After more than a decade of underperformance, even some long-time value managers have given up on the investment strategy of betting on stocks that appear cheap relative to their fundamentals.

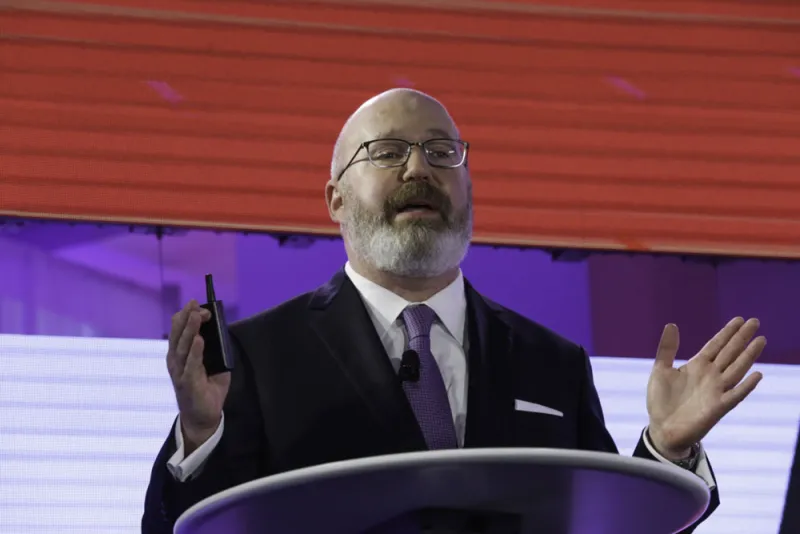

Not AQR co-founder Cliff Asness.

The value defender last week came out with another argument in support of value, explaining in a 16-page paper why the long-term expected return for value is “considerably higher” than many investors might think.

The missive follows what Bank of America strategists described as one of the strongest rotations ever into value stocks, which outperformed growth equities in February. This month of outperformance, however, came after years of underperformance, including the worst quarter ever for value at the start of 2020.

“Everyone knows the value strategy has been a grave disappointment out-of-sample since, say, 1990,” Asness wrote in the paper. “Even Fama and French know it,” he added, referring to Eugene Fama and Kenneth French, who famously documented the value factor’s existence in 1992.

“But, as odd as this might sound, the realized average return on a strategy is not necessarily the best estimate of its true long-term expected return,” he argued. “Why? Well, because one of the major things that buffets realized average returns is changes in valuations.”

According to Asness, when extreme changes in valuations are built into return expectations, it can cause investors to over- or underestimate future returns. He pointed to earlier research from Research Affiliates, AQR, and others that showed that accounting for these valuation changes can result in “a significant gain in the precision of your estimate (not just a different, less biased estimate).”

Asness went on to demonstrate this argument in the paper, using regressions to show how much valuation changes impacted realized returns in the Standard & Poor 500 index, U.S. government bonds, and U.S. stocks versus the rest of the developed market equities. Then he turned to value.

He found that, after 1990, the “failure” of value was “largely a result of changes in the value spread,” or value stocks becoming much cheaper than growth stocks over the period.

“If you think this spread doesn’t permanently widen going forward, you aren’t nearly as negative on the true expected return of value as those just looking at realized returns,” Asness wrote.

[II Deep Dive: Cliff Asness Said to Buy Value. The Market ‘Quickly and Violently’ Punished Him.]

Looking specifically at the “terrible value crash” between 2018 and 2020, Asness found that if not for “this pesky massive cheapening of cheap versus expensive stocks,” value investors would have expected to have earned 3.4 percent, instead of the 11.9 percent annual loss that actually occurred.

“The last three years’ value debacle has been mainly (actually in this case more than entirely) spread widening, not fundamental destruction,” Asness wrote. “Investors are simply paying much more for the same fundamentals (for expensive vs. cheap stocks) as opposed to fundamentals radically improving for the expensive relative to the cheap than they were at the end of 2017.”

In conclusion, Asness argued that accounting for valuation changes “rescues value from the dustbin of history that many want to throw it in” based on its recent performance.

“Value is a much better strategy than many would, and do, think just from looking at realized returns that end at a time of extremely cheap value vs. growth prices,” he wrote. “This should increase both our long-term confidence in the value factor and our staying power during its rough, sometimes very rough, periods.”