Melbourne-based entrepreneur Darren Dai has discovered a great way to increase the sale of Australian pine and softwoods to his Chinese furniture manufacturing clients: taking renminbi as payment.

Last year the head of Koalstralia Resources began accepting the Chinese currency, also known as the yuan, from customers instead of U.S. dollars. The change helps the company’s Chinese clients reduce transaction costs, including hedging and the typical 1.5 percent foreign exchange fees. “In turn,” explains Dai, “Koalstralia can benefit from more orders from the Chinese market.” The company has taken 8.2 million yuan ($1.3 million) in payment since last year, about 10 percent of its receivables.

Koalstralia Resources is far from alone. The use of the renminbi in international trade surged 150 percent in the 12 months through June, reports Swift, a Brussels-based cooperative that handles international payments among the world’s financial institutions. Nearly 16 percent of China’s $3.87 trillion of trade in goods and services is now settled in the country’s own currency, up from 8 percent in 2011 and virtually zero in 2010, according to HSBC Holdings data. (See also “China’s Currency Expands Creatively to Attract Investment”)

The currency’s growing role in trade has fostered a vibrant offshore market in renminbi-denominated deposits and corporate bonds — known as dim sum — as well as foreign exchange trading. Although a recent backup in rates has stalled issuance in the past three months, the market for renminbi corporate bonds has grown to $38.4 billion outstanding. London and Singapore have targeted renminbi business as a growth area, and both cities have joined Hong Kong as centers of bond issuance in the past year. “The increasing use of RMB is in line with China’s stature as a prominent economy and trading power,” says Jing Ulrich, J.P. Morgan’s Hong Kong–based chairman of global markets for China.

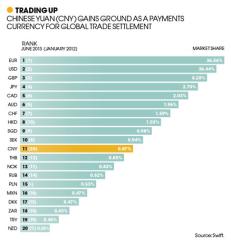

Click to enlarge |

In late 2010, as China was surpassing Japan to become the world’s second-largest economy, Beijing embarked upon an ambitious program to make the renminbi an international currency, which central bank governor Zhou Xiaochuan said would ultimately lead to reserve currency status. The plan is still in its early stages and will require major reforms to succeed, but recent developments suggest that it is gaining real traction in the markets. Some analysts and investors say the day is fast approaching when the renminbi will stand alongside the dollar, euro and yen as a major global currency.

“China’s capital markets could surpass those of the U.S. by 2020,” says Mark Mobius, executive chairman of Franklin Templeton Investments’ emerging-markets group. “When the RMB becomes fully convertible, it can rival the U.S. dollar. The reason the dollar has been so prominent is because it is the freest currency.”

The Legacy of Lehman: A Look at the World 5 Years After the Financial Crisis

- 5 Years After Lehman, No One Can Declare the Financial System Safe

- Europe's Banks, Slow to Restructure, Pose a Systemic Risk Today

- Emerging Markets Face Mounting Challenges as Global Liquidity Dries Up

- As the Fed Readies to Taper, Is the World Ready for Higher U.S. Rates?

There are threatening clouds on the horizon, though. China’s economy is slowing, and analysts are warning of mounting bad-debt problems in the banking system, a legacy of the massive 4 trillion-yuan stimulus program that Beijing pumped through the banks into the economy in 2009. If a financial crisis erupts, it could require a bailout as large as that stimulus program, slow the pace of economic reform and delay or derail plans for promoting the currency’s global use. “As more-vital issues come to the fore, there is a danger that RMB internationalization may take a backseat in the coming year or two,” says Paul Schulte, editor of “The Bull’s Eye Report” and former Asia strategist at Nomura International.

So far, however, the authorities show no signs of hesitation.

China is following a three-part strategy for promoting its currency, says Hu Yifan, a former World Bank consultant who is head of research at Haitong International Securities Group, the Hong Kong–based subsidiary of a leading Chinese investment bank. The first phase, encouraging trade settlement, is well advanced. Over the past five years, the People’s Bank of China has signed swap agreements with 22 nations in Asia, Latin America and Europe, with a total value of 2 trillion yuan, to foster the currency’s use in trade payment.

In the second phase the government will adopt an array of financial market reforms, including the establishment of special zones where capital can flow in and out freely, followed by full liberalization of the capital account, then unconditional renminbi convertibility. “China is moving from phase one to phase two, and this process may take three to seven years,” says Hu.

Click to enlarge |

Yet it’s notable that central banks in Japan, Russia, South Korea and elsewhere have begun to accumulate renminbi. The Reserve Bank of Australia has invested as much as 5 percent of its reserves in Chinese government bonds. “On the reserve currency front, this is already happening,” says Anita Fung, CEO of HSBC’s Hong Kong operations.

The internationalization of the currency is a long-term goal, says Hu, but other important changes are taking place in the markets. The renminbi has become the reference currency for much of Southeast Asia: Those countries’ currencies move more closely in line with China’s than with the dollar or the euro, according to a new paper by Arvind Subramanian and Martin Kessler of the Peter G. Peterson Institute for International Economics in Washington. The Indonesian rupiah, Malaysian ringgit, Philippines peso, Singapore dollar, South Korean won, Taiwan dollar and Thai baht all track the renminbi more closely than they do the dollar. “There is now a de facto RMB currency bloc in East Asia,” the economists write.

The increasing offshore use of the renminbi enhances China’s geopolitical power, says Laurence Brahm, a Beijing-based American lawyer and the author of China’s Century: The Awakening of the Next Economic Powerhouse. “We have to look at the globalization of the yuan as not just financial engineering but as part of an overall global strategy that is political as well as economic,” says Brahm, who advises China’s executive State Council on environmental policy and market reforms. “One obvious advantage is that when the RMB becomes widely accepted globally as a currency, it will become even easier for Chinese investors to go overseas.” Chinese companies have invested more than $380 billion in offshore acquisitions since 2006, according to the Washington-based Heritage Foundation. “That could top $1 trillion in the coming decade,” contends Brahm.

THERE IS NO RULE THAT DICTATES that a country’s economic weight must translate into an international role for its currency. For decades Japan has resisted a wider use of the yen, fearing that it would weaken Tokyo’s control of the domestic economy. A growing international role for the renminbi could undermine Beijing’s control because the authorities need to supply enough currency for its use to spread and to accept much of the volatility of free capital flows.

“The three major currency areas have all faced a major financial crisis following the strong development of the financial market and internationalization,” says Haitong’s Hu. “China will probably have to reinforce the regulation of its markets to avoid such a pitfall.”

The currency has made the most progress as a unit of settlement. The growth rate of renminbi trade settlement doubled in the year ended June 30, to 150 percent from 75 percent a year earlier, according to Swift. The currency now ranks 11th globally, behind the Swedish krona, up from 20th in January 2012. But trade settlement is highly concentrated because of economies of scale. The renminbi was used in just 0.87 percent of all cross-border payments in June, well behind the top four: the euro (37 percent), dollar (36 percent), British pound (8.6 percent) and yen (2.6 percent).

“Eleventh place is still far from the top,” notes Barry Eichengreen, an economist and monetary specialist at the University of California, Berkeley. “One can say that the renminbi is coming into being taken more seriously as a global currency. But it is still very far from being taken as seriously as the dollar.”

Still, China is the world’s largest trading nation, and its companies have an interest in using yuan rather than dollars or euros abroad. The authorities are encouraging the trend. In May, Beijing made the renminbi convertible for the current account, allowing companies in China to accept yuan payment for goods and services from offshore customers without any documentation or regulatory approval.

Half of all international companies in Hong Kong and almost a third in mainland China have begun using the renminbi to conduct cross-border business, according to a recent survey of 700 HSBC clients commissioned by the bank. Some 53 percent of Chinese businesses surveyed said they would offer discounts of as much as 5 percent for transactions settled in renminbi.

“Businesses are continuously searching for ways to reduce costs and find a competitive advantage,” says Simon Constantinides, HSBC’s head of global trade and receivables finance in the Asia-Pacific region. “A 5 percent saving across a buyer’s total China spend could be quite significant.”

Standard Chartered publishes the Renminbi Globalization Index, based on the currency’s use in trade, foreign exchange turnover, offshore deposits and offshore corporate bonds, among other things. The index has soared ninefold since the bank launched it in December 2010.

In contrast to the renminbi’s growing trade role, Beijing tightly controls the capital account, fearing that unregulated flows of investment funds could destabilize markets. The recent volatility in emerging markets underscored these concerns.

Nevertheless, the authorities are moving forward with steps to liberalize capital flows. In June the China Securities Regulatory Commission greatly expanded the quota for investment in Chinese equities by foreign fund managers. Officials are also experimenting with interest rate liberalization. In July the government allowed banks to set lending rates according to market demand; previously, the central bank effectively dictated most lending rates. Analysts expect the authorities to extend similar freedom to deposit rates in the near future. Officials believe that freeing up interest rates injects greater competition into financial markets, strengthening their ability to handle the external shocks that come with internationalization.

The results of these reforms can best be seen in Hong Kong, the former British colony that returned to Chinese control in 1997 and serves as China’s offshore financial center.

Since gaining permission to conduct trade settlement in renminbi in 2010, Hong Kong’s banks have handled an impressive flow. Settlement volume rose 37 percent in 2012, to 2.6 trillion yuan, and grew by 40 percent in the first six months of this year, to 1.7 trillion yuan, according to HSBC. As a by-product of this business, Hong Kong residents and corporations have accumulated the world’s largest offshore pool of renminbi: 861 billion yuan, including 698 billion yuan in savings accounts and 163 billion yuan in certificates of deposits.

To give these holders something to do with that money, in 2011 Beijing began allowing Chinese asset managers with operations in Hong Kong to raise renminbi funds for investment in mainland equity markets. The RMB qualified foreign institutional investor program, as it is known, was enlarged in March to include the subsidiaries of Chinese banks and insurers as well as global financial institutions. As of July, Beijing had approved an investment quota of 122 billion yuan under the program.

Hong Kong is beginning to develop a range of other renminbi-denominated financial products, including currency forwards, insurance products and various listed and unlisted investment funds. The dominant share of the action is in dim sum bonds, with 70 securities worth a total of about 300 billion yuan trading on the Hong Kong Stock Exchange. Financial firms also offer eight exchange-traded funds denominated in the Chinese currency, with a total market capitalization of more than 29 billion yuan.

Citigroup last year helped China Asset Management Co., the country’s largest fund manager, design the China AMC CSI 300 Index ETF. The fund, which launched in July 2012, was down 7.4 percent this year as of late August, compared with a 6.8 percent decline for the CSI 300 index. “We see China and more broadly the RMB as a huge potential for us,” says Kevin Wong, Citi’s Hong Kong–based head of fund services.

Daily renminbi turnover in the Hong Kong foreign exchange market now exceeds $10 billion, and banks quote cross rates against the euro, the pound and other major Asian currencies, as well as the dollar.

Daily volume on Hong Kong’s renminbi real-time gross settlement system, which supports the whole range of activities in the currency, hit 448 billion yuan at the end of June, up from just 5 billion yuan in late 2010. “While it is foreseeable that an increasing portion of mainland China’s trade and investments with the rest of the world will be conducted in RMB, the pace of the RMB’s internationalization would very much be a market-driven process going forward,” says Hong Kong Financial Secretary John Tsang.

Outside of Hong Kong and mainland China, only a minority of businesses settle their China trade in renminbi, according to the HSBC survey, but the bank expects the share to grow quickly. The current figures range from 11 percent of businesses in Singapore and the U.K. to 9 percent in Germany and the U.S. and 7 percent in Australia. “By 2015 we see up to 30 percent of China’s trade will be settled in RMB” and half of its Asia trade, says HSBC’s Fung. “ This will make the RMB the third global currency after the U.S. dollar and the euro.”

Although it has a strong lead, Hong Kong faces growing competition for renminbi business. In March authorities in Singapore and China doubled their swap agreement, to 300 billion yuan. In May the Monetary Authority of Singapore launched a renminbi clearing facility with Industrial and Commercial Bank of China’s local branch. Singaporean companies have built up 100 billion yuan in savings, according to the MAS.

Within the first month of establishing renminbi clearing, Singaporean banks issued 2.5 billion yuan worth of bonds, dubbed Lion City bonds. Last month Jiangsu-based Yangzijiang Shipbuilding (Holdings), China’s second-largest builder of ships and oil rigs, became the first company to have its shares trade in both Singapore dollars and yuan on the local stock exchange.

London is also angling for a share of the renminbi business. In June, PBOC governor Zhou and Mervyn King, then governor of the Bank of England, signed a 200 billion-yuan swap agreement. Last year renminbi trade settlement in London doubled, to more than 34 billion yuan, according to Mark Boleat, chairman of the Policy and Resources Committee for the City of London. “It is small, but the starting point is there,” he says. “We expect it to grow further.”

China is developing domestic centers for cross-border renminbi business. Last year the State Council said it would create an onshore hub in Qianhai, a warehouse-packed peninsula in the southern city of Shenzhen, to conduct business with banks in Hong Kong, just across the border.

In Shanghai, the mainland’s leading financial center, officials have announced the formation of a cross-border financial zone similar to Qianhai. Officials haven’t revealed many details about the Shanghai Integrated Free Trade Zone, but bankers and analysts say it is likely to focus on derivatives and commodities. Sources say the London Metal Exchange, a subsidiary of Hong Kong Exchanges and Clearing, is first in line to win permission to set up warehouses for the physical delivery of metals.

Beijing officials have made it clear that Hong Kong will be the primary offshore renminbi center. Officials are working on a mutual recognition reform that will allow Hong Kong–based financial institutions — including many subsidiaries of global firms — to sell their global mutual funds and equity-linked products in China through Chinese financial institutions. In exchange, Chinese institutions would sell their renminbi products through the Hong Kong firms’ global networks.

Mutual recognition, which market participants say could be implemented as early as 2014, would be a sign that Beijing is committed to achieving full currency convertibility by the 2020 target date, says HSBC’s Fung. “We expect in as early as five years China’s RMB will move toward full convertibility,” she says.

UC Berkeley’s Eichengreen is skeptical that Beijing can move that fast. “It is a very ambitious target, to put it mildly,” he says. “Strengthening supervision and regulation, fully deregulating interest rates, adopting a fully flexible exchange rate and opening the capital account all in seven years?”

The pace of financial market liberalization and renminbi internationalization will ultimately depend on the nation’s economic health, says Qian Yanmin, a professor of finance at Zhejiang University, in Hangzhou. A rise in bad debts in the shadow banking system, which includes lending by state-owned enterprises and the booming market for so-called wealth management products — investment products marketed by banks to get around regulatory restrictions — would slow reform efforts, he explains. “Shadow banking poses a very serious challenge,” says Qian. “China’s financial system won’t collapse in the short run but may need years of restructuring to clean up the mess.”

Even so, the direction of Chinese policy is clear, and Hong Kong’s Tsang contends that renminbi internationalization can help offset the recent slowdown in the economy. “The use of RMB will greatly facilitate bilateral trade and investment flows between China and the rest of the world as it reduces foreign exchange risk and costs of currency conversion,” he says. • •

The Legacy of Lehman: A Look at the World 5 Years After the Financial Crisis

- 5 Years After Lehman, No One Can Declare the Financial System Safe

- Europe's Banks, Slow to Restructure, Pose a Systemic Risk Today

- Emerging Markets Face Mounting Challenges as Global Liquidity Dries Up

- As the Fed Readies to Taper, Is the World Ready for Higher U.S. Rates?