Investors have shunned European equities over the past few years as the Continent struggled to recover from the financial and euro zone crises. But there may be life in European markets yet. The Stoxx Europe 600 index is up 0.32 percent year-to-date — a stark difference from the start of last year, when the index plunged into negative territory. The bellwether index did finish 2016 up 7.16 percent, enough of an advance that strategists on this year’s All-Europe Research Team ranking believe 2017 may be the year European equities bounce back.

Analysts at Bank of America Merrill Lynch, which tops the overall research ranking for the second year in a row, say that an uptick in global growth could begin to bring European earnings out of stagnation, a key metric for sidelined investors. The financial crisis hit European equities hard, and although a temporary boost from the European Central Bank’s stimulative monetary policy supported markets in 2015, earnings never followed. According to FactSet Research Systems, earnings remain 40 percent below 2007 highs. But if global growth holds at around 3.5 percent or goes higher, strategists predict, European earnings will rebound along with it. That could create new opportunities for long-term investors to get equities while they are still relatively cheap.

“We were surprised by how cautious global investors have become with respect to Europe yet again,” says Mislav Matejka, who leads the global equity strategy team at J.P. Morgan Cazenove to its fifth consecutive No. 1 ranking. Matejka is a name to conjure with in equity research. He and his team have to take perhaps the broadest of views — across macroeconomies, global markets, and geopolitics — in research, and this year’s voting confirms that the discipline only grows in importance as uncertainty rises. Equity strategy had the greatest number of voters and the second-most total votes of all the 45 sectors. And Matejka himself got the second-highest vote tally as well as the third-highest percentage of votes for an individual across the ranking.

“We believe that if the reflation theme starts to look more credible and sustainable, then Europe will benefit as well in this scenario. It was clearly hurt during the past seven years of a downward inflation spiral,” observes Matejka, a native of Croatia and a London School of Economics and Political Science grad.

He says the key focus for his team right now is assessing whether the recent nascent shift away from deflationary downside risks and toward reflation will have legs: “The direction of bond yields is an important parameter in this regard. Many investors we speak to believe bond yields will not sustainably move higher, and if they do, that would end up being a big problem for equity and other markets. They fear that the global economy won’t be able to tolerate higher yields.” But Matejka and his team differ. They argue that if yields rise, it will ultimately be healthy for markets, particularly equities.

“The move up in bond yields might compel asset allocators to finally start repositioning out of fixed income, and allow the leadership within the equity market to broaden out,” Matejka notes.

Matejka has even found himself with a nickname — or at least sharing one, courtesy of financial blog Zero Hedge, with his colleague, Marko Kolanovic, global head of quantitative and derivatives research at J.P. Morgan: the “Croatian Duo of Doom.” (Bloomberg once dubbed Kolanovic “Gandalf” for his prediction skills.) The reason: their bearish stance on U.S. equities. Matejka had released a research note suggesting that, unlike in Europe, where markets may be poised to bounce back, investors in U.S. markets would do well to sell into rallies and take a more defensive stance than they have over the past seven years. He's since made some tactical updates to that stance reflecting changes since the election, but the team's reputation for being willing to go against the grain is well known.

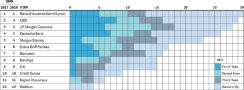

The Leaders The firm winners on the 2017 All-Europe Research Team show great stability. Bank of America Merrill Lynch repeats at No. 1, while UBS moves up two spots to No. 2. J.P Morgan Cazenove hangs tight at No. 3, Deutsche Bank slips two to No. 4, and Morgan Stanley falls one place to No. 5.

The All-Europe Research Team ranking is based on responses from money managers in the Euro 100, Institutional Investor’s lineup of Europe’s 100 biggest institutional investors, and other key Asian, European, and U.S. investors. In calculating weightings, the list focuses on analyst teams rather than individuals. The 2017 team reflects the opinions of more than 2,300 money managers at 784 institutions overseeing an estimated $6 trillion in European equities.

Even if earnings start to catch up, European equities will still have a way to go. The start of the year saw a lot of commentary on the possibility of a “great rotation” out of bonds and into equities, but that hasn’t begun. Strategists point out that many investors worry about political and macroeconomic issues in Europe, including upcoming elections in France and Germany. There is also a significant legal overhang for European financials from the financial crisis. It’s no surprise that Bank of America Merrill Lynch and J.P. Morgan — the top banks in the leaders table and weighted leaders table, respectively — are U.S.-based. J.P. Morgan recently claimed the top spot in investment banking market share in both the U.S. and Europe in its latest earnings report. U.S. banks have rebounded admirably; their capital structures are different from those of their European counterparts, making them more resilient to increased capital requirements and volatile markets, which has allowed them to take local market share from European banks.

Deutsche Bank, on the other hand, which is joint No. 3 for overall strength, has a much thinner capital reserve after its recent spate of massive fines and settlements, including its deal with the U.S. Department of Justice over mortgage practices leading up to the financial crisis. The bank’s overall business has been suffering as well, prompting staffing cuts and crippling its ability to take on risk in a bid for more revenue. Add to that low interest rates and sluggish local growth, and it’s hard to be upbeat about Deutsche Bank or other European banks.

This disparity between U.S. and European banks is having a chilling effect on the Basel Committee on Banking Supervision, which agreed to push back its implementation of new capital requirements until March at the behest of European bankers and policymakers, who said that proposed reserve requirements would be too much to bear while the recovery is still in early stages on the Continent. The delay gives everyone more time, but it also adds uncertainty around what the requirements will ultimately be and when they will be enforced.

Amid all of these bottom-line concerns, another regulatory push in Europe may change how asset managers source and pay for research — potentially creating new profit headaches for European banks that generate considerable revenue from research. European regulators are calling for greater pricing transparency and fewer conflicts surrounding how research is disseminated. While that seems straightforward, the change is tied to bigger and broader debates about asset management and what investors should be paying for. “This is a global question,” says Inigo Fraser-Jenkins, a senior quantitative analyst at Bernstein, who appears with his team for the first time in the ranking.

Fraser-Jenkins notes that as investors continue to base allocation decisions about active and passive products largely on fees, the cost of research will become almost as important as its content. “A lot of issues around research are bound up in this debate, in terms of who pays and how asset management works. Business models may have to change,” he says.

Bernstein is something of a pioneer of this model by offering research as an independent, stand-alone product. The firm leads a number of sectors in the ranking, and many analysts say independence allows for deeper research coverage and lessens the pressure to focus on managing or expanding banking relationships.

More traditional sell-side analysts remain philosophical about the role of research in banking relationships. Most agree that research will always have a place even if how it’s paid for changes. Asset managers will still want a view into companies they invest in but lack the resources to cover in-house. Investors too are likely to seek out sources for information they may not be able to find readily on their own.

Technology will also play an increasingly critical part in how asset management relationships are maintained. Everything from accounts management to trading to how research is presented is being transformed by technology. “A big irony is that a lot of quant funds haven’t recovered to their precrisis AUM, but so much of asset management now rests on a quant-style infrastructure in terms of technology and approach,” says Fraser-Jenkins, noting that the potential for further technology-driven cost cutting will likely be significant.

While debate swirls around these topics, the analysts themselves are simultaneously guiding the conversation and living through it. Analysts act as conduits, developing an expertise in their area and sharing information that can move markets. They also develop relationships with companies and investors that come with many obligations. “People are engaging with these questions at the highest levels,” Fraser-Jenkins says, which, he adds, has kept him interested in research as a long-term career: “The bigger strategic problem is that investing over the past 30 years has been relatively easy, in the sense that the correlations have been clear and the trends straightforward. That’s not the case anymore, and it’s unlikely we’ll get back there in the future. So we will have to think about how to operate in this new environment.”