1

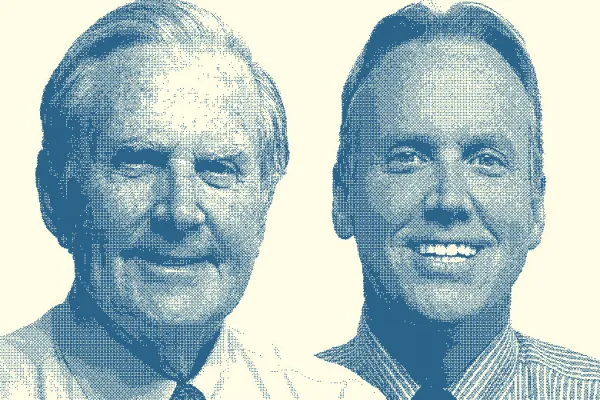

James

Robinson III &

James

Robinson IV

General Partner & Managing Partner

RRE Ventures

When RRE Ventures was new, in 1994, so was the commercial Internet. The firm easily commandeered rre.com as its web address and became a fixture in New York City’s venture capital community, which at the time was not nearly in the same league as Boston and Silicon Valley. But New York had something those locales didn’t: a concentration of large corporations, including financial industry giants, with growing appetites for innovation. And RRE had James Robinson III, who retired as chairman and CEO of American Express Co. in 1993 and could both open doors to the Fortune 500 and arrange introductions to technology entrepreneurs with whom he was getting acquainted as an angel investor. Robinson, whose 80th birthday is November 19, raised the investment stakes with RRE, which he, as general partner, co-founded with two managing partners: his son James Robinson IV and Stuart Ellman. James IV and Ellman, now 53 and 49, respectively, were Harvard Business School classmates who started a company that developed a touch-screen ordering system for stadiums that was ten years ahead of its time. Their timing as leaders of RRE’s nine-member investment team has vastly improved. The portfolio is a diversified set of technology, media and consumer plays, including such fintech disrupters as online lender OnDeck Capital, financial management service NerdWallet and a host of Bitcoin/blockchain investments, directly and through a relationship with Digital Currency Group (see Barry Silbert, No. 13). RRE has also invested in Ellman’s specialty of robotics (Jibo) and in space (Spaceflight Industries and Spire Global). “Most everything we look at has a 20-year gestation — we’re even seeing that in digital currency,” says James IV, underscoring the long view and patient perspective informing the firm’s more than $1.5 billion in investments. “If all you do is chase what’s hot, you’ll go wrong.” His father admits to pooh-poohing cryptocurrency, then “doing a 180,” in part thanks to Adam Ludwin, who worked at RRE from 2010 until early 2014. Ludwin co-founded Chain, a blockchain start-up now working closely with, among others, Nasdaq and First Data Corp., a company James III acquired while at American Express. RRE backed Ludwin early, and in September, James III joined Chain’s board.

The 2015 Fintech Finance 35

& James Robinson IV RRE Ventures

Evercore Partners

Bain Capital Ventures

Financial Technology Partners

General Atlantic |

Brad Bernstein FTV Capital

Anthemis Group

Goldman Sachs Group

Ribbit Capital

Nyca Partners |

Partnership Fund for New York City

Andreessen Horowitz

Digital Currency Group

Banco Bilbao Vizcaya Argentaria

Santander InnoVentures |

AXA Strategic Ventures

Citi Ventures

Credit Suisse NEXT Fund

SenaHill Partners

Bill & Melinda Gates Foundation |

Accion International

Marlin & Associates

CME Ventures

Illuminate Financial Management

Life.SREDA |

Innotribe SWIFT

Barclays

UBS

& Vincenzo La Ruffa Aquiline Capital Partners

REDI Holdings |

Startupbootcamp FinTech

Bloomberg Beta

Valar Ventures

Innovate Finance

FinTech Hong Kong |

| |