This is the 5th Japanese asset owner interview to appear on II Innovation. The other 4 interviews are:

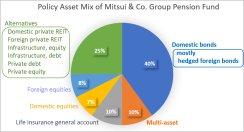

Kunihiko Ogura is the Executive Director of the Mitsui & Co. Group Pension Fund. The Mitsui & Co. Group Pension Fund, a defined benefit fund serving nearly 10,000 employees in 73 group companies, comprises JPY 25.7 billion in assets under management (as of the end of March 2021) with an assumed interest rate and expected return of 2.5%. The pension fund’s policy asset mix is 40% domestic bonds, 10% multi-asset, 10% life insurance general account, 7.5% domestic equities, 7.5% foreign equities, and 25% alternatives.

The fund generates income through aggressive investing in alternatives including private debt, private equity, domestic and foreign real estate, and both debit and equity stakes in infrastructure.

Given the longstanding and continuing environment of low inflation and low growth in developed countries, we anticipate diminishing returns on the four traditional assets. In the meantime, we are relying on illiquid assets as a stable source of income though we are not expanding our holdings at this time.

Management history: Keep a sense of balance and curiosity

I joined Mitsui & Co. in 1980 and was assigned to Sales Accounting, as it was called then. I was in charge of accounting and finance in various locations, in various posts in Japan and abroad. In 1998, I was assigned to the Project Finance Department, which financed the development of natural resources, infrastructure, and other areas handled by Mitsui & Co. I was involved in negotiations with financial institutions to finance various development projects. Having participated in infrastructure development, I now understand the appeal – and risks – to investors of infrastructure financing.

I later moved to the Finance Division of Mitsui’s American subsidiary in New York, where I presided over financing for all of North America. I was there during the global financial crisis of 2008 when liquidity in the financial markets simply evaporated for an entire month. For a time, it was nearly impossible to arrange any kind of financing. It was frightening to see the market with no liquidity. I had never seen anything like it.

Upon returning to Japan, I was assigned to a related real estate subsidiary and other companies before being appointed to Mitsui & Co. Group Pension Fund in 2017. My prior experience in the market had been on the procurement side, but in this move I switched to investment operations. I am looking at the same financial markets as before, but my thinking is very different now.

The Fund invests in privately placed REITs, but due to COVID-19 it’s difficult to get an accurate picture of what is actually happening in the real estate market based on figures alone. So I try to understand the market as a whole by looking behind the statistics – for example, by directly collecting voices from the front line using my former experience in the real estate market. What I value in my work is having a sense of balance and curiosity.