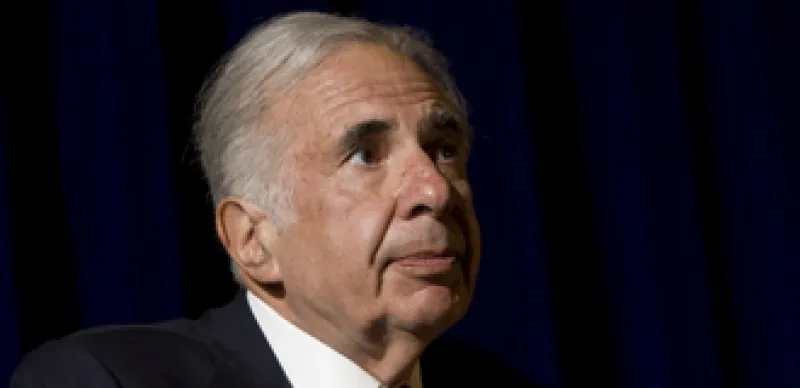

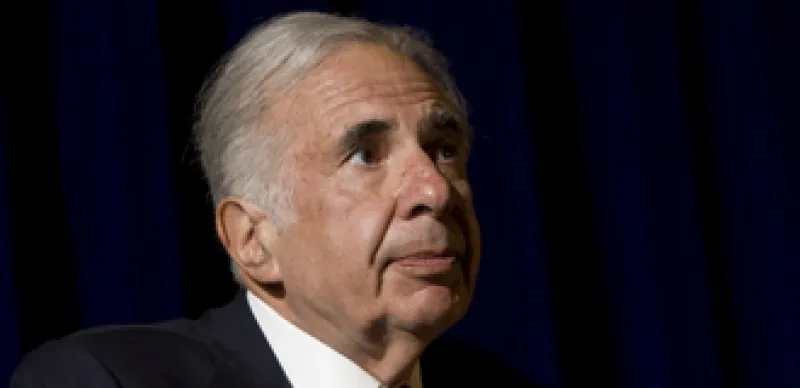

Icahn Ups Ante With Mentor Graphics

Carl Icahn is embroiled in another battle. This time with Mentor Graphics. One day after they rejected Ichan's $17 per share offer, Icahn fired off a letter to Mentor’s Board of Directors expressing his outrage.

Stephen Taub

March 30, 2011