Chief investment officer Vijoy Chattergy is no longer employed with Hawaii’s $16 billion state pension fund, where he had served as CIO since 2012, Institutional Investor has learned.

An automatic response from Chattergy’s former email account states that he is no longer with the Employees’ Retirement System of the State of Hawaii. The retirement system’s executive director Thomas Williams did not respond to multiple requests for comment by press time.

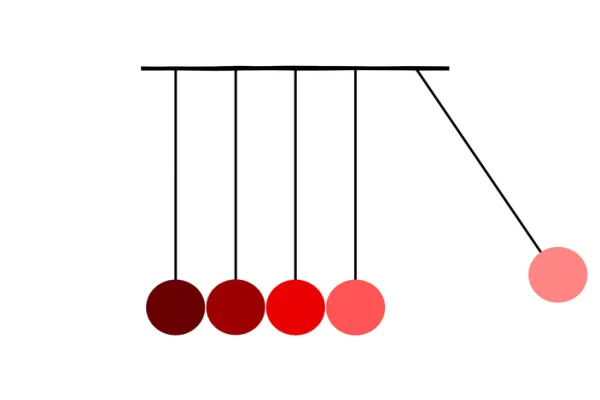

Local newspaper the Honolulu Star Advertiser first reported Chattergy’s departure on Thursday. A Wall Street Journal report last week noted that the pension fund had recently lost money after betting on low volatility through selling put options, a strategy that abruptly backfired during the sharp spike in volatility amid the stock market gyrations over the past few weeks.

“We’ve taken some losses that you’d expect with these sharp moves,” Chattergy told the Journal in an interview on Feb. 8.

The Journal article did not address Chattergy’s departure.

[II Deep Dive: Vijoy Chattergy Keeps Hawaii’s Pension Plans Open to Options]

Chattergy became CIO of the Hawaii pension fund in late 2012 after a brief stint as interim investment chief. He first joined the retirement system in 2011 as an investment specialist under then-CIO Rodney June, who would shortly after depart for the CIO job at the Los Angeles City Employees’ Retirement System.

In addition to implementing the options-based strategy, Chattergy spent his tenure broadening the pension fund’s exposure to private market asset classes like real estate and private equity.

The pension was severely underfunded when Chattergy took charge, and has remained in trouble since. As of June 30, Hawaii ERS had an unfunded liability of $12.9 billion, for a funded ratio of 54.9 percent.