| Buyback Scorecard CFOs Share Their Stock Buyback Secrets Best and Worst Programs Industry Comparisons |

| How the S&P 500 Stack Up as Stock Repurchasers 1—50 | 51—100 | 101—150 | 151—200 | 201—250 | 251—270 | ||||||||

| Company | Industry | Market Capitalization | $ Total Buyback | $ Total Buyback / Market Cap | Buyback Strategy | Buyback Effectiveness | Buyback ROI | |

| Average | $46,040 | $3,349 | 8.6% | 22.3% | 4.3% | 27.5% | ||

| Median | $21,057 | $1,530 | 7.2% | 22.4% | 3.4% | 27.4% | ||

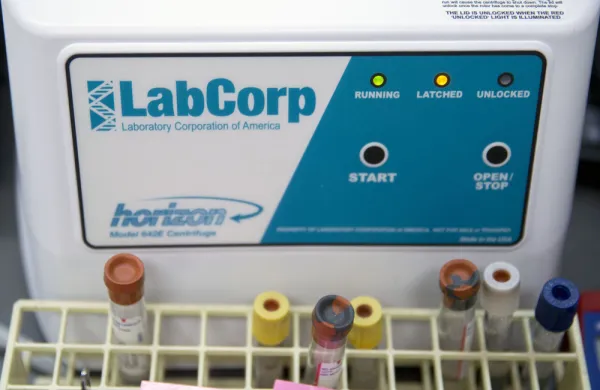

| 251 | Laboratory Corp. of America | Healthcare Equipment and Services | 8,377 | 1,518 | 18.1 | 1.8 | -3.3 | -1.6 |

| 252 | Jabil Circuit | Technology Hardware and Equipment | 3,712 | 278 | 7.5 | -12.6 | 12.3 | -1.9 |

| 253 | Family Dollar Stores | Retailing | 6,599 | 319 | 4.8 | 7.6 | -9.0 | -2.1 |

| 254 | International Game Technology | Consumer Services | 3,469 | 827 | 23.8 | 0.1 | -2.7 | -2.6 |

| 255 | Denbury Resources | Energy | 5,777 | 757 | 13.1 | -7.0 | 4.4 | -2.9 |

| 256 | PetSmart | Retailing | 6,798 | 876 | 12.9 | 10.9 | -12.4 | -2.9 |

| 257 | International Business Machines Corp. | Software and Services | 200,448 | 31,005 | 15.5 | -0.9 | -2.5 | -3.4 |

| 258 | Target Corp. | Retailing | 38,313 | 2,744 | 7.2 | 7.5 | -10.4 | -3.7 |

| 259 | Philip Morris International | Food, Beverage and Tobacco | 129,388 | 12,302 | 29.5 | 3.9 | -8.6 | -5.1 |

| 260 | Intuitive Surgical | Healthcare Equipment and Services | 16,790 | 1,348 | 8.0 | -7.6 | 1.6 | -6.2 |

| 261 | Marathon Oil Corp. | Energy | 24,573 | 1,051 | 4.3 | 3.8 | -11.6 | -8.2 |

| 262 | CH Robinson Worldwide | Transportation | 7,719 | 1,004 | 13.0 | -7.1 | -1.5 | -8.5 |

| 263 | Mattel | Consumer Durables and Apparel | 13,652 | 555 | 54.1 | 16.3 | -21.3 | -8.5 |

| 264 | Coach | Consumer Durables and Apparel | 13,785 | 1,094 | 7.9 | -15.1 | 4.7 | -11.1 |

| 265 | Quest Diagnostics | Healthcare Equipment and Services | 8,356 | 1,219 | 14.6 | -2.5 | -9.3 | -11.6 |

| 266 | Apache Corp. | Energy | 32,742 | 1,500 | 4.6 | -9.9 | -1.9 | -11.6 |

| 267 | Citrix Systems | Software and Services | 10,555 | 557 | 5.3 | -9.2 | -3.7 | -12.6 |

| 268 | Edwards Lifesciences Corp. | Healthcare Equipment and Services | 7,797 | 1,050 | 13.5 | -3.1 | -10.0 | -12.8 |

| 269 | CenturyLink | Telecommunication Services | 18,980 | 1,940 | 10.2 | -4.3 | -9.6 | -13.4 |

| 270 | Teradata Corp. | Software and Services | 7,848 | 745 | 9.5 | -13.4 | -10.8 | -22.8 |

| Source: Fortuna Advisors Analysis using data from the Capital IQ database. Financial Data from March 2012 to March 2014. Includes the 490 members of the current S&P 500 that were public for the full period. Market Capitalization as of: 03/31/2014. Companies Included here if $ Total Buyback / Market Capitalization is greater than 4% or if $ Total Buyback is greater than $1 Billion. | ||||||||