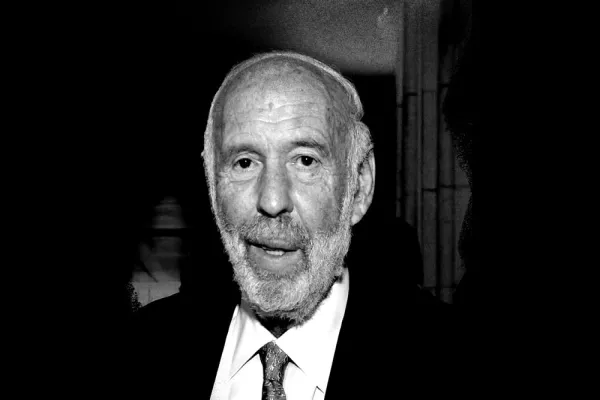

John Paulson hasn’t made many bad investment calls in recent years. But even the hedge fund manager and founder of Paulson & Co., who famously made nearly $4 billion personally by shorting subprime mortgages in 2007, seems to have been baffled by gold. Paulson reportedly lost anywhere between $1 billion and $1.5 billion during the first half of 2013 on a wrong-way bet on the yellow metal.

Paulson is not alone. Gold prices have slumped faster and farther than all but the biggest gold skeptic would have predicted. Since the start of 2013, the price of gold has declined by 27 percent, to $1,205 per troy ounce on December 27, the first time the commodity has had a negative annual performance in 13 years. The investment market was decimated as investors pulled roughly 850 tons from gold-backed exchange-traded funds, compared with inflows of 280 tons in 2012.

Gold was particularly volatile on December 18, when the Federal Reserve announced it would begin limiting quantitative easing. Two minutes before the Federal Open Market Committee made the announcement that it would begin tapering, gold for February delivery was trading at $1,235 an ounce, only to plunge to $1,220 just after outgoing Federal Reserve chairman Ben Bernanke began his speech. During his remarks, gold rebounded to $1,240 but lost ground again, dropping to a session low of $1,216 per ounce, just 4 percent above a five-month low of $1,211 on December 4.

Most now seem to believe that the worst of the financial crisis — or, rather, crises — is past, reducing the need for gold as a risk hedge. Even so, the pace of the decline has confounded many investors and analysts.

“It is still a bit of a mystery as to why there was so much ETF gold sold,” says Matthew Turner, a precious metals analyst at Macquarie Securities in London. “The best explanation perhaps lies in the psychology of investors. Normally, in gold there is a tendency toward bullishness as there are always people with a fervent belief in gold or, rather, not much faith in other assets.”

As the commodity plunges to its lowest levels for some time, some say the turning point is around the corner. Frances Hudson, global thematic strategist at Standard Life Investments in Edinburgh, Scotland, believes gold may be bottoming out. “With a sell-off of more than a quarter, perhaps we are reaching a base in technical terms,” she says. “Many lost faith with the market, since you haven’t had any inflation to hedge against.”

Eugen Weinberg, head of commodity research at Commerzbank in Frankfurt, feels there is a good chance gold will rebound as early as the first half of 2014. “Speculative financial investors have now largely exited the gold market, as evident from the fact that net long positions are at a 17-year low,” he says. “The negative market sentiment toward gold is also reflected in negative media reports and, for the most part, pessimistic price forecasts. All of this may indicate a rapid reversal of the trend. After the price has successfully bottomed out, gold ETFs should report inflows again from the second quarter, supporting the price recovery.”

Weinberg says that the commodity should rise to about $1,400 per troy ounce by the end of 2014. Société Générale strategist Albert Edwards, who in April was still predicting that gold would soar to $10,000 per ounce, remains fully in the bullish camp. He says this year’s slump is an expected correction from a “deeply overbought bull run,” but he remains convinced of its ultimate rise, pointing to 1975 and 1976, when gold had a 50 percent correction, from $200 to $100, before resuming an upward curve to $700 by 1980.

There are good reasons to believe in a rebound. Apart from investment, real demand for gold continues to support the market. In particular, the demand for gold in 2013 from China, the world’s top buyer, was phenomenal. The country has been absorbing gold ETF outflows in enormous quantities: almost 1,000 tons during the first ten months of 2013.

“These are staggering figures,” says Weinberg. “Exports from Hong Kong to mainland China have been running at 100 tons per month. We have never seen these kinds of figures before. With the panic selling from ETF investors, [the Chinese] have been able to buy these amounts without impacting the price.”

Analysts believe that a large majority of Chinese buying can be traced to the People’s Bank of China, the country’s central bank. With official figures stating that Chinese central bank holdings remain at 1 percent in gold, with an expected allocation of 4 percent to 5 percent, there is room for more buying. In fact, the level of demand for gold from Chinese buyers should continue in 2014 because of rising incomes, a growing middle class and a lack of investment alternatives, analysts say.

By contrast, demand in India, the second-biggest consumer of gold for jewelry after China, slumped in the second half of 2013, 50 percent below the first half, reflecting the Indian government’s adoption of a rule in August to restrict imports. The Indian government, which has been seeking to control domestic gold demand, is expected to relax its policy in 2014, which could see buying return to the market.

In contrast to the tendency of investors in the West to focus on short-term profits, gold buyers in Asia often have other motives for their purchases, regarding the metal as a long-term investment — it is a traditional wedding present for that reason — or inflation hedge. The question is whether fast-money investors will return to the market on the back of these real asset purchasers. Should momentum pick up, Edwards’s forecast may not be inconceivable.

Get more on asset management.