Recent global and market events have seen defined contribution (DC) plan participants grow nervous, and DC plan sponsors perhaps looking for answers to questions from nervous investors. Those invested in stable value funds, however, might be less stressed. Stable value funds are offered primarily through employer-sponsored retirement plans, and are designed to be resilient and preserve principal. With $808 billion in AUM at the end 2019, stable value represents more than 10% of the $7.8 trillion U.S. defined contribution market, according to the Stable Value Investment Association. Approximately 75% of retirement plans offer a stable value option,1 among them those managed by Vanguard, which has a particular expertise in the area. Currently, 64% of DC plans on Vanguard’s platform offer stable value.2 II recently spoke with Patricia Selim, Head of Stable Value Investments at Vanguard, to gain more insights on why the firm’s stable value funds can help absorb market shocks – and how experience, resources, investment strategy, and the firm’s infrastructure all combine to create a world-class investor experience.

Stable value investors are usually thought of as having a low risk tolerance and being near or in retirement – but do stable value funds appeal to other types of investors, too?

As you note, stable value investments are ideally suited for DC plan participants who want to help protect their retirement savings and have income during retirement. The funds are designed to preserve principal, provide a steady rate of return – overall, a compelling risk/return profile. That said, stable value can be leveraged as part of a balanced portfolio to any investor seeking fixed income exposure and/or capital preservation. For example, investors with high exposure to equities may find downside protection in stable value, especially during periods of market volatility. That’s especially noteworthy as volatility spikes become more frequent. The tradeoff for the capital preservation trait of stable value is a lower income stream compared to traditional bond funds. Stable value funds also have some limitations when switching between options within a plan, unlike money market funds.

Where do stable value funds fit into the retirement income conversation?

At Vanguard, we recommend investors think of retirement through the lens of prioritizing four goals: basic living expenses, contingency reserve, discretionary spending, and legacy – or what they’ll transfer to heirs or charities. Stable value is a conservative product, and conservative products align well with near-term basic living expense and contingency reserve goals in Vanguard’s retirement model. So, if those are an investor’s priorities, stable value could be a good fit.

Another much discussed topic these days is staying in DC plans while in retirement, which has some benefits for the businesses and the employees. How do stable value funds fit into that scenario?

In some cases, plan sponsors are actively encouraging participants to stay in the plan once they retire. There are a few reasons this might appeal to a retiree, and two of which are lower fees and the continued fiduciary oversight by the plan sponsor. However, if an investor wants to retain access to stable value, they must stay in the plan, because stable value is only available in tax qualified plans. If a retiree in a DC plan rolls assets into an IRA, they cannot reallocate assets into stable value funds. In Vanguard’s stable value pool product, about 37% of assets are associated with inactive participants who are either retired or no longer active in their plan. Those participants choose to stay in stable value because they might not have access to it in their other accounts.

The markets have suffered some supershocks recently. In that context, what might a plan sponsor want to remind participants who are invested in stable value funds?

Unique accounting standards help smooth the returns earned by plan participants and insulate them from daily market volatility. These standards allow book value accounting for stable value portfolios, rather than the mark-to-market accounting required for most other DC plan investments. The result is that stable value funds can amortize market value gains and losses from the underlying fixed income portfolios over time.

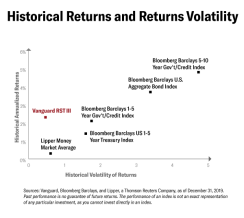

If all of that accounting talk is too in the weeds for plan participants, remind them that stable value funds are designed to provide bond-like returns with very low return volatility, even during periods of market stress. This provides investors a very attractive risk/return profile.

In reviewing recent performance figures, the change in monthly return from February to March for Vanguard’s most utilized stable value commingled trust – the Retirement Savings Trust III, was up 0.7 bps with 20 bps return in March 2020. The money market average went down 3 bps and earned 7 bps and the Bloomberg Barclays Agg went down 239 bps and returned -59 bps.3 The value proposition of stable value is clear, and we’ve seen that play out via tremendous inflows into stable value with the rise of market volatility.

In the same context of the supershocks, there has been some doom and gloom around fixed income in general. Has that been overstated?

We have certainly experienced a multi standard-deviation event with spreads widening, and the underlying holdings in fixed income strategies were not immune to the “supershock,” as you called it. However, based on the accounting standards I just mentioned and some other reasons, “shocks” have not really occurred in Vanguard stable value funds.

What are some of the other reasons?

Our stable value portfolios are highly diversified across fixed income sectors. Vanguard has been managing stable value for more than 35 years, and our underlying fixed income strategies are managed in-house by our active taxable team. This team is comprised of more than 90 portfolio managers, traders, credit researchers, and quant analysts and manage approximately $160 billion,4 placing them amongst the largest active taxable fixed income fund managers.

We also have the resources and expertise to conduct risk management oversight of the entire portfolio every single day, as well as operational risk management, accounting operations, client services and legal among others. We can see the CUSIP-level of detail within the portfolio every day, with oversight provided by our senior leadership team, the stable value management team, and our independent risk management team.

Vanguard stable value funds also have a bias toward high-quality credit, correct? How does that benefit investors?

The individual bonds in the underlying strategies must be rated at least A-. Some of our competitors go into the BBB space or even lower. So, when you think about times when we’re expecting an increase in downgrades, we have a lot more runway before we would be a forced seller or need to write down the book value of an underlying bond. That overall credit quality bias really fares well in times of market stress. We also have a credit quality bias regarding our insurance providers. In the stable value space, we partner with both traditional and synthetic insurance providers. On the traditional side they must be at least AA- rated, and on the synthetic side they must be at least A- rated.

Another differentiator for Vanguard is that we have 13 different traditional and synthetic wrap providers that we partner with. That large number of wrap providers also means that, if necessary, we can redeploy assets quickly without putting stable NAV at risk. Other stable value providers might be concentrated with a few wrap providers, and if one exits the market, is downgraded, or isn’t open to additional capacity, that strategy really puts the portfolio at risk.

Add it all up – experience and resources, robust risk controls, high quality credit bias – and our Retirement Savings Trusts have top performance relative to peer group averages in both book value return and market to book value ratio.5

Looking forward to a recovery period, what might DC participants expect of their stable value funds?

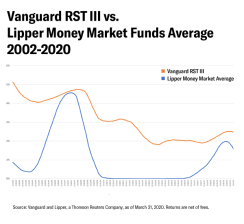

Stable value funds are always gradually migrating toward current yields of the underlying fixed income securities, which generally have an average duration of two to four years. If you look at the years following the 2008 global financial crisis, for example, the Fed kept rates low for an extended period of time. Returns on Vanguard’s stable value pool were gradually declining but investors still did fairly well, earning 2.95% per year on average from 2009 to 2011– although they had a higher starting point than today’s yields. The returns on money markets – the other principal preservation option – were near zero during that same period.

It should be noted that while stable value funds experience rate declines gradually, the same is true on the way back up. When the Fed was raising rates from 2015 to 2018, money market funds responded quicker than stable value and the return differential closed. However, given the longer duration of stable value funds compared to money markets, stable value is designed to outperform over full market cycles.

Will the likelihood of continued near or at zero interest rates affect stable value fund performance?

Stable value performance will migrate downward along with other fixed income products, but the initial decline in participant returns will be less severe due to the smoothing nature of the crediting rate.

So, even in a zero-rate environment, workers and retirees with an aversion to risk shouldn’t be making fixed income allocations to “under the mattress?”

Money under the mattress loses value because of inflation. While not designed to be an inflation instrument, stable value has historically performed better than the inflation rate. Having a conservative investment option that seeks to protect principal while still offering positive returns and liquidity for participants is a strong value proposition.

In general, do plan sponsors and consultants do as good a job explaining stable value funds as they do, say, TDFs?

Participant communication and education is extremely important. Since stable value funds are not offered outside tax qualified plans and thus are not available within IRAs, they are just not as well-known as other investment products. However, the consultant and advisor communities do an excellent job partnering with plan sponsors to enable participant education – and Vanguard has resources and expertise available to help talk through plan design and what might be best for a plan sponsor, and to make sure they understand the full benefits, scope, and implications of stable value funds.

To learn more about Vanguard’s stable value products and strategy, please click here.

1 Deloitte 2019 Defined Contribution Benchmarking Survey Report

2 How America Saves, 2019 edition

3 Vanguard and Lipper, a Thomson Reuters Company, as of March 31, 2020. Vanguard Retirement Savings Trust III has 1, 5, and 10-year annualized returns of 2.48, 2.16, and 2.31, respectively.

The performance data shown represent past performance, which is not a guarantee of future results. Investment returns and principal value will fluctuate, so investors' shares, when sold, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at www.vanguard.com/performance.

4 As of March 31, 2020.

5 Hueler, data as of March 31, 2020

All investing is subject to risk, including the possible loss of the money you invest. Bond funds are subject to the risk that an issuer will fail to make payments on time, and that bond prices will decline because of rising interest rates or negative perceptions of an issuer's ability to make payments.

A stable value investment is neither insured nor guaranteed by the U.S. government. There is no assurance that the investment will be able to maintain a stable net asset value, and it is possible to lose money in such an investment.

Vanguard Retirement Savings Trust III is not a mutual fund. It is a collective trust available only to tax-qualified plans and their eligible participants. Investment objectives, risks, charges, expenses, and other important information should be considered carefully before investing. The collective trust mandates are managed by Vanguard Fiduciary Trust Company, a wholly owned subsidiary of The Vanguard Group, Inc.

© 2020 The Vanguard Group, Inc. All rights reserved.