To fulfill its dual mandate of price stability and a low rate of employment, the U.S. Federal Reserve has been guided by the Taylor rule for roughly 20 years. The Taylor rule, first proposed in 1993 by Stanford University economist John B. Taylor, goes something like this: The appropriate short-term interest rate, set by the central bank, is a function of the slack in the labor market and the difference between actual inflation and the inflation target. Until the 2008–’09 financial crisis, the unemployment rate was a sufficient indicator of the labor slack. Hence the Fed could set interest rates based simply on core inflation and the unemployment rate. Thanks largely to this framework, the Fed managed to be successful on the employment front — but even more so on the price stability front.

But the situation has changed recently. On one hand, inflation was painfully low in 2013, and on the other, the unemployment rate has dropped sharply. Which part of the dual mandate should the Fed favor?

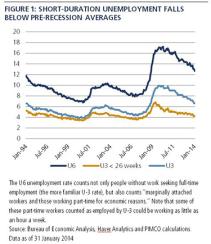

Some who blog about the Fed argue that the drop in the unemployment rate should have resulted in earlier rate hikes, citing a recent study by Robert Gordon of Northwestern University. They claim that short-duration unemployment, that is, less than 26 weeks, is the best indicator of labor slack and that since that rate has already fallen below prerecession averages (see chart), the economy is at risk of overheating.

Meanwhile, in her February 11 testimony before Congress, newly installed Fed chairwoman Janet Yellen went in the opposite direction, saying there was probably more slack in the economy than a cursory glance at the unemployment rate would suggest. “Those out of a job for more than six months continue to make up an unusually large fraction of the unemployed, and the number of people who are working part time but would prefer a full-time job remains very high,” said Yellen. “These observations underscore the importance of considering more than the unemployment rate when evaluating the condition of the U.S. labor market.”

Both sides have a legitimate point of view, though in my opinion Gordon vs. Yellen is a bit like the 1971 Ali vs. Frazier boxing match, which was dubbed by sportswriters the “Fight of the Century.” They’re both seasoned heavyweights. That the two can have such a stark difference of opinion on the topic underscores the validity of the debate over the unemployment rate’s suitability as an indicator. Most likely, Yellen will have the last word, though she might also have her own agenda. Would she really be concerned by a bit too much inflation because of a tighter labor market?

Based on our analysis, Pimco’s outlook for 2014 inflation has core personal consumption expenditures (PCE) moving up to 1.6 percent year-over-year at the end of 2014, compared with the present 1.2 percent rate. Longer term, the index really depends on what the Fed does.

Since the unemployment rate may or may not be the right measure of output slack, it is not a reliable indicator for conducting monetary policy. Taking any lags into consideration, we will know if the economy has reached the end of the cyclical downturn when inflation picks up. Thus the Fed will have to choose between being behind the curve, waiting to see if inflation actually picks up, and risking a hawkish mistake. The last time it chose to ignore weak inflation prints and started to discuss monetary policy tightening, my colleague here in Newport Beach, deputy CIO Mihir Worah, and I warned in our June 2013 Viewpoint, ”Promise to be Irresponsible” that the Fed would end up doing more quantitative easing to compensate for its hawkish mistake. That same month, then–Fed chairman Ben Bernanke announced that when “asset purchases ultimately come to an end, the unemployment rate would likely be in the vicinity of 7 percent.” Today the Fed is still expanding its balance sheet, while the unemployment rate is well below 7 percent.

Pimco expects that between balancing the risks of a hawkish mistake and some inflation overshoot, Yellen will choose the latter, especially since inflation has undershot the Fed’s mandate by so much in recent years. Since 2009, inflation as measured by PCE has averaged 1.4 percent. Given a medium-term inflation target of 2 percent, inflation could average 2.6 percent for the next five years to catch up. Essentially, Yellen could wait for core PCE to move back to a solid 2 percent before she hikes the Fed interest rate. Since the unemployment rate is an unreliable measure, we believe inflation should guide monetary policy. But it’s up to the inflation jury to decide.

In the meantime, investors can position their portfolios to benefit from this monetary policy framework. Short-duration assets should be “safer” than long-duration assets because they benefit from the low-for-longer policy rate stance, whereas longer-duration will likely suffer from inflation uncertainties. We expect that strategies that seek carry from factors steepening the yield curve will perform well. The inflation premium should rise, and, significantly, inflation uncertainties mean real assets should be less volatile than nominal ones.

Jeremie Banet is an executive vice president and a portfolio manager on the real return team at Pacific Investment Management Co.’s headquarters in Newport Beach, California.

See Pimco’s disclaimer.

Get more on macro.