Illustration by Leonardo Santamaria

The development of private credit is the fundraising phenomenon of the past eight years. But the impact of soaring credit businesses on the valuations and stock prices of the large listed buyout firms — such as Blackstone Group, KKR, Apollo Global Management, and Carlyle — is an open question.

These firms have embraced private credit (assumed for this article as direct lending, leveraged loans, and derived collateralized loan obligations), and filled the void banks left after the financial crisis.

A terrific asset builder, private debt fundraising grew at a 8.9 percent compounded annual rate over the past five years and at an even more impressive 11 percent over the past two years, according to McKinsey. That is a 45 percent faster rate than for private equity fundraising — which was still strong at 7.6 percent compounded over two years. The absolute value of U.S. corporate private debt is assumed at over $700 billion, which means a yearly potential fee pool upwards of $7 billion.

KKR’s numbers, for instance, are telling. Alternative credit assets under management (AUM) shot from $2 billion in 2010 to $34 billion in 2018 — a 17-fold increase. In the same period, private equity assets less than doubled from $45 billion to $81 billion. Today, only a very independent-thinking general partner would focus solely on private equity when most top sponsors have embraced the credit wave.

All the while, management at listed buyout firms complain about undervalued stocks despite their highly profitable operations, strong yields, and massive AUM growth. Blackstone and KKR produced excess returns over the S&P 500 of 14.4 percent and 3.4 percent per year, respectively, from 2012 and April 2019. Yet their stocks have traded at multiples 40 percent to 60 percent lower than that of the index.

Ares, KKR, Blackstone, and Apollo have tried to boost valuations by dropping the partnership structure, which limited stocks’ access to the deep market of mutual fund investors. Volatile performance fees may be another key factor affecting share prices, due to the difficulty of establishing normalized earnings.

This is where credit businesses help. First, building credit AUM increases the ratio of predictable fees to performance fees, diluting the volatility associated with the private equity assets. But there’s a flip side. Credit is inherently less remunerated than private equity, typically producing lower internal rates of return and carried interest income. In essence, these sponsors might well be trading performance for stability and predictability.

There is a caveat. Credit may not be less profitable to manage than private equity — on a management fee basis only. At Blackstone’s 2018 investor day, it reported fee-related earnings margins of 42 percent for credit and 37 percent for private equity. While the metrics are not fully comparable, Carlyle’s fee margins for credit and corporate private equity were nearly equal in 2018 at 19 and 20 basis points, respectively.

In-house credit capabilities also enhance deal flow — a significant plus in the mature and very competitive buyout market. Providing loans is simply another way to develop a relationship with a company. Private equity firms have successfully developed flexible and competitive debt structures to win these deals. Most limited partners in private equity funds would reasonably ask about the risk of conflicts since the same asset manager might approach a company with both equity and debt financing. And yes, these conflicts exist. But buyout firms, fearful of reputation risk, tend to address these in their internal policies and even in funds’ legal documentation.

Finally, investors’ vigorous appetite for leveraged loans has strongly supported the buyout market. As a multi-asset class investor, I’m attracted to 8 percent to 12 percent annual returns — with high recovery rates and limited duration risk — after this year’s equity rally. On paper, opting for credit means trading the downside risk of equities for a capped return that’s close to equities’ long-term target rate (about 6 percent). In reality, I remain mindful of herding among private credit managers and inadequate risk premiums given the competition for deals.

We see early signs of compressed credit returns. Rising capital inflows and competition for assets mean projected returns trending closer to 10 percent for recent vintages than the high teens delivered by loans issued a few years ago. On the private equity side, leverage of 6 times EBITDA (often “adjusted”) is common on corporations with resilient cash flow. De-leveraging may be a struggle for mature assets with limited growth, providing bad news for equity holders.

Direct credit risk also exists in fund portfolios and in CLO tranches. Impacts of the latter cannot be underestimated. Private equity firms are present in the entire structure of CLOs: they own the issuers, hold the loans, and are managers and investors in CLOs underpinned by these loans.

Given all this, how attractive are listed alternative managers?

Buyout firms’ shift to more predictable earnings — thanks to credit — is a strong positive. But there is no way to predict how credit risk will materialize.

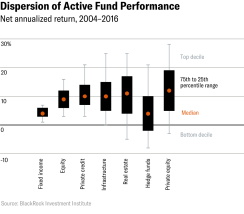

The long-term picture could be much less favorable. Credit has many of the characteristics of a volume strategy, with lower revenues and limited differentiation potential. The famed operating and strategic talent that has long justified private equity fees isn’t necessary for private debt, beyond origination and restructuring. In essence, the limited dispersion across debt funds, as illustrated below, sets the condition for fee pressure.

This is the same story that has played out in long-only asset management over the past decade: Firms selling more or less the same products are forced to compete on price and scale. There are very few examples of industries that engaged in volume and low-fee strategies and ended up better for it.

Pierre Mordacq is a senior private equity investor and heads AtlanVest, a single family office and permanent capital vehicle focusing on growth and buyout investments.

Feedback? Contact II’s deputy editor Leanna Orr at leanna.orr@institutionalinvestor.com.