< Wall Street's Nerds: The World's Most Powerful Trading Executives

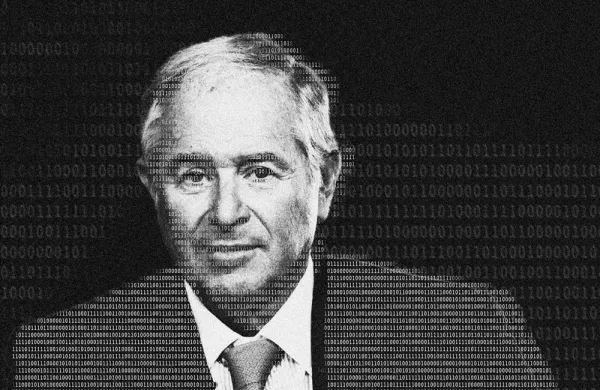

25. Michael Chin & Neill Penney

Co-heads of Trading

Thomson Reuters

PNR

Thomson Reuters' network spans the globe and touches all asset classes. More than 2,000 customer sites around the world use the company's enterprise platform to support their trading infrastructure. Thomson Reuters data is used to price more than $3 trillion in assets every day. Yet co-head of trading Neill Penney says, "We can no longer be all things to all people in the rapidly evolving marketplace." Although Thomson Reuters is not averse to expanding its portfolio when it makes strategic sense — in January it completed the acquisition of REDI Holdings, a major player in execution management systems — Penney, 46, and his counterpart, Michael Chin, 50, emphasize partnerships with other innovators. They announced deals last year with, for example, OptionsCity Software for an app enabling commodity options and futures orders to be executed on the Thomson Reuters Eikon platform, and with BestX for foreign exchange transaction cost analysis. "Our open platform approach means we are able to connect BestX with our FXall and FX Trading platforms, bringing our customers improved capabilities while eliminating the integration work they would otherwise have to perform themselves," Penney said at the time. Explains Chin, "We're committed to developing our own solutions and inviting the best innovators into our ecosystem." The result is "unique provider content sets" that may include market data, news, and analytics.

With a mathematics degree from the University of Oxford, Penney worked at FXall and later rose to European head of fixed-income e-trading strategy at Morgan Stanley before joining Thomson Reuters in 2013. Chin, who has an information decision systems degree from Carnegie Mellon University, was previously president and CEO, respectively, of trading technology companies TradingScreen and Mantara and was Thomson Reuters' global head of equities. Chin says that the company will be investing in REDI, which serves 3,800 traders worldwide, to meet buy-side needs for "truly open, broker-neutral trading systems."

The 2017 Trading Tech 40

BlackRock

Bats Global Markets

Nasdaq

MarkitSERV

Citi |

Bloomberg Tradebook

CME Group

Intercontinental Exchange

KCG Holdings

Goldman Sachs Group |

Fidelity Institutional

MarketAxess Holdings

NEX Optimisation

Tradeweb Markets

IEX Group |

Hong Kong Exchanges and Clearing

MillenniumIT

Citadel Securities

Convergex

Cinnober Financial Technology |

Broadway Technology

Aquis Exchange

Arcesium

Mana Partners

Thomson Reuters |

S3 Partners

AQR Capital Management

Corvil

Algomi

Portware |

Financial Industry Regulatory Authority

OTC Markets Group

Dash Financial

Quantopian

Ross III PDQ Enterprises |

Vela Trading Technologies

Tradier

OpenDoor Trading

LMAX Exchange

Monex Group |

| |