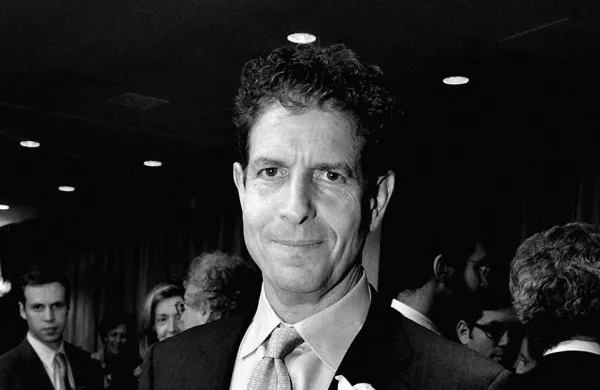

Goldman Sachs Group’s co-head of investment banking Gregg Lemkau is joining alternative asset manager MSD Partners as chief executive officer next year.

MSD, which is tied to Michael Dell’s family office, said Monday that Lemkau will become CEO in February. He will work alongside chief investment officer John Phelan, who co-founded the investment firm with other principals of Dell’s family office MSD Capital.

MSD Partners was started in 2009 to give “select investors” the opportunity to invest in strategies developed by Dell’s family office, according to the statement. The New York-based alternative assets manager and MSD Capital — which was created in 1998 to solely manage the Dell family fortune — together manage more than $15 billion of assets.

Lemkau, who joined Goldman as an analyst in 1992 and has filled several senior roles at the bank, will help MSD Partners expand its existing business as well as push into new areas for investment. The firm’s investment strategies are now focused on credit, private equity, real estate, and public equities, according to the statement.

“Gregg brings to MSD a powerful set of complementary skills and a very similar partnership ethos that will allow him to hit the ground running as MSD Partners’ new CEO,” Phelan said in the statement. He pointed to Lemkau’s experience building businesses and recruiting “high-performance” professionals as “invaluable” to the firm’s expansion efforts.

Lemkau’s past roles at Goldman included co-head of global mergers and acquisitions; global co-head of technology, media, and telecom; and global co-head of its health-care group. Dell, the founder and CEO of Dell Technologies, has known Lemkau for “a number of years,” according to the statement.

“He will be a great fit for the culture that has been built at MSD over two decades,” Dell said. “There are opportunities for substantial continued growth.”

[II Deep Dive: The World’s Dominant Investors in Private Equity]

MSD has more than $6 billion of commitments and capital under management in credit, according to its statement. The asset manager has committed almost $2.8 billion of equity to real estate deals and has made more than $1.6 billion of private equity investments.

Direct lending firm Owl Rock Capital Corp., Ultimate Fighting Championship, and clinical research services company WIRB-Copernicus Group are among the companies in MSD’s private equity portfolio. The firm’s major real estate deals include Four Seasons Maui, Fairmont Miramar Hotel & Bungalows, and the Boca Hotel Resort & Club.

“The MSD team has a great opportunity to expand its existing strategies where the firm already has been successful, as well as consider new areas of opportunity,” Lemkau said in the statement. "I am thrilled about the opportunity to help lead and continue to grow a large alternative investment firm from such a strong foundation.”