Developments in Greece are a clear step into uncharted territory and thus may have unpredictable consequences. But Europe’s policymakers have weapons in their armory that should help prevent short-term volatility from spiraling out of control. Among the most important of these is the European Central Bank’s quantitative easing program. It serves as a crucial backstop for regional bond markets. The ECB can calibrate QE bond-buying to address turbulence, for example, by adjusting the speed and the composition of purchases when trouble spots arise.

So far, the experience of ECB-style QE suggests that it has an outsize impact on regional bond markets. That’s in part because the ECB’s monthly bond purchase quota — some €60 billion ($66.4 billion) of mostly government bonds — constitutes such a big proportion of the total regional bond supply.

The QE effect in Europe has been further intensified because so much of the region’s debt was trading at superlow yields when the program was first announced back in January. Indeed, the rush of ECB money had driven yields on nearly 30 percent of Europe’s sovereign debt into negative territory by April.

Buyers of bonds with negligible or negative yields benefit only if they manage to sell them later at higher prices. With QE scheduled to run through September 2016, investors seemed to be concluding that European bond prices could move in one direction only: higher. Yet slightly better economic data later on prompted speculation that the ECB might rein in QE. Together, these sentiments had sent regional bond markets into a tailspin by May. German Bund yields surged, bond prices fell, spreads on peripheral debt widened significantly, and the euro showed some recovery from multiyear lows.

Did this mean investors had reassessed their medium-term expectations for European fixed-income markets? Not necessarily.

Instead, we think the sell-off quickly gained momentum because investors were holding bonds that could similarly benefit from QE-driven dynamics. This resulted in crowded trades and offered little room to maneuver as sentiment changed, particularly since liquidity is lacking in large swaths of Europe’s bond markets. When numerous investors simultaneously looked for an exit in challenging market conditions, the sell-off accelerated. Months of price gains were wiped out in days.

Even without the uncertainties stemming from recent developments in Greece, we had been expecting that rising prices and falling yields would return this year. That’s because the impact of ECB buying is going to get an extra kick when fewer bonds become available to buy each month.

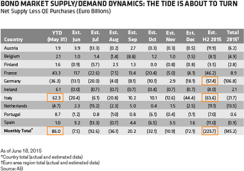

The plunge in regional bond yields when QE began encouraged many governments to take advantage of this ultracheap borrowing opportunity by front-loading issuance in the first half of the year. Ireland, for example, had completed about 70 percent of its full-year bond issuance by May. Such a busy issuance calendar has, so far, provided enough bonds for the ECB to meet its QE quota each month.

Supplies could start to dry up as the year progresses, though. In fact, the net supply of European sovereign bonds looks set to turn negative in the next six months because total bond redemptions will exceed expected new issuance. This bond drought can be expected to turbocharge the impact of ECB buying on prices, forcing a comeback of low to negative yields, spread compression across the euro zone’s bond markets and a general flattening of yield curves.

Remember the flash spike in U.S. Treasury prices last October? That was driven by an unanticipated turn in investor risk appetite, which had a huge impact on prices because several big market players changed course together. It shows that even the world’s biggest government bond market can’t escape extreme price volatility when many jump on the bandwagon.

What can investors do? Start by moving away from the crowd. In particular, we think, the recent widening in peripheral spreads and the move higher in core European government bond yields have opened up attractive buying opportunities in high-yielding, long-duration bonds.

Yield curves in Italy and Spain are relatively steep, so their long-term bonds offer a nice yield pickup: 30-year Italian and Spanish debt is yielding around 3.5 percent, compared with the less generous 1.25 percent on offer from those countries’ five-year bonds. These superior yields disappeared in the months following the ECB’s announcement that QE would start — even before the bank actually began buying these bonds.

Where are these yields now? They’re around the same level they were before QE began — or, in some cases, even higher.

Here’s a word of caution, however: We’ve seen how quickly upside potential can be wiped out when lots of investors try to book profits on similar assets at the same time. Instead of viewing QE as a one-way bet on rising prices, be prepared for prices to stay volatile. And think twice about government bonds, whose return potential relies almost entirely on the prospect of price gains.

Investors would be better served by focusing on higher-yielding assets whose income cushions offer a buffer against any hits to capital returns when turbulence strikes. Paying for the privilege of lending to governments — which is what investors are doing when they buy negative-yielding government bonds — is not a sound long-term investment strategy.

John Taylor is a portfolio manager of fixed income at AllianceBernstein in London.

See AllianceBernstein’s disclaimer.