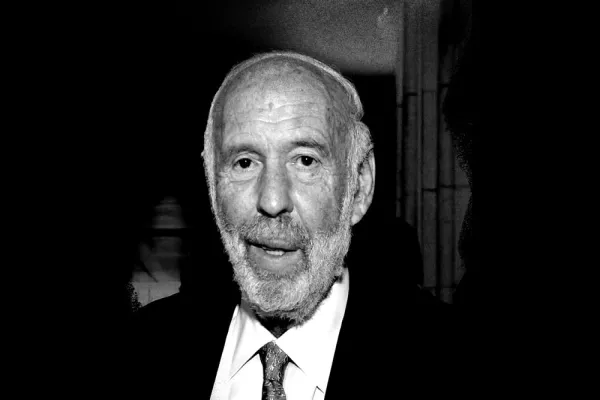

Real estate brokerage company Realogy Holdings raised $1.08 billion in its Thursday initial public offering after its shares sold at the top of the offered range of $23 to $27 each. This is good news for John Paulson, who initially invested in the company through convertible senior subordinated notes. After the offering, the paper will be converted to common stock, and Paulson will own about 10 percent of the company, which is controlled by private equity firm Apollo Global Management. Paulson (who owns the stake through his Paulson Credit Opportunities Master fund), and to a lesser extent York Capital Management, were among a group of investors that had bought convertible securities when the company was struggling several years ago and are poised to see a nice paper profit. Keep in mind Paulson cannot sell for at least 180 days, while York is locked up for 180 days after the prospectus was filed. A hedge fund manager who was named one of Institutional Investor’s Rising Stars in 2010 also made a lot of money on Realogy.

Investors redeemed money from hedge funds in October, according to one scorekeeper. Hedge fund flows as measured by the SS&C GlobeOp Capital Movement Index declined 0.67 percent from September. "Inflows have remained steady, while outflows have spiked in line with quarter-end rebalancing," said Bill Stone, chairman and CEO of SS&C Technologies, in a press release.

Citadel Advisors disclosed in a Securities and Exchange Commission filing that it now owns 5.4 percent of LSI Corp., which makes semiconductors for storage devices. The filing was made in a 13G, which means it is strictly a passive investment, for now. LSI’s stock trades at $6.63, down from a high of $8.80. At the end of the second quarter, Citadel also had puts and calls on LSI.

A Ghana court ruled that hedge-fund manager Paul Singer can hold on to Argentina’s navy vessel, the ARA Libertad, until the court rules on whether Argentina is still the legal owner of the defaulted debt. Until then, Singer will in effect be the captain of the ship.

The Bank of Nova Scotia is looking to become a big player in the hedge fund industry. Canada’s third-largest bank plans to provide more prime brokerage services to hedge funds, including clearing listed derivatives trades.