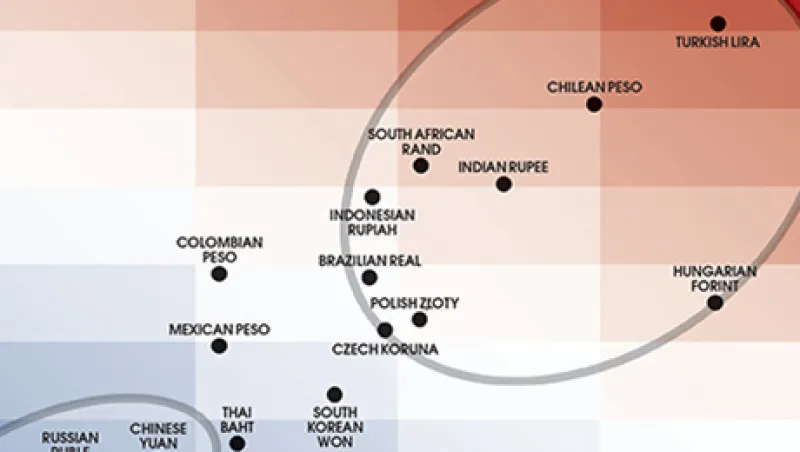

Emerging markets breathed a sigh of relief last month when the Federal Reserve Board declined to start tapering its bond purchases, but many of these economies remain in a vulnerable position. External deficits explain much of the problem. Foreign funding requirements, which include debts coming due in the next 12 months and current-account deficits, have risen sharply for a number of countries. It’s no surprise that India, Indonesia and Turkey, which have among the largest funding requirements, have seen their currencies tumble recently.

More broadly, efforts to improve governance, attack corruption and pursue growth-enhancing structural reforms have waned in recent years across much of the developing world. Not coincidentally, growth in average incomes has moderated as well. The lesson seems clear: Countries can no longer rely on cheap U.S. liquidity and a China-driven commodities boom for their prosperity. Today sound economic policy is more important than ever. The hard work of sustaining growth in living standards begins at home.

Chart by Todd Albertson

Read more about banking and capital markets.