Izzy Englander’s Big Payday

Illustration by II

Thanks to gains in Millennium’s flagship funds last year, the money manager makes another appearance on Institutional Investor’s Rich List.

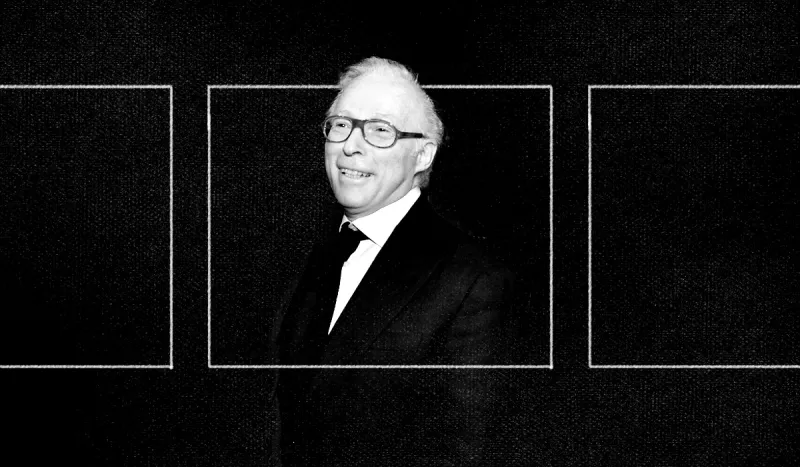

Ronald Shear

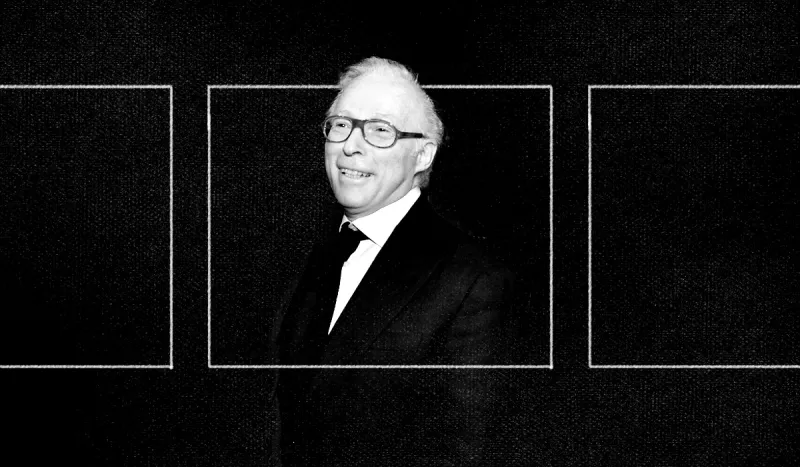

Steven Tobias

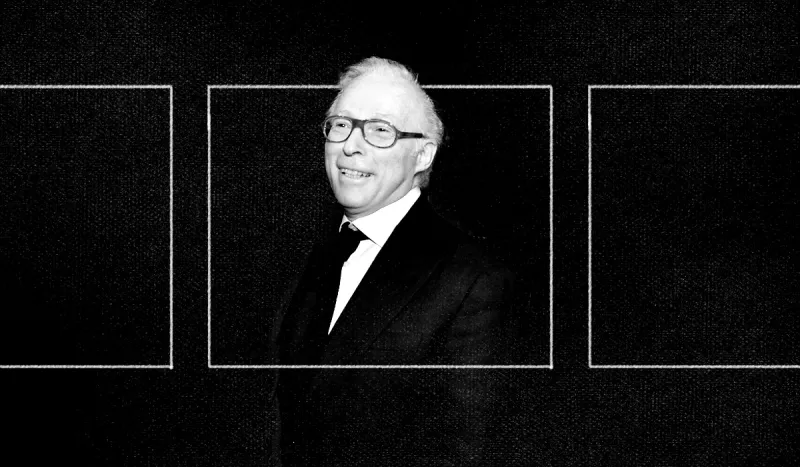

Ken Griffin

Jack Nash

Izzy Englander