactured goods are rare or are produced only in a few places. For example, the Republic of Congo is the world’s key producer of cobalt. Manufacturing processes dependent on highly specific inputs from relatively few sources will find it hard to hedge.

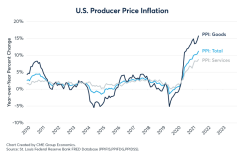

Input cost increases: Input costs (producer prices?) are currently rising more rapidly than the rate of consumer price inflation. This higher cost factor comes at a time when one may want to decrease manufacturing costs. The U.S. Producer Price Index for all final goods and services is running (as of April 2022) at 11% above a year ago, while the goods component of the producer price index is running at a more elevated 16%.

Skilled labor: Reshoring operations depends to a large extent on the availability of a trained workforce, or a pool of workers that can be readily trained in skilled operations. The availability of labor in China has been one of its advantages, but that position is being challenged by emerging nations like Vietnam, Philippines, Bangladesh, Mexico and others.

Wages: Wages are rising in many countries, which also makes the process more expensive and difficult. Higher wages may also be accompanied by a higher probability of labor strife, strikes and stoppages. For example, unions at U.S. West Coast ports are currently negotiating a new labor contract.

Prices paid by wholesalers have been rising

A tight labor market has pushed wages higher

Ability to pass on costs: Companies in different industries will have varying opportunities to pass on costs to their clients, and this will depend in part on their competitive environment. Companies with strong competition and tight margins are much less likely to shift their supply chains unless absolutely essential.

Unrelated, yet simultaneous considerations: Central banks are withdrawing accommodation, which has implications for foreign exchange. The Japanese yen had slumped to a 20-year low against the U.S. dollar amid a divergence in monetary policies between the two countries – the Federal Reserve has raised rates by 75 basis points in two moves since March, while the Bank of Japan is easing monetary policy. The People’s Bank of China is also easing, with the yuan falling to a one-year low against the greenback.

Yuan’s weakness reflects concerns over China’s growth

Bottom line

From a strategy perspective, it remains to be seen whether we are entering a period of de-globalization and economic fragmentation. From a logistics perspective, the process of reshoring operations is difficult, complex, takes years and is costly, with a relatively high risk to capital investment.Some companies might find it hard to pass on costs in industries with strong competition and tight margins, while also managing the impacts of inflation and changing central bank policies.

Read more articles like this at OpenMarkets