Some traders ruefully describe 2011 as “shockingly volatile,” even as others are pricing new Ferraris in sleek showrooms on Park Avenue and in Mayfair. What combination of asset volatility and fast-car returns is in store for 2012?

In the June 2011 issue of Institutional Investor, I described a reference scenario of the events that global macro traders believed to be moving markets last year, based on a two-day conference at Ditchley Park in Oxfordshire, England. According to this scenario, global macro hedge funds were focused, laserlike, on just four key events: the Federal Reserve Board’s monetary stance, a Chinese hard or soft landing in terms of GDP growth, euro zone stresses and that perennial favorite, oil prices. As I explained in my previous article, “with four big events, there are 16 possible outcomes (two to the fourth power) in the reference scenario ‘decision tree.’”

With the benefit of hindsight, how did these scenario events actually play out, and how skillfully did our traders predict the four outcomes? Are the same cyclical and secular drivers of these events still at work? Looking forward, will these be the four key variables in 2012? And as the accountants tally up hedge funds’ year-end winners and losers, what is the reference scenario for 2012—and with what odds?

The Fed’s Stance: Loose or Looser

The Federal Reserve’s monetary stance is the first big event under traders’ scrutiny, as the Federal Reserve Open Market Committee’s decisions will drive asset markets around the world, for good or for ill.

One branch leading from this decision is moderate economic recovery, reflation of price levels, sustained U.S. government deficits,

The other branch of this part of the decision tree says this party can’t go on for much longer and leads to slower economic recovery, flat employment and selective deflation (or the dreaded “stagflation”), some nominal reduction of the federal deficit, a continued expansive Fed stance and gradual shrinkage of the trade deficit. The former branch might be described as “business as usual,” the latter as “malaise” or “painful adjustment.” At the end of the day, the latter scenario writes off QE2 as a dangerous illusion.

“Future Shocks,” June 2011

Original Prediction: Painful Adjustment

Traders in our poll overwhelmingly bet on the “malaise/painful adjustment” outcome, 68 percent to 32 percent (with a standard deviation of 17 percent). The individual arguments supporting this view reflected global macro traders’ conviction that long-term adjustment is crucial—“This party just can’t go on forever,” one trader explained. The traders were also confident, in some cases adamant, that financial markets would force a fiscal deficit reduction in Washington: “If Moody’s gives the Treasury a downgrade, even Congress will have to pay attention,” was a popular comment. Most traders have a visceral dislike of quantitative expansion in any form—“QE is just a central bank’s monetization of government debt, any way you look at it,” observed one trader.

I should add that all quotes in this article are guaranteed genuine, but some of our traders’ firms have blanket policies forbidding their employees from being quoted in the financial press.

Actual Outcome: Business as Usual, Plus ‘Twist and Shout’

Contrary to the traders’ average prediction, we are still heading up the “business as usual” branch at the start of 2012, with no real deal on the U.S. fiscal deficit and with another shot of QE via September’s Operation Twist, although, unlike QE1, the Twist was balance-sheet neutral for the Fed.

The U.S. federal deficit in fiscal 2011 was -8.6 percent of GDP, barely down from 2010’s -9 percent. According to International Monetary Fund forecasts, the U.S. fiscal deficit will shrink only slowly, stubbornly sticking above 6 percent five years out. Consensus forecasts for U.S. economic growth are 1.8 percent for 2011 and 2 percent for 2012, with unemployment running at 9 percent and 8.7 percent, respectively. Even as government debt continues to climb, households will deleverage very slowly, and the external trade deficit will keep running at the 3 percent–of-GDP level more or less indefinitely.

The benefits of QE may still be a dangerous illusion in the minds of many financial professionals and has encountered a groundswell of political opposition in the Republican Party. But all indications are that the dominant dove faction on the Federal Reserve Board is keeping this option open. “Public political criticism of the Fed is nothing new and won’t have more than a marginal impact on its policy actions—maybe just on how it communicates them,” says Thomas McGlade, a Greenwich, Connecticut–based portfolio manager and director of U.S. operations for London-based hedge fund firm Prologue Capital.

Drivers: Deflation and Unemployment Fears Trump Deleveraging

As an example of the communication style described by McGlade, in a November 15, 2011, speech at the Council on Foreign Relations in New York City, Chicago Fed president Charles Evans made the case that inflation was essentially under control, displaying slides showing that the FOMC “central tendency” forecasts have core inflation running well under 2 percent for several years while unemployment slowly creeps down from the 9 percent level, still hovering in the 8 to 9 percent range a year hence and not going below 7 percent until 2014. If Evans’s view indeed reflects the central tendency of the Fed, the cyclic driver of slow U.S. recovery and sideways unemployment will wash the urgency out of deleveraging.

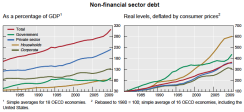

The persistence of secular leveraging was called rather rudely to the Fed’s attention by the now-famous paper on “the real effects of debt” by Brandeis University finance professor Stephen Cecchetti and his colleagues, presented at the Fed’s August 2011 Jackson Hole meeting; it later appeared as the Bank for International Settlements’ BIS Working Papers 352. I have seen copies of the graphs from this paper (see graph below, left) taped to traders’ screens and pinned to the corkboard over a trading floor’s espresso machine.

According to the BIS team’s calculations, total nonfinancial debt in 18 OECD countries grew from 167 percent of GDP to 314 percent between 1980 and 2010, an increase of almost 5 percent of GDP per year for three decades, as shown in the graphs. This trend has brought us to the point in many of these countries where debt levels are stifling GDP growth, according to economists Carmen Reinhart and Kenneth Rogoff. This implies that households and then governments must go through a sustained and painful deleveraging process.

Says Paul Brodsky, co–managing member of New York–based hedge fund firm QB Asset Management: “The issue across the board in developed economies is solvency—not discrete liquidity flare-ups among sovereigns, banks or households. Nor is a lack of confidence among consumers the issue. It all comes down to the extraordinary gap separating systemic debt from existing base money. The world needs to deleverage.”

The FOMC may think that deleveraging and adjustment are necessary someday, but putting more of the 25 million unemployed or involuntarily part-time employed Americans back to work appears to be more pressing—the central banker’s version of Saint Augustine of Hippo’s famous prayer, “O Lord, grant me chastity and continence, but not yet.”

Prediction for 2012: The Fed Will Make It Too Dangerous to Hold Bonds

Looking forward into 2012, our sample of traders believes the important choice is no longer between business as usual and adjustment, but between more quantitative easing or not, and the vast majority believe the Fed will engage in QE3. The average bet is 70-30 in favor of QE3, with a standard deviation of 22 percent.

There is broad consensus among traders that U.S. growth and employment are sliding sideways in an L-shaped, “slow and fragile” recovery through 2012, and the real question at this point is when and how much the doves at the Fed will resort to QE3. “How many bullets does the Fed really have left in its gun at this point?” asks Prologue’s McGlade. “From now on, the only remaining impactful policy option is additional QE, which could be balance-sheet neutral or expansive. And sometime in the first half of 2012, provided that the data continues to undershoot the hurdles of the dual mandate, I think we will see additional QE involving balance-sheet expansion rather than another balance-sheet-neutral move like Twist, and most likely involving mortgages this time.”

There is disagreement over what the transmission mechanisms from QE3 back into the real economy are—if any. “By pressing rates so low, the Fed is just making it too dangerous to hold cash and bonds,” concludes a skeptical global macro trader. “If you need yield, you are being forced up into equities and other real assets—not a comfortable position to be in.”

China: Hard or Soft Landing?

Will Beijing keep real Chinese GNP growing somewhere around its current target of 7.5 percent for the next year? Or will inflation fears cause the leadership to dampen demand levels back down toward 5 percent? There is a history of Beijing throttling the economy back and forth rather radically. As Arvind Sanger, founder of New York–based hedge fund firm GeoSphere Capital Management, says, “The Chinese authorities have only two economic management tools at their disposal—one is a flamethrower, and the other is a fire extinguisher.”

One possible outcome from the China event is real growth in the 8 to 10 percent range, with increasing inflation above 5 percent, sustained feverish levels of capital and infrastructure investment, and some reduction in net exports (which together add to 70 percent of GDP)—not quite the flamethrower mode but still pretty hot, and consistent with a “business as usual” view of the world. The other possible outcome is a hard landing: growth around 5 percent, with persistent inflation and expansion of net exports.

“Future Shocks,” June 2011

Original Prediction: Soft Landing

On average, the traders assigned a 57 percent probability to the soft-landing path and 43 percent to a hard landing, with a standard deviation of 19 percent. The dominant view argued that the leaders in Beijing had a lot of tools at their disposal to drive the economy in the direction they wanted it to land, including ownership of the banking system and a cushion of several trillion dollars in foreign exchange reserves.

Actual Outcome: Headed for Hard Landing but Changed Course

The traders were on the money, on average. We are still in soft-landing territory, with Chinese real growth expected to hit 9.2 percent on an annual basis in 2011, according to Xinhua News Agency. This growth was achieved by sustained high levels of domestic investment and by net exports, although the ratio of net exports to GDP declined from 3.1 percent in 2010 to 2.4 percent in 2011.

“They [Beijing] were tightening at the beginning of 2011, tightening real estate lending and raising some tax rates, but then they changed in October, with a minor monetary ease, some tax cuts for business and a shift toward easier monetary and fiscal policy, suggesting that the Chinese leadership is more concerned about the risk of a “hard landing,” says Laurence Zuriff, managing partner of Granite Capital International Group, a New York–based investment firm.

There is considerable uncertainty about the real rate of inflation, given doubts about the accuracy of reported consumer price index figures: Official 2011 inflation is running at somewhere between 5 and 6 percent (6.1 percent in September and 5.5 percent in October). Some believe this number has been engineered by the government statistics office—for example, by lowering the weights of food in the CPI basket.

Drivers: Rebalance, but Not Yet

Cyclically, the Chinese face the same trade-offs noted in my last article. The Politburo, which charts the basic guidelines for macro policy, fears the twin miseries of unemployment and inflation. If real growth falls below 7 percent or so, China cannot absorb annual increases in the workforce; if inflation rises much above 5 percent, the population gets restive.

Secularly, the members of the Politburo know they need to rebalance the components of GNP sooner or later — probably sooner — because the large weight and high growth rates of fixed investment and net exports can’t continue indefinitely and will have to be replaced with high personal consumption. All the official speeches acknowledge this. But no one in Beijing appears to be in any hurry to accelerate adjustment at the risk of domestic instability.

According to Ben Simpfendorfer, a Hong Kong–based economist for New York–based financial advisory boutique Global Strategic Associates and editor of the “China Insider” newsletter: “China has some of the world’s best economic planners, but the scale of the challenges are daunting, especially in the midst of a political transition. Beijing’s biggest challenge is weaning itself off state-owned heavy industry and revitalizing the private sector. The economy was, ironically, better balanced in 2008, or shortly before the crisis.”

Chinese officials think the shrinkage of net exports will continue, although some in Beijing are already raising alarms about a possible sharp swing down. According to Zhang Yansheng, director of the Beijing-based Institute for International Economics Research, under the National Development and Reform Commission, “What we’re facing now is a grave situation for exports, and slowdown is inevitable in the third and fourth quarters.”

So a soft landing is still the target, though what constitutes “soft” appears to be somewhat slower nominal growth—say, 8 percent rather than 9 percent—and the danger zone of hard-landing growth is a bit higher: say, 6 percent rather than 5 percent.

Prediction for 2012: China Needs Reform, Not More Easing

Looking forward, the traders believe that China’s glide path toward lower growth is still one of the big four events that will move financial markets in 2012. The average prediction continues to see a soft landing, but the odds fell from 57 percent in June to 53 percent looking forward into 2012.

“China has the firepower to prevent a hard landing in 2012, but the economy needs more reform, not more policy easing,” says Simpfendorfer. “Flushing the system with more credit will only worsen imbalances. China’s middle-income trap is approaching fast unless productivity gains start replacing labor and capital as the main drivers of growth. Policy easing can only delay, not avert, the challenges.”

Granite’s Zuriff agrees that 2012 will be a tougher growth environment for Beijing’s leaders. “Global demand will likely be lower, and their wage inflation is reducing their competitive advantage in a lot of export sectors,” he says. “And there have been a series of frauds and corporate governance issues, like Sino-Forest and Alipay, that are undermining inward foreign investment. The housing sector is overbuilt and vulnerable to a big price correction, and the Communist Party leadership itself is going through a big transition in the second half of the year. When trying to determine if we will see a hard landing in 2012, we have to ask if the party leaders will try to buy growth to buy stability in front of the leadership transition—and if they’ll succeed.”

Of course, the 53-47 split of our poll indicates average confusion more than anything else, as the standard deviation of the forecast widened from 20 percent to 23 percent. “We can’t understand economic policymaking in Brussels or Washington anymore, much less in Beijing,” complains one trader. “Plus, if the Chinese don’t make their growth or inflation targets, they can just make it up. But at the end of the day, the Chinese can have a soft landing because they can afford it—they have the resources needed to carry them through a transition period.”

Euro Zone: Extend or Breakup?

Will the EU peripheral states force bondholders to take a haircut on their debt? Or will the EU, the European Central Bank and Germany somehow manage to bail them all out in a way that doesn’t force big write-downs?

All macro traders believe the question isn’t whether the periphery writes down its sovereign debt, but rather how it does so. One branch of the European debt limb of the decision tree is what one trader describes as “extend and pretend,” with some kind of government bailout that keeps holders of Irish, Greek and Portuguese sovereign debt from taking big write-offs, thereby averting contagion to the European banking system. This is business as usual in the euro zone. The other branch is an ugly adjustment that reveals the scale of the exposure of French and German banks to peripheral sovereign debt and threatens to spread to Italy and Spain.

[“Future Shocks”, June 2011]

Original Prediction: Extend and Pretend

The average probability estimate for “extend and pretend” was 53 percent, versus a 47 percent prediction of an ugly default, with a standard deviation of 25 percent, a wide distribution around the mean.

The average prediction gave the euro authorities almost even odds between going up the “extend and pretend” path with a bailout that didn’t result in a haircut for the holders of euro zone periphery sovereign debt and an ugly default on the periphery, which would rapidly spread to Italy and Spain as well as threaten the credibility of the European banking system, including the core French and German banks. The big standard deviation suggests a fairly wide dispersion around the mean by individual traders. Some believed the Europeans could trudge toward a solution and eventually muddle through. Others insisted that markets wouldn’t wait that long.

Actual Outcome: Ugly Adjustment

The funding crisis of European banks and sovereigns alike is driving them both pell-mell into the reluctant embrace of the ECB. This surely constitutes evidence that we are going down the ugly-adjustment pathway.

In the last half of 2011, French banks’ dependency on the ECB for liquidity exploded, from €10 billion to €100 billion ($13 billion to $130 billion). The FTSE index of French and German banks dropped from 100 to 60. Moody’s Investors Service downgraded the credit ratings for BNP Paribas, Crédit Agricole and Société Générale, while Fitch Ratings downgraded the long-term ratings of Barclays, Credit Suisse and Deutsche Bank.

Euro zone authorities are still pretending that the monetary union part of the “European project” is on track, but this could fall apart any day now. They are also pretending that there has been no default event for the holders of European sovereign debt, even while twisting their collective arm to take a big haircut—a truly surreal juxtaposition. In the meantime, Greek debt is trading at a deep discount to par, which is surely a write-down in the real world. Beyond the Continent everyone is watching the circus of euro negotiations with a combination of anxiety and disbelief. “Demographics have caught up with the European social welfare state, and European governments made promises they can’t keep, so what we’re seeing is the bursting of the entitlements bubble,” says one Connecticut-based global macro trader. “These last weeks have been a fiasco for European authorities. The EFSF [European Financial Stability Facility] is hamstrung, the outlook for the euro is bleak, and any chance of a year-end rally is gone. The banking crisis will deepen, sovereign bond yields will continue to increase, and we traders are facing grindingly volatile markets with a downward trend.”

Drivers: The Sovereign Debt Danger Zone

The cyclic and secular drivers of euro zone survival going into 2012 are the same as in mid-2011. The euro zone is sliding into a second recession, and the long-term problems of center-periphery price adjustment (or lack thereof) and sovereign debt remain unresolved. The sheer scale of the political compromises and subsequent approvals required to alter the euro zone agreement—particularly in Germany—is dragging out the adjustment process and amplifying the cyclical crisis.

The basic math on the sustainability of sovereign debt is still in place: Once sovereign yields climb above the likely GDP growth rate, the debt burden will climb and sooner or later crush the state. By this measure, all of the so-called PIIGS—Portugal, Ireland, Italy, Greece and Spain—are already above the sovereign yield danger zone.

Prediction for 2012: Either Way, It’s Game Over in 2012

Our traders remain almost equally split on the euro zone trajectory—53 to 47—with an average forecast that Brussels and the European authorities can somehow pull off an extend-and-pretend bailout of the periphery and the core through 2012, but the standard deviation of the forecasts narrowed from 25 percent to 19 percent. The overall tone, however, is increasingly skeptical as traders and other market participants watch the European authorities dither through endless summits, deadlines and “senior consultations.”

“With some help from other wealthy European states and ECB repo operations, Germany has the money to do a wholesale credit wrap of euro-area bank and sovereign debt,” says Prologue’s McGlade. “But there are stringent conditions from the Germans for that wrap. Plus, the political and nationalist constraints in the other states that have to accept those German conditions are uncertain and volatile. The scale of funding needs in the first quarter at the sovereign, banking and corporate level in Europe is absolutely huge, and that means some sort of climax is imminent.”

From his market soundings, McGlade believes he is not alone in this view. “The ECB is dancing as fast as it can to preserve the European banking system, and the market is sniffing this,” he explains. “[ECB president Mario] Draghi’s hawkish refusal to allow the ECB to expand the bond purchase program has begun a new, dangerous chapter in the euro crisis. The global pool of capital will not fund those debt rollovers unless it is at a steep discount, and at such a discount the debt-service load becomes untenable and the government business models unsustainable.”

Another Greenwich-based macro trader is equally pessimistic. “The euro is destined to be a weak currency in 2012,” he says. “Rates are going to zero or just 25 basis points, Brussels’ interventions will remain haphazard, and the ECB will continue to disappoint those calling for full-force monetization of struggling sovereign debt. Greece and Italy will both default in 2012, and the ‘core’ European banks are going to have to get recapitalized. We are on the precipice of a nasty election cycle globally, and there is going to be a lot of tearing of social fabric.”

Not all observers are so bleak about the euro zone’s prospects, though they agree that 2012 is a year of decision. “The political obligation on the part of the Germans to avoid the disintegration of Europe is so great that ultimately they will choose the lesser of two evils and decide to take the hit and guarantee debt. The Greeks and Italians will write rules, and the Germans will sign the checks,” predicts a senior investment banker. “Either way, it’s game over within 2012. Either Germany concedes or the euro zone dies.”

Oil: Medium or Expensive?

The final big event is oil prices. Every day since the Arab Spring broke out in December in Tunisia, traders have been running and rerunning the odds that chaos in the dusty streets of Middle Eastern and North African capitals will result in fewer oil tankers passing the Strait of Hormuz. Since it is well established that there is very little swing capacity in the oil market with which Saudi Arabia could maintain stability in oil prices (even if it wanted to), a minor disruption in oil exports from the Gulf could result in big price increases. One possible outcome is expensive oil, $125 or more a barrel; the other is medium to expensive oil at about $100 a barrel.

[“Future Shocks”, June 2011]

Original Prediction: Medium Oil

The majority view of the macro traders was the second outcome, toward medium to expensive oil, but only narrowly so, with an average 52 percent probability and a large standard deviation of 21 percent. Traders were more concerned about possible supply shocks caused by the Arab Spring rippling more widely through the oil-supplying countries of the Middle East and less concerned about variations in demand, especially from China and India.

Actual Outcome: Medium Oil as Libya Is Off-Line and Then On-Line

The prediction was right—we are down the path of $100 to $110 oil. “Oil in 2011 was all about Libya,” says one macro trader, who spent a decade as an energy specialist. “Libya went off-line in February and came back on-line in the fall. Before the war they were pumping 1.6 million barrels per day, which then dropped to zero. That’s the chief reason Brent got up to $130 per barrel. But Libya has exceeded expectations recently and is back pumping between 800,000 and 900,000 barrels per day.”

Drivers: Finely Balanced Supply and Demand

The same cyclic and secular drivers are likely to be propelling oil prices in 2012. Emerging-markets demand has absorbed the small incremental pumping capacity that softened developed market demand is freeing up. On the supply side there is still political instability in several major suppliers: Iran, Libya, Nigeria and Venezuela.

In terms of secular drivers, the Arab Spring has resulted in massive injections of funds back into those nations’ societies by nervous sheiks and kings. This puts some pressure on them and OPEC to pump more. On the other hand, it also gives them an incentive to cut back on supply so they can raise prices. For example, because of enhanced fiscal commitments, the price of oil that Saudi Arabia needs to balance its budget—the so-called budget break-even point—went up to $80 a barrel and may climb to $115 a barrel in a year or so at current production rates.

The secular drivers increasing supply or substitutes outside of politically dicey areas in the Middle East and Africa through oil shale, deepwater drilling and fracking are steady but will take time. In the meantime, conventional oil capacity is increasing only about 1 percent per year on a net basis, which, combined with slim marginal capacity, could produce quite a bit of volatility in 2012.

Prediction for 2012: It’s All about Geopolitical Risk

Traders seem to have changed their minds about oil prices more decisively than about the other events. The average forecast is 59 percent that oil will stick at $100 or below throughout 2012, with a standard deviation of 18 percent.

“We are entering 2012 with low oil inventories but with overall demand flat because of recession here and in Europe, and with OPEC pumping at high levels, inventories will build in the early parts of the year, which will knock prices down,” says the energy-specialist-turned-macro-trader. “If Libya holds together, the balances for the second half of 2012 are very bearish. Prices should go flat to down through the year. So we’re really looking at geopolitical risk here. If one more big supplier goes off-line for whatever reason, these prices must go up again to ration demand.”

The Arab Spring continues to reverberate in traders’ minds. “For whatever reason, the capital markets have simply turned a blind eye to the situation or have gotten comfortably numb with all that has transpired in the Mideast, beginning with the immolation of that Tunisian vegetable vendor that sparked the Arab Spring,” says Stevyn Schutzman, chief macro strategist at RBC Capital Markets. “But these situations in the Mideast are all interconnected. The ripple effects that U.S. withdrawal from Iraq may have on the capital markets could be enormous—not just on the oil price but more broadly into energy policy and even defense spending.”

One Extreme or Another?

Some traders insist that oil prices could also move upward in response to higher inflation expectations generated by several central banks engaging in quantitative easing throughout 2012—a wall of money pumped into the world economy by the Fed, the Bank of England, the Bank of Japan and the ECB. “The financialization of money over the last generation demands the monetization of finance now,” says QB Asset Management’s Brodsky. “The value of goods, services, assets and labor must be reconciled in real terms with our global currencies, both for takers and providers of them. So I expect inflation because of central bank money manufacturing that forces the general price level higher.”

This is an uncomfortable reminder for all forecasters—in academia or trading—that the big events that will move markets in 2012 are not the truly independent variables so prized by the runners of regressions but rather covariant in complex ways.

When smart traders are equally split on the odds while the markets are getting both volatile and increasingly cross-correlated, one strategy is to simply bet on both ends. According to Alen Mattich in his Wall Street Journal blog: “The hope may be for a muddle through when it comes to the euro crisis, but investors are increasingly betting on one extreme or another. Take a look at the oil market . . . [with] very heavy activity in out-of-the-money options on oil prices—at either end of the spectrum. Although prices are currently hovering at around $100 a barrel, investors are betting that prices either collapse by half or surge by 50 percent. But it’s not just oil. Everywhere you look, asset prices seem unstable.”

Concludes Brendan Dornan, principal of New York–based Dornan Capital Management: “The best strategy for this is to sell at-the-money puts and calls, and use the proceeds to fund purchases of many more out-of-the-money puts and calls. This is the ‘barbell strategy’ advocated by Nassim Taleb.”

So what do you need to sleep easily through the new year with your barbell bets? Probably a lot more information than you have. Peter Bernstein, the preeminent academic historian of risk-taking, described the trader’s dilemma, likely to be as true throughout 2012 as it was in 2011:

The information you have is not the information you want.

The information you want is not the information you need.

The information you need is not the information you can obtain.

The information you can obtain costs more than you want to pay.

James Shinn (jshinn@princeton.edu) is a lecturer at Princeton University’s School of Engineering and Applied Science. After careers on Wall Street and in Silicon Valley, he served as the national intelligence officer for East Asia at the Central Intelligence Agency and then as assistant secretary of Defense for Asia at the Pentagon. He serves on the advisory boards of GSA, Oxford Analytica and CQS, a London-based hedge fund.