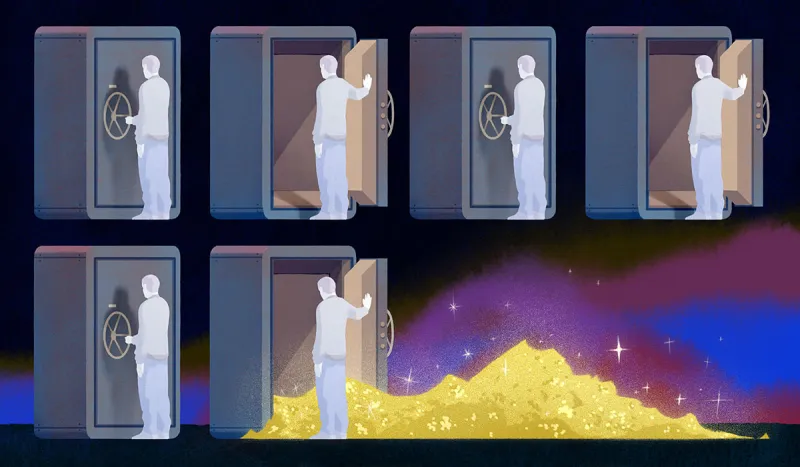

Illustrations by Leonardo Santamaria

Eleven years ago, Institutional Investor proclaimed “The Death of Value Investing.”

It was November 2008. II columnist Edward Chancellor believed the ongoing credit crisis had revealed “a profound weakness” in the investment discipline popularized by Benjamin Graham, the economics professor widely known as the father of value investing.

“The credit bust is bringing fundamental changes to the economy at a mind-numbing speed,” wrote Chancellor, then a senior member of GMO’s asset allocation team. “As the credit crisis continues and the global economy worsens, things could get a lot worse for Graham’s disciples.”

Eleven years later, things certainly haven’t gotten much better.

Value stocks — traditionally defined as companies that trade at low prices relative to characteristics like earnings and book value — have largely underperformed since 2007, trailing throughout an explosive bull market for growth stocks, rapidly growing companies with rising valuations.

There’s no single reason for this unprecedentedly bad run for value investing. Down-on-their-luck value investors point the finger at everything from interest rates to index funds to antitrust regulation. Many blame exorbitant private market valuations and FAANG stock euphoria. Softbank is a name that comes up a lot.

Whatever the precise cause of the underperformance, value’s proponents insist that it won’t last forever. Many argue that current valuations indicate that the strategy is on the cusp of a comeback. Some say it may already be here — just look at September.

Others, however, believe that the problems that have plagued value investors for a decade-plus are not cyclical, but structural. These investors and market observers claim that popular indicators of value no longer work — that the market and the companies that operate in it have fundamentally changed in a way that renders ineffective the approach outlined in the bible of value investing, Graham and David Dodd’s Security Analysis.

Even defenders of value, like GMO’s Ben Inker, acknowledge that some of the strategy’s return drivers have deteriorated since the financial crisis. Value stocks today are trading at a much larger discount than they have in the past — and these cheap stocks have stayed cheap as high-flying growth stocks keep growing. “Something clearly has changed,” Inker says.

If value investing truly died 11 years ago, as Inker’s former colleague suggested, what will it take to resurrect it?

This group of investors is eager to point out how very cheap value stocks currently appear in comparison to growth stocks, especially the so-called FAANG companies: Facebook, Apple, Amazon, Netflix, and Google. These investors view value stocks’ long period of underperformance as merely a painful side effect of the decade-plus-long rally in growth stocks — a run of outperformance that has pushed stock valuations to the extremes, with these tech giants leading the way.

“In order for a real rotation to happen, you have to look not at value, but at growth, and see where the cracks start appearing,” says Alex Roepers, founder and chief investment officer of Atlantic Investment Management. Some of the most noticeable cracks have appeared in what the value-oriented investor describes as “the most frothy part of the market: pre-IPO unicorn companies.” Usually tech companies — or at least firms marketed as tech companies — these are venture capital–backed start-ups that have ballooned to valuations above $1 billion in the private market before going public. Although private market valuations have been climbing for several years now, it was the 2017 launch and rapid deployment of Softbank’s $100 billion Vision Fund that really pushed things over the edge, according to Roepers.

“We’ve seen Uber and Lyft and WeWork try to go public. WeWork turned out be a complete disaster,” Roepers says. “If I have one word for the rotation, it’s ‘WeWork.’”

The Softbank-backed office space leasing company, once valued at $47 billion, nearly went bankrupt after its initial public offering failed in September. Roepers thinks the WeWork debacle will curtail Softbank’s ability to raise a “relevant” second fund — “which means there will be less ammunition to continue this lunacy of throwing money around,” he adds.

The chilly reception for unicorn IPOs, combined with “a lot of wobbling” by growth stocks in September, has Roepers feeling confident that a rotation to value is not just imminent, but already underway.

“It could be that September was a false signal, but I’m encouraged by what’s happening to some of the frothy parts of the market,” he says.

Other value believers are feeling similarly optimistic, if slightly more cautious. “It’s hard to predict,” notes Stacie Mintz, a quantitative equity portfolio manager at PGIM-owned QMA. The multiasset and quant specialist has been tracking the widening spreads between the cheapest and most expensive stocks — spreads that have recently become “stretched to an extreme,” Mintz says.

For example, when Mintz’s team recently analyzed the implied earnings growth of current stock prices, they found that the median expensive company “would have to grow 25 percent every year for the next ten years to justify its price,” she explains. “For data like that, it feels like we must be near a turning point.”

“A lot of people think the stock market is expensive today because of the PE multiples,” says Brad Neuman, senior vice president and director of market strategy at growth investment firm Alger. Wrong, he says. “The stock market is actually cheap on a price-to-free-cash-flow basis.”Neuman argues that the traditional ways investors classify which stocks are cheap and which are expensive have become “dramatically skewed” as business practices have outpaced U.S. accounting standards.

“There’s been a dramatic change over the past several decades in how companies invest,” he explains. “Historically, when companies invested, most of their assets were tangible assets. Today companies invest in more intangible assets.” These intangible assets — patents or intellectual property, for example — aren’t accounted for in the same way that tangible assets are. “They’re expensed, not capitalized, which means they don’t show up in book value,” Neuman notes.

This inherent flaw in book value — and, relatedly, earnings — has lately been attracting a lot of notice in finance and academic circles, as investors and market observers have attempted to figure out why value investing strategies haven’t been working.

Bernstein analyst Inigo Fraser-Jenkins and his colleagues in June flagged the increasing importance of intangible assets as one of several structural challenges facing value investors, arguing that the usefulness of book value and earnings as value indicators has become “questionable.”

This accounting problem was also the subject of a recent academic study by New York University business school professor Baruch Lev and the University of Calgary’s Anup Srivastava. The two accounting professors found that a simple value strategy relying on the price-to-book ratio had underperformed not just for the past dozen years, but for the better part of the past three decades.

“This expensing of intangibles, leading to their absence from book values, started to have a major effect on financial data (book values, earnings) from the late 1980s, due to the growth of corporate investment in intangibles,” they wrote. Speaking to II, Lev explains that this “madness of accounting” has dragged down the performance of value investors ever since.

“All the important investments like R&D and IT are immediately expensed, and people are left with highly misleading ideas about profitability and about value,” he says. “Especially with respect to small companies and medium companies that are not followed by a lot of financial analysts and not written up by the media, people rely on the financial reports. And they are terrible.”

Still, when value investors are asked about this potential flaw in their investment approach, most are what can charitably be described as dismissive. Although the book-to-value ratio is a prominent measure of value —it’s the one used in the famous factor model developed by Eugene Fama and Kenneth French — it’s not the only, or even the primary, measure used by value investors, particularly those following the teachings of Benjamin Graham. Roepers, for example, says Atlantic Investments has “never” used price-to-book, opting instead to focus on other measures like cash flow.

“Selecting low price-to-book or low price-to-earnings companies is not value,” argues Eben Otuteye, a finance professor at Canada’s University of New Brunswick. Otuteye has spent the past several years studying value — the Graham and Fama-French definitions — alongside Mohammad Siddiquee, an assistant professor of finance at Mount Saint Vincent University. Although there is a large degree of overlap between the two approaches, the two professors point out that value investing, as laid out in Security Analysis, involves finding companies that are not just cheap but also have other desirable characteristics like profitability and financial stability. GMO’s head of asset allocation makes a similar point, noting that the Fama-French definition is “less close to the platonic idea of value.”

Says Inker, “I do think there should be some deterioration in the long-term performance to Fama and French–type value factors.”

In any case, U.S. accounting issues can’t explain the international dominance of growth stocks, according to Research Affiliates CIO Chris Brightman, who points out that international accounting standards call for the capitalization of many intangible assets. The book value theory is “correct as far as it goes, but it’s not large enough to account for the magnitude of what we’re seeing,” he says.

As Brightman views it, value’s extended run of underperformance is mainly because of the “extraordinary increase in corporate profits” that’s occurred in the wake of the financial crisis.

“Sales over the last ten years since the crisis have not grown all that much faster than the economy — and that makes sense, of course,” he explains. “However, earnings before interest and taxes have been growing much faster than sales. Companies have had a really successful run in improving margins.”

The growth of corporate profits has partly been fueled by a combination of low interest rates, low taxes, and stagnant wages. But Brightman primarily attributes the “fabulous run for profitability” to companies’ pursuing business strategies that allow them to earn high profits with minimal investment. Some call this strategy building a moat. Others call it rent seeking, or creating a monopoly.

Whatever term you choose, the result has been an increase in industry concentration, with the largest, most dominant players in each industry taking on bigger shares of the aggregate profits. It’s a trend that’s been detrimental to value strategies, which generally make money when there’s turnover — when growth stocks stop growing or cheap stocks start becoming more expensive.

“High-growth companies have been able to retain growth for longer, and the really somewhere-between-boring-and-crappy cheap companies have had a harder time generating excitement about them,” explains Inker of GMO. “Historically, at least a couple of these highfliers would have fallen from grace by now, and they haven’t.”

Inker, for his part, believes that the more static prices are likely a “temporary feature” of the market and will eventually regress toward longer-term averages. Still, change may require intervention by forces outside the market.

“If the environment stays the same, I think you will find rational CEOs and rational boards of publicly traded companies will continue to do what’s been so well rewarded, which is to build moats and extract rents,” Brightman says. “Unless regulation and antitrust policy changes, I don’t see the present environment changing.”

Next year’s presidential election in the U.S. could usher in a new regulatory regime, one that cracks down on monopolistic behavior. “I don’t think you’d want to be long Facebook the day Elizabeth Warren is sworn in,” Brightman notes. But even if the 2020 election doesn’t trigger value’s comeback, the strategy’s proponents are certain that something eventually will.

“It would be extremely odd if there was any group doomed to underperform forever or win eternally,” Inker says. “If nothing else, prices would adjust.”