Sai Kuen (Tony) Lee & team J.P. Morgan

The buy side says: “He provides excellent analysis and incisive commentary.”

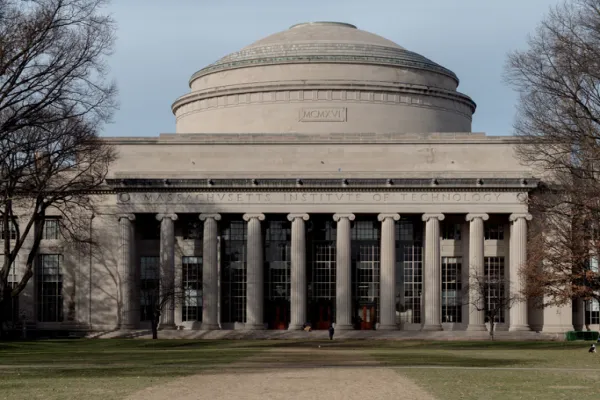

Sai Kuen (Tony) Lee and his team at J.P. Morgan repeat in the top spot, receiving kudos from one investor for their “prompt attention to clients and invaluable research.” The crew is keeping a watchful eye on higher oil prices, which “will erode profit margins for many companies and sap consumer spending,” Lee says; at the same time, the analysts are cautious about a “potential sharp slowdown in China that would weigh on stock prices and future growth prospects globally.” Both of these risk factors “are negative for the equity markets and could lead to increasing levels of market volatility,” Lee explains. The five-member team, which is based in Hong Kong and Tokyo, is advising investors to “consider using options for implementing their directional views or hedging purposes,” since the breakeven levels of option strategies have become very attractive. Lee, 33, joined J.P. Morgan in 2008, having worked previously at Bear Stearns Asia and Merrill Lynch. He earned a master’s degree in engineering from Ithaca, New York’s Cornell University.

— Carolyn Koo