< The 2014 Tech 50: Moving Out of the Lab and Into the Cloud

8

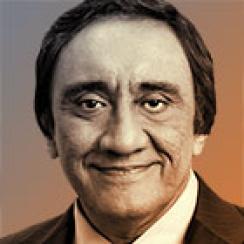

Phupinder Gill

Chief Executive Officer

CME Group

Last year: 12

Dealing with post-financial-crisis derivatives trading and clearing regulations, CME Group feels its customers’ pain. Phupinder Gill believes the company is uniquely placed to ease those burdens by “leveraging technologies to make clients’ lives easier.” The $3 billion-in-revenue parent of the Chicago Mercantile Exchange and other markets, including recently launched CME Europe, has been designated a systemically important financial institution, notes Gill, who has been CEO for the last two of his 26 years with the organization. “More agencies are looking at us” — not just futures regulators but also the Bank of England and Federal Reserve — “and that raises the cost of compliance.” In that sense, CME is no different from other exchanges that spent the previous decade focused on the speed, reliability and functionality of their trading platforms. An opportunity for CME to set itself apart and gain a competitive edge lies in the application of its global reach and economies of scale to “help clients meet regulatory requirements as cost-effectively as possible,” says Gill, 53. Building “seamless, straight-through regulatory reporting” into the transaction flow, for example, is especially appealing to “smaller clients lacking the bandwidth to do it on their own.” Not neglecting the longer term, CME has formalized a formerly ad hoc strategic investments function, targeting “early-stage companies that can transform trading in a meaningful way.”

The 2014 Tech 50

1

Dave Cross

| 1

| 3

IAN CURCIO 2011

| 4

FayFoto/Boston

| 5

Teri Pengilley

|

| Thomas Secunda Bloomberg | Jeffrey Sprecher Intercontinental Exchange | Catherine Bessant Bank of America Corp. | Stephen Neff Fidelity Investments | Lance Uggla Markit |

6

| 7

| 8

Photographer:Charlie Simokaitis

| 9

| 10

Mark McQueen

|

| Robert Goldstein BlackRock | David Craig Thomson Reuters | Phupinder Gill CME Group | Anna Ewing NASDAQ OMX Group | R. Martin Chavez Goldman Sachs Group |

11

| 12

| 13

| 14

| 15

Christopher Elston

|

| Deborah Hopkins Citi Ventures | Dan Mathisson Credit Suisse | Daniel Coleman KCG Holdings | Michael Spencer ICAP | Michael Bodson Depository Trust & Clearing Corp. |

16

| 17

| 18

Todd Plitt

| 19

| 20

|

| Joe Ratterman BATS Global Markets | Dominique Cerutti Euronext | Ron Levi GFI Group | Gaurav Suri D.E. Shaw Group | Charles Li Hong Kong Exchanges and Clearing |

21

Larry Lettera/ Camera 1

| 22

| 23

| 24

XT

| 25

|

| Lou Eccleston S&P Capital IQ | Lee Olesky Tradeweb Markets | Richard McVey MarketAxess Holdings | Seth Merrin Liquidnet Holdings | Antoine Shagoury London Stock Exchange Group |

26

Production

| 27

Wayne R. Martin

| 28

| 29

Thorsten Jansen

| 30

Adam B. Auel

|

| Christopher Perretta State Street Corp. | Kevin Rhein Wells Fargo & Co. | Peter Carr Morgan Stanley | Hauke Stars Deutsche Börse | Robert Alexander Capital One Financial Corp. |

31

| 32

| 33

Paul Elledge

| 34

| 35

Stephen Brashear

|

| David Gershon SuperDerivatives | Chris Corrado MSCI | Joseph Squeri Citadel | Tanuja Randery BT Global Services | John Bates Software AG |

36

| 37

| 38

| 39

Photo Credit: Kevin Irby

| 40

|

| Gary Scholten Principal Financial Group | David Gledhill DBS Bank | Simon Garland Kx Systems | Cristóbal Conde FinTech Innovation Lab | Jeff Parker EidoSearch |

41

| 42

Jeff Smith Photo

| 43

| 44

| 45

|

| Kim Fournais & Lars Seier Christensen Saxo Bank | Kenneth Marlin Marlin & Associates | Tyler Kim MaplesFS | Jim McGuire Charles Schwab Corp. | Jim Minnick eVestment |

46

| 47

| 48

tomohisa ichiki

| 49

David Poultney

| 50

A.E. Fletcher Photography

|

| Steven O’Hanlon Numerix | Sebastián Ceria Axioma | Yasuki Okai Nomura Research Institute | Niki Beattie Market Structure Partners | Mas Nakachi OpenGamma |