It wasn’t just GameStop.

Gabe Plotkin’s Melvin Capital Management late Wednesday provided new insight into negative positions the firm held at year-end that may have contributed to its stunning 53 percent loss in January.

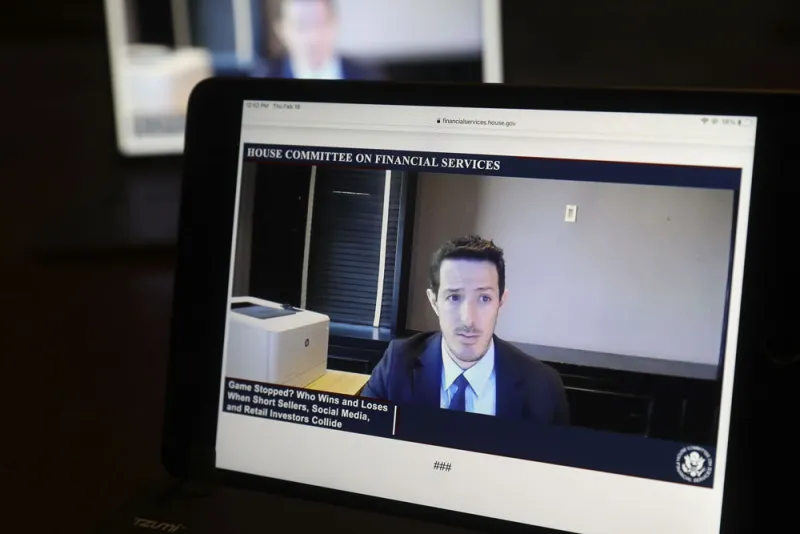

The steep decline had largely been attributed to a Reddit-fueled assault on heavily shorted stocks including GameStop, which bludgeoned short sellers like Melvin and other hedge fund firms. The blow up resulted in Point72 Asset Management and Citadel pumping $2.75 billion into Melvin’s hedge fund to shore up its finances.

In its initial 13F filing covering the fourth quarter and publicly disclosed in mid-February, Melvin had listed eight stocks for which it held put options. These included GameStop, AMC Networks, Cryoport, First Majestic Silver, GSX Techedu, and Simon Property Group, among others.

But on Wednesday, Melvin filed an amended version of the document disclosing that as of December 31 it held put positions in an additional eight companies not previously known.

Six of those eight companies’ common stocks surged in price in January. From January 2 to January 28, one of the eight stocks Melvin had betted against nearly doubled in price. Two surged around 50 percent through January 27, while three others rose at least 20 percent over the same period.

Just two of the stocks’ prices did not move a meaningful manner.

[II Deep Dive: Melvin Capital Is Facing Nine Lawsuits Related to the GameStop Frenzy]

There is no way of knowing from public documents how long Melvin held these options positions, whether Melvin increased or decreased it bets throughout the month, or if it also had outright short positions on any of the stocks.

In any case, shares of ViacomCBS, Melvin’s largest put position among the newly revealed eight, rose roughly 50 percent for the month through January 27.

The common stock of Ligand Pharmaceuticals, Melvin’s second largest put position among this new group, nearly doubled for the month through January 28. The stock would rise another 13 percent before peaking on February 9.

Meanwhile, shares of Ollie’s Bargain Outlet Holdings, another negative bet, rose about 30 percent through January 27.

Melvin’s put positions in the other stocks were much smaller in market price value. Three of them surged in price through late January.

They included ADT, Kroger, and Tabula Rasa Healthcare.

The two stocks for which Melvin held puts that didn’t move much in price during January were Trinity Industries and WW International.

Melvin did not return a call seeking comment.

Plotkin, the founder and CIO of Melvin, is a former trader and consumer stock specialist at Sigma Capital Management, then a division of SAC Capital, where he spent eight years.

Melvin, launched in 2014, surged by more than 46 percent in 2019 and 52 percent in 2020.