At 78, Mark Mobius is as fit as a pro weight lifter. Although the executive chairman of Templeton Emerging Markets Group travels 300 days a year, he stays in shape by sticking to his daily workout regime of running and pumping iron. Likewise, Mobius is a die-hard when it comes to emerging and frontier markets. Barring world war or a natural cataclysm, he believes, an equalization of global economies is under way and the developing world will keep growing for decades.

Mobius, who oversees 14 funds for U.S.-based Franklin Templeton Investments, regarded the collapse of confidence in emerging markets during the past two years as a buying opportunity. Taking a long-term view has helped the veteran equity manager grow his group to some $40 billion in assets, from nothing in 1987, the year he joined Templeton, Galbraith & Hansberger, the firm founded by Sir John Templeton, in Hong Kong.

Mobius blames the emerging-markets sell-off on hedge funds spooked by the prospect of the U.S. Federal Reserve Board tapering its quantitative easing program. Having bet on the spread between emerging-markets sovereign debt and U.S. Treasuries, many of them dumped their contracts at losses, prompting some global institutional investors to withdraw to developed markets.

“The sell-off was due to the psychological impact of tapering,” Mobius says at Franklin Templeton’s offices in Central, Hong Kong. “But after the psychological impact eased, many people realized growth continues in emerging markets.”

The numbers back him up. The MSCI Emerging Markets Index has been a roller-coaster since it peaked at 1,200 points in April 2010, falling more than 30 percent, to 830, later that year. It’s since risen and fallen three more times, dipping to 917 this February. As of late August the index had topped 1,080, its highest level since 2010.

A U.S.-born German citizen who holds a Ph.D. in economics from the Massachusetts Institute of Technology, Mobius thinks emerging countries have returned to a longer-term cyclical bull market. Banks that have hoarded cash for years will probably release it as central banks ease up on requirements for loan-to-deposit ratios, he notes. “There is just too much money waiting to be invested,” Mobius says. “That is why emerging markets have been doing well.”

He also expects to see strong equity performance in frontier, or less developed, nations from Africa to South America, which are enjoying the dividends of shifting to market economies. Asia and Africa both run at about 6 percent annual growth, Mobius explains: “This is creating a whole new arena for emerging-market investors.”

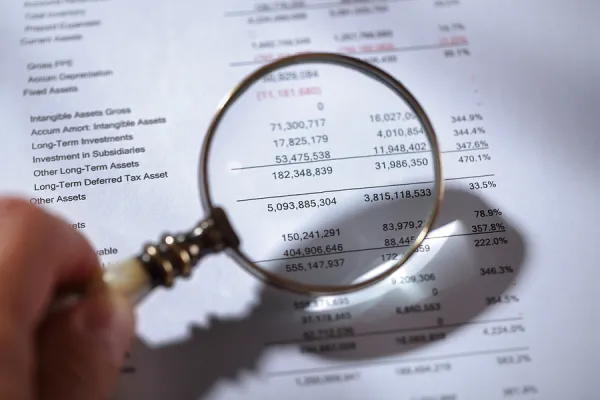

Mobius has invested in developing economies for more than 40 years. Before joining Templeton, which Franklin Resources acquired in 1992, as head of its new Templeton Emerging Markets Fund, he was president of Taipei, Taiwan–based International Investment Trust Co. Mobius now leads 51 managers and analysts in 18 offices worldwide. He and his team have done particularly well on their flagship, $12.7 billion Templeton Asian Growth Fund, which gained 14.2 percent for the 12 months ended July 31. The fund’s 13.7 percent annualized return for the previous decade beat the MSCI AC Asia ex Japan Index and research firm Morningstar’s Asia ex-Japan equity funds category by 1.43 percentage points and 2.98 percentage points, respectively.

Performance across all emerging markets is less impressive. As of July the $886 million Templeton Emerging Markets Fund had posted a ten-year annualized return of 8.38 percent, lagging the MSCI Emerging Markets Index by 3.99 percentage points and Morningstar’s global emerging-markets equity funds category by 2.26 percentage points.

For Mobius, emerging markets’ broader advantages over developed economies include higher growth rates, lower debt and bigger foreign-exchange reserves. “These provide a potentially positive macroeconomic backdrop, complemented by booming consumer growth,” he says. He’s agnostic when it comes to countries: “What is most important to us are the fundamentals of individual stocks.”

However, he’s especially bullish on Brazil, China and India. He singles out China, which has launched reforms targeting everything from corruption to integrated rural-urban development. As for India, Prime Minister Narendra Modi’s recent landslide victory proved how fast market sentiment and stock prices can improve, Mobius contends. He points to the country’s relatively high savings rate, youthful population and diversified economy, noting, “India’s middle class also has the potential to grow significantly, which means that it could become an even greater consumer market.”

Mobius looks for emerging-markets businesses that enlist technology to improve their bottom lines, whether it’s a bank using computerization to drive better services or a mining company adopting innovative exploration methods. But he also sees threats from digital communications tools. “Technology is driving knowledge of risk and as a result is driving risk all over,” he says. “If people know what is happening quickly, they react quickly and may also make more mistakes.”

Instant access to information has made his job tougher by boosting client demand for short-term gain, he adds. Mobius says he’ll never change his simple strategy, though: “Find those companies that are well managed that will be able to take advantage of technological changes, and stay with them for the long term. Don’t jump around.” • •