A day after the International Monetary Fund on June 4 cited “remaining employment slack” as a reason the Federal Reserve might consider holding off on its policy rate “lift-off”this year, the argument appeared weaker than it already did. That’s because the June 5 employment report displayed a very robust 280,000 jobs gained in the U.S., with revisions to March and April combining to add 32,000 more jobs than previously reported. Around the same time, William Dudley, the president of the Federal Reserve Bank of New York, offered a downbeat assessment of labor market gains, suggesting that “recent solid job gains and a further decline in the unemployment rate have occurred only because productivity growth has slowed markedly.” In the end, even as the Fed debated its policy path this week, we think that an excessive focus on aggregate nominal data has led many to misapprehend the true strength of the economy and the underlying structural evolution that is at play as a result of technological change. And, as we at BlackRock have argued, this in turn has resulted in a Fed that appears to be afraid of its own shadow when it comes to normalizing rates.

On the labor market front, this cyclical recovery might have been unusually protracted, though there is little ambiguity about its genuine strength when examined in detail. Indeed, at the headline level, the long-term strength in labor markets is highlighted by the fact that the three-, six- and 12-month average payroll gains are running at 207,000, 236,000 and 255,000, respectively, which is considerably stronger than the 200,000 average level of jobs growth typical of past periods of economic expansion. In fact, when we couple recent data with the fact that the 5.6 million jobs created in the past 24 months is greater than the combined total created in the 13 years prior, we clearly see the evidence for an employment landscape that is stronger than at any time over the past 20 years.

Fascinatingly, when delving into the details of the recovery’s employment reports, gains in the service sector have been key, whereas decent — but less robust — improvements in goods-producing jobs sectors highlight the evolution of a continued technological substitution effect: machines taking the place of people on the factory floor. Yet the remarkable strength of this service sector jobs recovery needs to be placed in a broader context to be properly appreciated. In fact, over the past 24 months the professional and business services sector has added an average 49,000 jobs per month, compared with the 10,000 jobs per month added to the sector in the 13 years prior. Likewise, despite disappointing retail sales numbers of late, there has been an astounding reversal of fortune for retail employment, with positive trends in both service employment and retail clearly evident in the data (see chart 1). Remarkably, retail employment has been robust, even as we witness a technology-driven shift to online purchasing from brick-and-mortar stores, coming as it does alongside a strong recovery for the economy overall.

Service-Sector Employment and Retail Gains Have Greatly Aided Job Recovery

Source: Bureau of Labor Statistics, BlackRock

Of course, one of the key arguments for doves at the Fed has been the general lack of wage improvement over much of this economic cycle, although even on this front we are seeing meaningful improvement. In fact, although the employment report’s average hourly earnings measure has lagged other wage measures, this past month’s 0.3 percent gain, running at 2.3 percent year-over-year, is beginning to illustrate the strengthening wage situation displayed by other indicators (see chart 2). Furthermore, when wage gains are coupled with very modest levels of inflation, the real income boost to the household sector looks solid. And as my BlackRock colleagues Martin Hegarty and Gargi Chaudhuri recently argued in this column, as we continue to see the rate of wage gains improve, the inflation rate can be expected to respond alongside this. As inflation firms in the months ahead, it will become abundantly clear that the Fed has had a window of opportunity to move on rates.

Improving Wage Growth is Now Apparent in Various Measures

Source: Bureau of Labor Statistics, Haver Analytics, Barclays Research

Finally, as for Dudley’s contention that the strong jobs recovery is solely because of reduced productivity, we think that dramatically overstates the case. Although the seeds of innovation that spark future productivity gains can come at seemingly unlikely times — and we at BlackRock would argue that the dot-com crash as well as the 2008–’09 financial crisis and the subsequent Great Recession may well be seen as examples of just such a time — there are natural lags with which productivity advances operate. That fact, and the timing of measurement, can therefore create an illusion of productivity weakness. When we cyclically adjust economic cycles, benchmarking each cycle to a 5.75 percent unemployment rate, we see that nonfarm labor productivity in the most recent period, from 2003 to 2014, is 1.5 percent, roughly in line with the longer-term median of 1.53 percent, and it may surge higher in the near future.

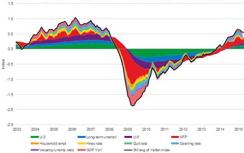

The readiness of the economy to begin interest rate normalization is not only borne out from a qualitative evaluation of the data, but it is also quite apparent from our proprietary index of labor market/economic conditions, which we informally call the “Yellen Index” (see chart 3). The measure has seen a significant improvement over the past year. Many doves have cited the fact that if the Fed raises rates too soon and then has to reverse, its credibility could be damaged, but we would suggest that when it comes to central bank policymaking, credibility cuts both ways. The balance of evidence suggests that the economy is prepared for an initial rate increase, and that a measured path of increases to a terminal rate level lower than historical averages would not risk the recovery.

BlackRock's "Yellen Index" Indicates the Economy's Readiness for Policy Rate Lift-Off

Source: BlackRock

Rick Rieder, managing director, is chief investment officer of fundamental fixed income and co-head of Americas fixed income for BlackRock in New York.

Get more on macro.