Credit rating agencies Fitch Ratings announced Monday that it had lowered its ratings on PG&E Corp. further into junk territory, in another setback for the troubled utility provider that has turned up in the portfolios of some high-profile hedge fund firms.

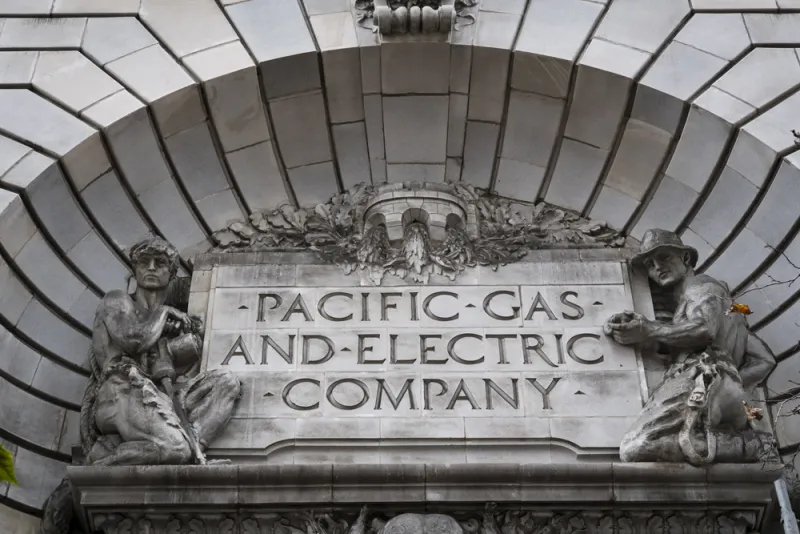

PG&E, which is the parent company of California energy provider Pacific Gas and Electric Co., announced Monday that both companies plan to file for Chapter 11 bankruptcy protection on January 29. Fitch lowered PG&E’s long-term issuer default ratings from BBB- to C following the announcement. S&P Global Ratings and Moody’s had also lowered their ratings to junk.

Several major hedge fund firms are poised to lose out on their bets that PG&E would outperform in 2019. Big hedge fund names like Baupost Group and Viking Global are among the firms that Institutional Investor previously reported had PG&E holdings. PG&E shares fell more than 17 percent on Tuesday, closing at $6.91, after falling more than 52 percent on Monday.

“The imminent bankruptcy filing reflects the culmination of a crisis of confidence driven by potential wildfire-related liabilities in the tens of billions of dollars related to the Tubbs and Camp Fires without a clear path to timely recovery of such costs under California law,” according to a Fitch report on its ratings.

PG&E’s problems aren’t limited to its ongoing wildfire struggles, according to Fitch. The company has had “repeated accidents and operational problems in its natural gas business,” which include a pipeline fire and explosion in 2010 in San Bruno, California, Fitch's report said.

PG&E could be downgraded further. According to PG&E’s most recent form 8-K with the Securities and Exchange Commission, it did not plan to make interest payments worth roughly $21.6 million due Tuesday on its 2040 senior notes. If PG&E fails to make the payments within 30 days, it would default on those loans, Fitch’s report said.

A default like this would result in a further credit rating downgrade to a D rating, according to Fitch.

Once PG&E files for bankruptcy, the public will be able to learn which institutional investors hold PG&E notes. PG&E declined to comment on the report.

Institutional Investor previously reported that several hedge fund firms took big stakes in PG&E during the third quarter of 2018. These included BlueMountain Capital Management, Appaloosa Management, D.E. Shaw, TCI Fund Management, Hound Partners, and Viking Global Investors.

A spokesperson from Appaloosa declined to comment, as did a spokesperson for D.E. Shaw and a spokesperson for TCI. Spokespeople for each of the other funds did not immediately respond to emails seeking comment on the holdings.

[II Deep Dive: Several Prominent Hedge Funds Took Big Stakes in PG&E Last Quarter]

Seth Klarman’s Baupost was also among the hedge fund firms that took stakes in PG&E during the third quarter. Bloomberg reported Monday that the firm bought legal claims against PG&E in November, which would give Baupost the right to recover losses incurred from the wildfires. A spokesperson for the firm declined to comment.