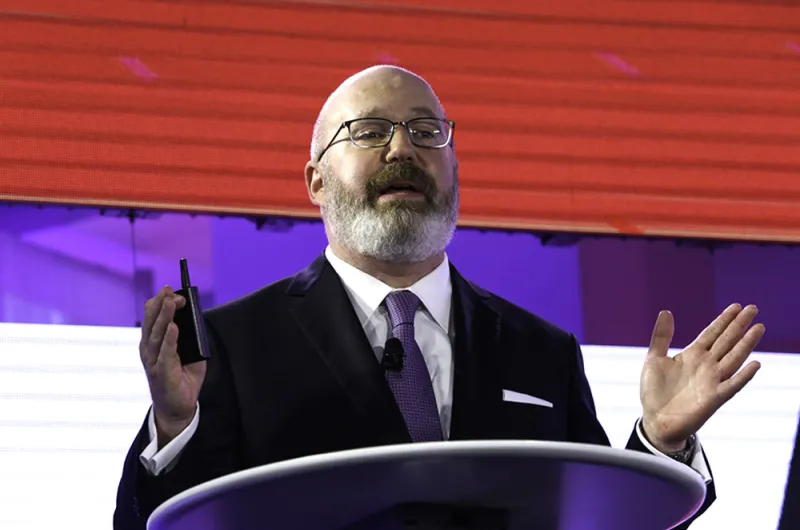

Investors may be paying for private equity’s illiquidity instead of its attractive returns, according to AQR Capital Management co-founder and quantitative investor Cliff Asness.

Private equity’s long lock-up periods may be worth the higher fees because it keeps investors from acting irrationally when markets become volatile, Asness wrote in a December 19 blog on AQR's website. They can’t sell in a panic at the “worst times,” he said.

“What if illiquid, very infrequently and inaccurately priced investments made them better investors as essentially it allows them to ignore such investments given low measured volatility and very modest paper drawdowns?” Asness wrote in the blog. Private equity’s “big time, multi-year illiquidity and its oft-accompanying pricing opacity may actually be a feature, not a bug!”

This runs counter to conventional wisdom in private equity, which is that investors are willing to take on illiquidity — a “bad thing” — in order to access better returns, according to the blog. Investors instead may view the long lockups as a positive feature that is worth lower returns because it protects them from selling at the wrong time.

A levered small-cap portfolio, which offers a similar profile to private equity, may also be a good for long-term investors, according to Asness. But he said many investors couldn’t stomach having to wait out the volatility in bad times.

[II Deep Dive: Cliff Asness: It’s ‘Time to Sin’]

In turns out that investors’ preference for illiquidity may be rational — even it means paying higher a price for “somewhat lower return,” according to the blog.

“Sounds really counter-intuitive, I know,” he wrote. “But it also sounds, to me, pretty plausible.”