By Andrew Capon, for CME Group

AT A GLANCE

- According to a survey by the World Gold Council, almost 80% of central bank reserve managers plan to increase their gold holdings over the next year

- Given that new gold supply is highly constrained, prices could reach new highs if inflation proves to be sticky rather than “transitory”

“Reflation” trades were rewarded, but traditional inflation hedges were not. Gold fell by 6.5% in H1 as investors, particularly in the U.S., dumped their holdings of the precious metal. $8.5 billion of outflows were recorded by U.S. gold-backed ETFs. However, since then, the investment backdrop has become more nuanced. Asset allocation in H2 might prove to be more difficult.

Fiscal policy factors in

The reflation narrative reflected the success of the COVID-19 vaccination rollout, paired with monetary and fiscal largesse. This combination led strategists to predict a V-shaped recovery as the global economy hit the reset button. Inflation prints came in higher than central bank targets, but 72% of investors in the June Bank of America Global Fund Manager survey believed the repeated reassurances of policymakers that this inflation was “transitory.”In both June and July, U.S. CPI recorded 5.4% increases. In the eurozone, PPI rose a record 10.2% year-over-year. Monetarists would argue we are now seeing the lagged effects of unprecedented stimulus. In April 2020 alone, U.S. M3 (aka broad money) rose by 7.3%, a figure higher than any full year over the previous decade. S&P reports that government spending has increased by the equivalent of 13% of global GDP.

Fiscal policy has become a significant driver of aggregate demand. President Biden’s $1.4 trillion of infrastructure spending and the European Union’s Green Deal at $1 trillion are two examples. These initiatives require labor. But just as inflation has been dismissed as transitory, the tightness in labor markets in the U.S. and the UK are regarded as short-term and frictional.

The role of labor

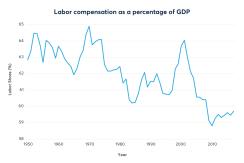

However, labor has an increasingly loud political voice. Supply chain bottlenecks in the wake of COVID-19 also suggest that the inexorable rise of offshoring and globalization will slow. The Phillips curve, which measures the relationship between prices, wages and output fell into disuse in the 2000s. But labor compensation as a share of U.S. GDP has begun to tick up.Has the “death” of the Phillips curve been greatly exaggerated?

If policymakers are wrong and inflation proves sticky, gold is likely to move up the asset allocation agenda during the remainder of 2021. The opportunity cost of owning (zero-yielding) gold vs. 10-year U.S. Treasuries has only been lower in the last decade at the height of the COVID-19 pandemic between February 2020 and 2021.

In August 2020, the price of gold rose to new records, heading above $2000 per ounce. Globally, one-quarter of all bonds still have a negative yield (German bunds out to 30-years) and only one-third have a yield higher than 1%. India was eclipsed by Germany as the second biggest retail market for gold in H1, but Indian investors are returning as COVID-19 slowly abates. Current active cases there are at their lowest level since March 2020.

The latest Commitments of Traders report from the CFTC shows short gold (and silver) positions are being cut. Improving sentiment and changing positioning look likely to provide short-term support for gold.

Supply and demand at a tipping point

Between 2001 and 2011, the price of gold surged from $225 per ounce to $1906 per ounce. This was accompanied by a record M&A ($38 billion in 2011) and capital expenditure binge. Since then, capex has fallen by 70%. Gold exploration budgets hit $10.8 billion in 2012, but gold discoveries (206 million oz.) peaked six years earlier. Since 2006, there have only a handful of new mines with potential reserves greater than 6 million oz. that have come on stream.Cost cutting has forced miners to focus on brownfield sites, and existing reserves are rapidly being depleted. The Witwatersrand Basin in South Africa has produced approximately 40% of all the gold ever mined, but current production is around one-tenth of its peak in the 1970s. Reserves at many of the world’s biggest mines – Mponeng in South Africa, Carlin Trend in the U.S., and the Super Pit in Australia – are in decline.

Mark Bristow, the CEO of Barrick Gold, the second biggest miner, said in August that “the gold mining industry’s chronic tendency to harvest the gold price instead of investing in the future has resulted in declining reserves and a shortage of high-quality development projects.”

Perhaps the biggest support of all for gold is likely to come from central banks. At the turn of the century, the U.S. dollar made up 73% of reserves in the IMF’s COFER database. That has fallen to less than 60%. The share of Chinese renminbi and the euro have grown modestly, but the strong capital preservation characteristics of gold enable reserve managers to sell their dollars while waiting to see if a true competitor to the U.S. dollar will emerge from the challenging pack.

The Bank of Thailand purchased 90 tons of gold in April and May, increasing its holdings by 60%. The central banks of Brazil and Hungary have also been active, and Russia added to its gold holdings in July for the first time since June 2020. Almost 80% of reserve managers plan to increase their gold holdings over the next year, according to a survey by the World Gold Council.

This long-term support for gold prices from central bank buyers could provide a floor above $1700, given that new supply is highly constrained. If inflation remains stuck above policy targets, asset allocators will be forced to reconsider the traditional role of gold as a hedge. That would help gold regain its luster and could move prices higher.

Read more articles like this at OpenMarkets