Shares of Buffalo Wild Wings surged 6 percent, to close at $163.75, after activist hedge fund firm Marcato Capital Management called on the restaurant company’s chief executive officer, Sally Smith, to resign, asserting, “The status quo is unacceptable – oversight and accountability must be restored.”

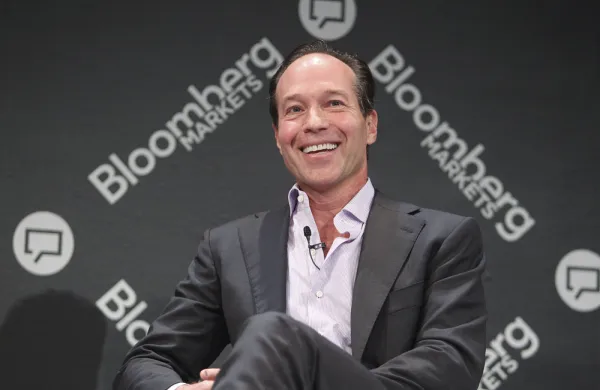

The hedge fund firm also filed proxy materials nominating four individuals to the board of directors, including Mick McGuire III, who heads up Marcato, which owns 6.1 percent of the shares.

“Simply put, the financial and operational performance of Buffalo Wild Wings over the past several years has been inexcusable,” McGuire states in a press release, which once again details why he believes the company has underperformed and needs a series of changes. “As shareholders, we deserve a Board and management team with real skin in the game that will take action to strengthen the Buffalo Wild Wings brand, recapture operating margin opportunities, allocate capital intelligently, and employ an efficient franchising plan,” he adds.

In response, Buffalo Wild Wings says in a press release: “Over the past decade, Buffalo Wild Wings’ performance has consistently led the casual dining industry, delivering superior results to our shareholders while providing a differentiated guest experience to our customers.” It adds that since the company went public in 2003, under Smith the stock has generated total returns of 1,697 percent.

___

Tiger Global Management boosted its stake in Apollo Global Management to more than 28.1 million shares, or 15 percent of the total as of April 17. The hedge fund firm founded by Chase Coleman disclosed in March that it had taken an initial stake of 7 percent in the private equity firm and boosted that position two weeks ago.

___

Adage Capital Partners disclosed that as of April 11, it owned 4.75 million shares of Vantage Energy Acquisition Corp., or 9.9 percent of the total. Vantage Energy Acquisition is an energy-focused special purpose acquisition entity created to do a variety of types of deals. It went public on April 11.

___

Credit Suisse reiterated its outperform rating on Whole Foods Market in light of the 8.8 percent activist stake taken in the high-end grocer by JANA Partners and an industry veteran. “We have been big advocates of the turnaround opportunity…for some time,” the investment bank states in a note to clients.

“We also believe the market underappreciates the potential to unlock value through a sale to a strategic buyer.”

It is also excited about press reports that The Kroger Co. may seek to acquire the company, asserting it “seems particularly well-positioned to bid for this still high-quality asset, and press reports add credibility.” Other rumored potential buyers include Amazon.com.