By Jeff White & Owain Johnson, CME Group

AT A GLANCE

- Winter weather, COVID-19 uncertainties and low storage levels combine to present the U.S. natural gas market with potentially one of its most challenging winters in years

- Record activity for August in nat gas options trading is a powerful signal that market participants are focused on managing winter risk earlier than normal

In late September, the October natural gas options contract expires, and November becomes the first available trading month. The roll from October to November is traditionally considered to mark the official switch from the summer trading season to the winter trading season for natural gas.

The winter trading season comprises the November through March contract months, and there are already multiple indications that traders are preparing for a particularly active and volatile winter season.

The Winter’s Tale

The first indicator is that traders are positioning themselves for winter much earlier than usual: August 2021 looks set to become the most active August of all time in terms of natural gas options trading.August is typically a slow month, so the record activity levels are a powerful signal that firms are wary about what might happen later in the year, and they are keen to establish robust risk management programs for the winter season as early as possible. This elevated activity level is translating into a higher than normal build in open interest for the winter season.

Open interest for the November to March period is already at around 750,000 contracts, which is the highest level seen since 2017, the most active year ever for natural gas options.

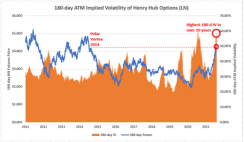

Another key indicator suggesting that the winter ahead will be challenging is that 180-day at-the-money implied volatility (ATM IV) – the measurement that covers volatility over the next six months of price activity – is at the highest level it has been for at least 10 years. 180-day ATM IV for natural gas is currently running at 60%, compared with just 40% for the October contract. To put the current 60% into context, even at the time of the legendary Polar Vortex of 2014, which had a huge impact on U.S. natural gas prices, 180-day ATM IV did not move past the 50% mark.

Winter of Discontent

Every winter season is hard for natural gas traders to predict, largely because it is so difficult to make accurate long-range estimates about weather patterns and about how potentially freezing temperatures may or may not impact gas demand and production.The winter of 2021 is particularly difficult to predict, as the volatility metrics suggest. This is firstly because of the ongoing impact of the COVID-19 pandemic. Natural gas demand will vary dramatically depending on whether or not there are further lockdowns that might impact economic activity.

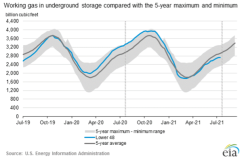

Storage of natural gas in the lower 48 U.S. states has also been trending lower in recent months, falling below the five-year average. Typically, natural gas should be added to storage during the summer months in order to be withdrawn during the winter season.

With less gas in storage than is typical at this time of the year, some market observers are nervous that there will not be sufficient supplies to act as a buffer if withdrawals need to reach an unusually high level, should the winter prove to be a severe one.

This reduced level of storage reflects in part a new dynamic facing the U.S. natural gas market: the increase in exports of U.S. liquefied natural gas (LNG). LNG prices are running at high levels in other parts of the world, encouraging increased shipments of LNG, which offers better returns at present than putting gas into storage.

Winter Calls

The combination of traditional winter concerns, added to the obvious uncertainties around the progress of COVID-19, at a time of high demand for U.S. LNG and low storage levels, combine to present the U.S. natural gas market with potentially one of its most challenging winters in many years.Given the difficult outlook for this winter, it comes as little surprise that the options market is currently making more use of calls – which give the buyer the right but not the obligation to receive natural gas futures – rather than puts, which give the right but not the obligation to sell futures.

In the remaining summer months, there are equal numbers of puts and calls, implying fairly balanced market expectations, whereas open interest for the upcoming winter season shows calls are around 50% more popular than puts. This implies that more traders are concerned about a price spike in the winter months.

The fallout from COVID-19 has represented an unprecedented challenge for the global energy industry, and U.S. natural gas has additional reasons to expect increased volatility. It is clear from the longer-term measures of implied volatility that no one is expecting anything other than further challenges this winter.

Read more articles like this at OpenMarkets