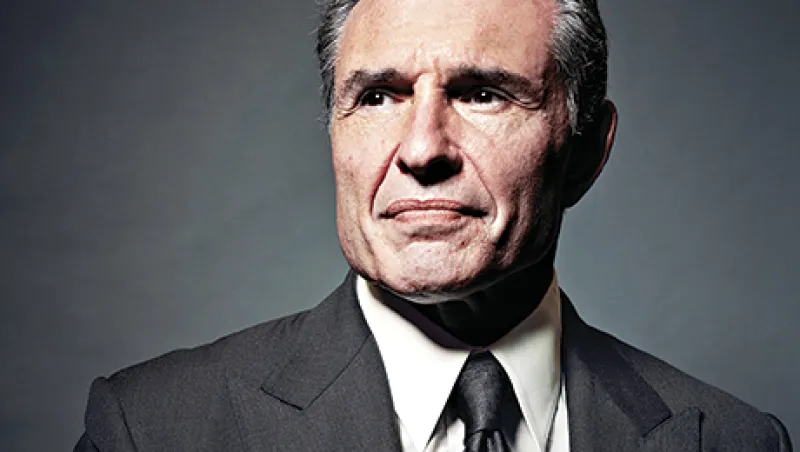

When John Bardis founded MedAssets in 1999 — near the height of the dot-com bubble — the idea of providing technology and consulting services to hospitals and health systems might have seemed a bit, well, boring. But now Bardis’s company, which helps health providers save money by aggregating purchasing and find money by enhancing their billing and collecting systems, is in the middle of health care reform, which promises to bring a dramatic transformation of the U.S. medical system.

The Patient Protection and Affordable Care Act, better known as Obamacare, was designed to provide health coverage for 30 million uninsured Americans and prevent insurance companies from rejecting people with pre-existing illnesses, among other things. Its ultimate success relies on its ability to lower medical costs. That’s where Alpharetta, Georgia–based MedAssets comes in.

U.S. health care is a $2.7 trillion industry; measured independently, it would be the fifth-largest economy in the world. “Costs are more than $8,500 per person in the U.S.,” Bardis, 57, explains. “The next closest Western nation is about $3,700 per person, so we’re spending more than twice per capita and not necessarily getting health results that are twice as good.” While the U.S. has 4 percent of the world’s population, it consumes 40 percent of global health care spending.

MedAssets, for its part, which went public in 2007 and has a market capitalization of about $1.4 billion, has a track record of significantly lowering costs for hospitals and other acute-care facilities. “We’re building solutions that provide efficient resource management in the delivery of care so that, at the end, there are resources available for more people to be cared for,” says the MedAssets CEO.

Health care reform is not without controversy, but Bardis loves being in the thick of big issues and change. A wrestler in college and an alternate on the 1976 U.S. Olympic team, Bardis got involved in the fight to keep wrestling designated as an Olympic sport. He served on the board of USA Wrestling, the national governing body for the sport, and became team leader for the U.S. Greco-Roman wrestling team for the 2007 World Championships and the 2008 Beijing Olympics. Then, in 2011, he was appointed to the board of the U.S. Anti-Doping Agency. Last year, even after death threats aimed at its CEO and board, the agency approved stripping cyclist Lance Armstrong of his seven Tour de France titles and banned him from cycling for life. “It was about helping the next generation of children understand the concept of fair play,” Bardis says of his work on the board.

After graduating from the University of Arizona with a BS in business, Bardis went to work for American Hospital Supply Corp., which was later acquired by Baxter International. At Baxter he rose to senior management. In 1987 he joined Kinetic Concepts, a publicly traded medical equipment company, and later became president. From 1992 to 1997 he was CEO of TheraTx, which operates nursing facilities and provides rehabilitation services.

Two years later he founded MedAssets, which now has 4,200 hospital clients and provides supply-chain management and group purchasing services, process improvement (such as reducing the time it takes to treat someone in an emergency room), quality and safety assessments, consulting and software to better manage hospitals’ revenue streams. Net revenue for the first half of this year increased 9.8 percent to $344 million, as compared with the same period of 2012. The company is on track to generate $700 million in 2013 revenues. Senior Writer Julie Segal recently met with Bardis to discuss the opportunities presented by the Affordable Care Act and his biggest frustrations with health care.

Institutional Investor: Why are you focused primarily on the hospital piece of the health care puzzle?

Bardis: Of the $2.7 trillion that is spent annually on U.S. health care, 5,000 hospitals do $1 trillion of it. Hospitals are the most economically and physically intense organizations in the world. As a point of comparison, in 2007 before the recession, 28,000 car dealers distributed $400 billion worth of cars in the U.S. These 5,000 hospitals do $1 trillion.

MedAssets provides technology and services to improve hospital profitability. How do you do that?

First, we manage the elements of the supply chain that make us look like Sam’s Club for hospitals. Of the $1 trillion that hospitals spend annually, $200 billion is for medical supplies and drugs. Our purchasing organization, which manages more than $50 billion a year, aggregates multiple hospitals’ volumes and plays a role in procuring supplies at a fair price. We contract with about 1,800 vendors globally, for everything from medical devices to pharmaceuticals to imaging equipment, and also help clients deploy all that less expensively. We also have professional services as well as information technology and software that help measure how those products are being used in producing outcomes for patients.

Isn’t the success of MedAssets’ revenue cycle technology due mostly to the complexity of Medicare?

Exactly. MedAssets touches close to $365 billion in net patient revenue with our revenue cycle technology products. And that’s because of the complexity of payment from one insurance company to the next and from one state to the next.

When Medicare started in ’65, the program incented every provider to create its own cost structures and submit bills using specific accounting principles. But it was like a 100-meter dash with bad direction. Hospitals and other health providers looked good at the starting line, but when the gun went off, everybody went on a different path. That’s why no two hospitals in the U.S. have identical costs for the same procedures because they were incented early on to create their own cost infrastructures. We take those costs and try to rationalize them to a market-based approach that will help hospitals and patients better understand best practice.

The New York Times recently ran a story about an American who went to Europe to have hip replacement surgery at a fraction of what it would have cost in the U.S. Can MedAssets help narrow that gap?

Yes, we’ve helped our clients reduce costs by $3 billion. Having said that, we do spend more than $8,500 per person in this country for health care. So it’s not surprising that it’s less expensive to get the same procedures done elsewhere.

But here’s what we’ve done for a coalition of hospitals in Texas. Over the span of three years, we’ve led them to savings of $92.2 million, achieving more than half of that in the first 18 months. Those savings came from looking holistically at distribution and clinical sourcing agreements, pharmacy services, and $46 million in savings from giving physicians different choices for expensive implants.

How did the U.S. get to this point?

The system has always had perverse incentives. In 1983 the federal government put cost-of-living caps on Medicare because, up to that point, whatever the cost was, you could pass it along and the government would pay you, and so would private insurance. The government said, “Geez, by 1994 or so, we’ll be broke if we stay on this trajectory, so we’re going to cost-cap it.”

But that was like trying to stop the Exxon Valdez ten feet from the shoreline. It could not happen. So we shifted those cost increases to the private sector. Today private insurance both costs more and pays much, much more for the very same procedures than Medicare or Medicaid. But private insurers made an enormous sum of money because they kept 20 percent. What’s their incentive to keep cost down? It’s been a good business for them to keep 20 percent of $2, as opposed to 20 percent of $1.

How will the Affordable Care Act change this?

We’re going to see state insurance exchanges emerge as competitive to traditional private insurance. We believe that individually purchased coverage will make consumers far more likely to be prudent buyers of health care. This in turn will require providers to offer cost and outcome data in advance of purchase. Today pricing often bears no resemblance to value. The fundamental laws of supply and demand do not exist in health care pricing or value as we know it. We just saw IBM, Time Warner and Walgreen decide to hand some of their people their health care benefit dollars and ask them to go to the market and buy insurance themselves. Because here’s what happens: When an employer is self-insured, then those who choose not to be healthy can raise the cost for everyone else.

So these big companies are saying, “We’re going to give everybody the same dollars; you go out and buy.” This is a watershed event. Private corporations began providing health insurance benefits during World War II as a way to reward their employees in an age of wage and price freezes. Little did corporate America know what it was getting involved in. But now we’re seeing a potential reversal of this for the first time.

What other health initiatives can MedAssets impact?

Everybody is talking about population health management, which is being able to predict and adjust to changes in how health is managed — not how health care is delivered but how health is managed. It’s very important, for example, for us to address the needs of the urban and rural poor in this country and increase their access to quality food and education so they can eat a healthy diet and make other healthy decisions. On the corporate side, at MedAssets, the design of our new 200,000-square-foot Plano, Texas, facility takes into account our focus on exercise, healthy diet and a positive social environment.

What are your biggest opportunities going forward?

In terms of numbers, without branching into any other areas, our addressable market is right around $12 billion to $13 billion. We think we have pretty good headroom to grow in the markets that we’re already in.

Strategically, in the area of procurement, for example, today there is no nationally utilized e-procurement methodology. Everybody uses [enterprise resource planning] systems that have huge holes. That means that while contracts say one thing about pricing terms, hospitals don’t always get those prices because they often lack the right technology and other controls over the procurement process. We built an e-commerce exchange for Tenet Healthcare where we manage 92 percent of anything that’s bought for the system. Today, of the more than $50 billion in procurement we do, we push about $4 billion through our e-commerce exchange. So there is real opportunity for growth here.

What are some of the biggest challenges?

In health care the challenges are regional in nature. You’ve got to be able to react to what’s happening locally. As much as there is a national debate, each of these markets is different, so you’ve got to be able to have accurate insight.

What’s your biggest frustration?

We’ve been in situations where we’ve come in and literally put $30 million worth of targeted price and cost savings — with an absolute proof of pathway to achieve it — and an organization has said, “I can’t focus on this right now.” Those people are just occupied with other things. • •

Read more about investors.