British investment firm Man Group announced in December that it was forming its first onshore fund in China, a move made after it was granted a wholly owned foreign enterprise license in 2017.

The fund, to be managed by Man’s team in Shanghai, will target high-net-worth individuals in China and aims to be “uncorrelated with traditional portfolios,” the firm said in the announcement. “The strategy seeks to identify and capture market trends across diverse liquid onshore markets, focusing initially on listed futures including agricultural commodities, industrial commodities, bonds, metals, energy, and stock indices.”

The new fund marks a positive turn for the firm, which had $103.5 billion of assets under management at the end of September and is well known globally as a highly sophisticated — and aggressive — quant fund manager. In September 2015, during China’s massive and brutal stock market crash, rumors swirled in Chinese media that the chairwoman of Man’s China operations, Li Yifei, had been asked to assist a government investigation into market manipulation.

According to the South China Morning Post, Li was questioned by authorities in August 2015 — the height of a massive regulatory crackdown on market speculators that led to the arrests and disappearances of dozens of leading financial industry executives. Li then reappeared in an interview with Caixin Media Co. in September 2015, saying the rumors about being questioned were false, according to the South China Post.

Li and Rosanna Konarzewski, a spokeswoman for Man, declined to comment for this article.

Analysts in the country applaud the company’s perseverance in a market that many around the world still see as risky for short-selling.

Although shorting is technically legal in China, it is very expensive and authorities frown upon it.

[II Deep Dive: Why Fund Firms Are Gunning for China]

Other hedge funds might have just quit and left China after such an incident, says Peter Alexander, the Shanghai-based managing director of research firm Z-Ben Advisors, a specialist on China’s asset management industry.

“Man’s perseverance in China is especially surprising given new leadership,” Alexander says in an email, referring to Luke Ellis’s being brought on as chief executive officer in late 2016. “Typically, China is seen as a risky proposition, so most other newly appointed CEOs would have sidelined any China ambitions, at least in the short term. That is normal. Doubling down and pressing ahead isn’t normal. Call me impressed.”

It’s surely not lost on Man that the Chinese market holds tremendous growth potential. Alexander says there is no question in his mind that in the longer term, Man will be rewarded for sticking it out.

“Financial reforms will create opportunities for foreign financial companies,” he says by phone. “It is great to see Man’s management team is doing something more significant on the mainland. It is a great opportunity for them.”

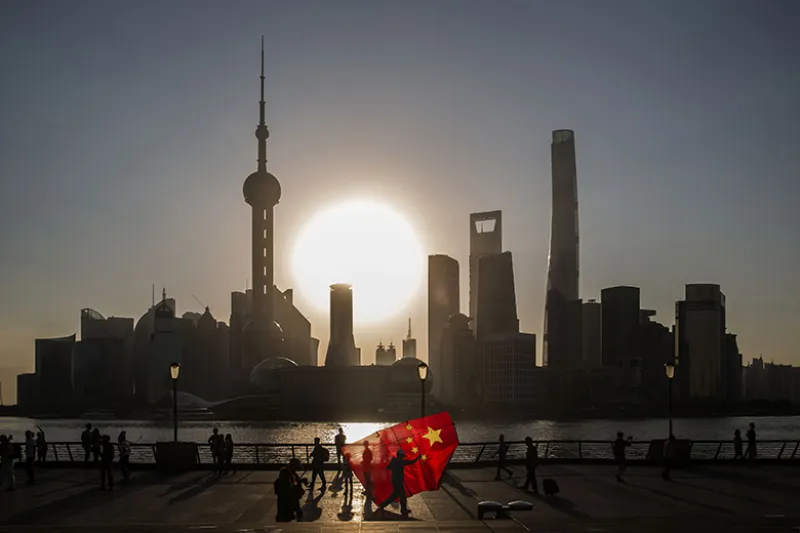

Photo illustrations by Mike McQuade