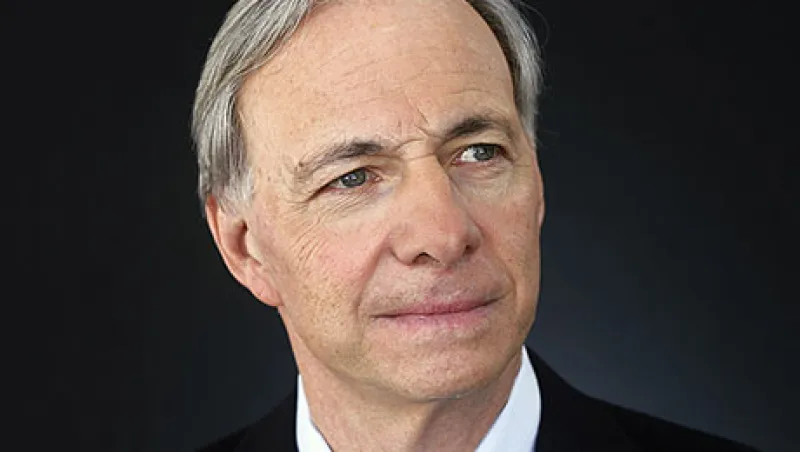

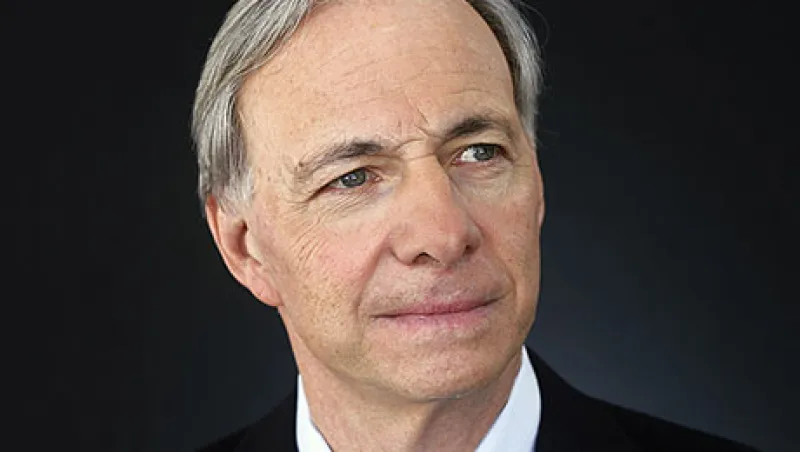

Ray Dalio Steps Down from Management at Bridgewater

Dalio will remain co-chief investment officer next to Bob Prince and Greg Jensen in a management shake-up at the world’s largest hedge fund firm.

Christine Idzelis

March 1, 2017