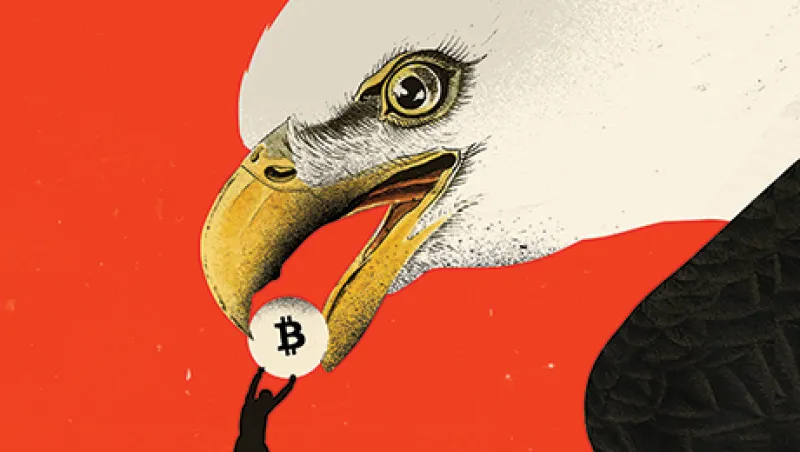

In mid-2011, New York Senator Charles Schumer issued the first of many calls for authorities to crack down on Bitcoin. Silk Road, an anonymous online market accepting payments in the digital currency, had launched earlier that year to almost instant success. Its main product quickly became drugs. Schumer described Silk Road as “the most brazen attempt to peddle drugs online that we have ever seen.” Bitcoin, he declared, was “an online form of money laundering used to disguise the source of money.”

Crisp, indignant dismissals of Bitcoin, the most prominent and successful of a rich family of digital currencies, became a standard trope for many U.S. lawmakers in the years that followed. In early 2014 the collapse of Tokyo-based Mt. Gox, once the world’s largest Bitcoin exchange, fed Capitol Hill’s angst about this dangerous new technology. West Virginia Senator Joe Manchin described Bitcoin as “highly unstable and disruptive to our economy,” calling for an outright ban. But cooler policymaking heads saw the digital currency chaos not as an excuse for proscription but as an invitation to regulation. Unregulated, Bitcoin and its peer currencies, which include Dogecoin and Litecoin, were a major headache for the government. Regulated, they might yet open a road to innovation and safer markets.

This week the New York State Department of Financial Services issued the final version of the so-called BitLicense, an authorization scheme for companies wishing to hold digital currency on behalf of customers in New York. NYDFS, whose responsibilities include oversight of money transmitters — firms that transfer and take custody of money — is the world’s first agency to take a stab at regulating the complex, sometimes bewildering world of digital currency. Bitcoin and its associated technology, once maligned as a crucible of lawlessness, terrorism and vice, are moving into the legal and commercial mainstream. Wall Street has upped its interest in digital currency in step with heightened regulatory interest. Several large banks, including UBS, have opened digital currency innovation labs and venture arms, and pioneering former JPMorgan Chase & Co. executive Blythe Masters is now running a digital currency start-up, emblematic of conventional finance’s warmer embrace of this still-new technology (see also “Big Banks Are Confident in the Face of the Bitcoin Threat”).

NYDFS’s decision to move first on digital currency regulation is both bold and risky: bold because it’s unusual to see large-scale financial services regulation emerge absent a crisis or major market shock; risky because an overly prescriptive regulatory hand could crimp innovation and weigh down digital currencies before they’ve had a chance to take online flight. Most members of “the community,” as the entrepreneurs, hackers and investors of the digital currency universe like to call themselves, agree that regulation is needed to legitimize their technology. But how much regulation should there be? As the digital currency community gets set to comply with the BitLicense regime and braces for waves of further regulation from other agencies in the years ahead, it’s not yet clear whether lawmakers have found the right answer to that question.

“It’s a very delicate balancing act,” says NYDFS head Ben Lawsky, who announced his resignation shortly before the release of the BitLicense. Lawsky is leaving the agency at the end of June for the private sector, but he made the BitLicense regime a centerpiece of his tenure as a regulator, and the project is still closely associated with him. Digital currency regulation should protect consumers, prevent money laundering and foster innovation all at the same time, he explains. These objectives are not easy to reconcile, and there’s a similar tension between the two worlds that regulation of digital currency seeks to marry: Wall Street and Silicon Valley. The banking system is conservative and tightly regulated; the tech industry has traditionally existed under much brighter regulatory skies, with start-ups able to spawn and grow and innovate and fail with freewheeling abandon. “When those two worlds collide, it is very unclear what results,” Lawsky admits.

Bitcoin and the blockchain — the name given to the currency’s underlying protocol — remain a technology with far more promise than realized value. Cryptocurrency boosters paint a universe where applications of the blockchain will lead to real-time auditing, self-policing or “smart” contracts, drastically reduced settlement and clearing costs for financial transactions and much else besides. But this is a universe still to come. Regulation matters because it will have a defining hand in shaping the limits and possibilities of that far-off world, and regulation by NYDFS matters even more because it will influence how subsequent regulators, both here and abroad, frame their thinking about virtual currency.

“The DFS has definitely stuck its neck out in a way regulators rarely do,” says Jerry Brito, executive director of Coin Center, a Washington-based advocacy group. “It’s been very bold of them, and they deserve plaudits for that.”

In Who Controls the Internet? Illusions of a Borderless World, legal scholars Jack Goldsmith and Tim Wu make the point that early attempts by government to regulate the Internet targeted the intermediaries that control online information flows: search engines, payment processors, file-sharing services. Law is fundamentally about people, in this one narrow sense, at least: Without intermediaries regulations have nothing to attach to. The most popular digital currencies are built on structural protocols that emphasize decentralization, disintermediation and openness. This presents a novel challenge for government. With intermediaries absent from this monetary system, what is there to regulate? Bitcoin was invented in 2008, and for the first few years of its existence, when commerce was limited and the currency’s dollar-equivalent market value flatlined, regulators could safely ignore this question. But in 2011 things began to change as a number of Bitcoin exchanges and so-called wallet services, such as San Francisco–based firms Coinbase and Circle, which give consumers a way to purchase everyday items using Bitcoin, emerged. In late 2013 the price of Bitcoin spiked dramatically, rising above $1,000 from $125 in two months. This brought the total market value of all Bitcoins in circulation to just over $13.5 billion — a tiny amount when viewed in the context of the aggregate value of global financial markets, but enough to capture the serious attention of government. And with the emergence of service firms on top of the trustless, disintermediated blockchain, government finally had something on which to focus its attention.

The U.S. Senate held hearings in 2013 to educate lawmakers on the potential and perils of digital currency. In March of that year, the Treasury Department’s Financial Crimes Enforcement Network issued guidance stipulating that Bitcoin exchanges and related businesses fell within the ambit of U.S. sanctions and anti–money laundering laws. But the leading U.S. financial agencies stood back: There was little movement on digital currency regulation from the Federal Reserve, the Securities and Exchange Commission or the Commodity Futures Trading Commission, mainly because digital currency, as a still-new technology with few meaningful products or investment vehicles beyond the currency itself, did not fall easily within existing mandates. In the end, a relatively obscure entity took on the challenge of being the first major agency to regulate Bitcoin.

In some ways NYDFS is an unlikely place to kick off what is likely to be the years-long process of bringing digital currency into the regulatory fold. The agency itself is young, created by Governor Andrew Cuomo in 2011 via the amalgamation of New York State’s old banking and insurance departments, and it is still carving out its identity. Adding to the uncertainty is the departure of Lawsky, a former prosecutor and Cuomo chief of staff who made his name with big, go-it-alone sanctions and money laundering actions against non-U.S. banks.

In mid-2013, NYDFS launched the process that would eventually lead to the drafting of BitLicense with a show of force, subpoenaing 22 start-ups and investment firms active in digital currency, demanding they hand over information related to their business activities. This was a highly unusual way to begin a nonhostile intelligence-gathering mission. Fred Wilson, a founder of New York–based venture capital firm Union Square Ventures, one of the companies subpoenaed, described the move as “a punch in the gut.”

Since then the agency has softened its approach to the digital currency community. But the road has not been without bumps. Following the July 2014 release of the first draft of the proposed BitLicense scheme, Circle announced in a blog post that it would consider blocking New York Internet addresses and withdrawing from business in the state altogether if the license was promulgated without changes. NYDFS has incorporated many of the digital currency community’s complaints into the final version of BitLicense, displaying a flexibility and openness that have impressed many former critics. But it’s still very much an open question whether BitLicense will help legitimize digital currency and create a better bridge between the slightly anarchic world of Bitcoin innovation and the more sober world of mainstream financial services.

“There’s a tension between them as a single-state regulator and what they’re setting forth, because what they’ve published looks like federal regulation,” Coinbase co-founder Fred Ehrsam says of NYDFS. “They’ve tried to do too much too quickly.” Ehrsam asserts that today we have seen barely 5 percent of the total innovation that will eventually emerge from digital currencies and their underlying technology; the extreme youth of the sector should have prompted a far lighter regulatory touch, in his view. “If you’re a virtual currency start-up and you’re part of an industry that has been around for three years at most, the amount of regulation to comply with is more detailed than if you’re Western Union, which has been around for 200 years,” Ehrsam says.

The cost of complying with BitLicense’s stringent anti–money laundering requirements and the need to seek regulatory approval whenever a licensed company undergoes a material change of business or control are the main bones of contention. These won’t prove disruptive to established businesses in the sector, but for smaller start-ups the cost and delay associated with regulatory compliance will “increase barriers to entry and entrench existing large players as an oligopoly,” says Vitalik Buterin, founder of Ethereum, a Zug, Switzerland–based nonprofit organization developing noncurrency applications for the blockchain. This, critics contend, will kill innovation. The change-in-control provision, affecting any new equity investment greater than 10 percent of a company, also worries digital currency investors. This could slow the pace of investment and turn investors off more-active participation in the sector, says Jalak Jobanputra, founding partner at New York–based FuturePerfect Ventures. “If the regulators understood the way venture capital and early-stage financing works, they would realize that timing is of the essence,” adds Jobanputra, who has invested in several digital currency start-ups.

Others within the digital currency community take a less strident approach, accepting the burden of regulatory compliance as the logical result of the technology’s tilt into the financial mainstream. “To really light up the value of Bitcoin and the blockchain, it needs to interoperate with the existing financial system,” says Circle CEO Jeremy Allaire. If companies want to achieve broad customer reach in the sector, they have to be willing to accept a higher level of regulatory scrutiny, he argues: “If you are taking custody of people’s money, you need to make sure that money is going to be safe and not used to illegal ends. You really do take on a larger set of responsibilities.”

In response to the criticism, NYDFS has pointed out that most of what Bitcoin firms are being asked to do under the new rules — whether it is examinations, anti–money laundering compliance, accounting or recordkeeping — is similar to what other financial firms must do. And although its stance on anti–money laundering compliance is unyielding, the agency has implied that many of the current concerns — for instance, over approval for business changes — will eventually be shown by practical experience of the new regime to be exaggerated. But the vagueness of these assurances provides a recipe for regulation that is capricious and personality-based rather than clear and rules-based, contends Coin Center’s Brito. “We trusted Ben Lawsky, but we don’t know who the regulator is going to be in 20 years’ time.”

Other state banking agencies have made tentative steps into digital currency regulation. (Forty-eight have money transmitter rules, which gives some sense of the eventual scope of regulation in this area.) Most notably, there’s a bill before the California state legislature calling for digital currency companies to be licensed with the state’s Department of Business Oversight. More recently, there have been murmurs of activity from big federal agencies such as the SEC and CFTC; the latter is widely expected to release a white paper in the next few months on how it might regulate digital currency–based derivatives. Overseas, the U.K. government in March published a paper setting out the broad principles of how it intends to regulate digital currency. This included a proposal for a government-funded research initiative to spur innovation in the sector, which some critics of NYDFS’s approach have held up as an example of how to “do” regulation with a more proactive, technology-friendly agenda.

One thing Lawsky has consistently emphasized is the need to avoid a “race to the bottom” in formulating regulation on digital currency. The sheer proliferation of agencies with potentially overlapping oversight in the sector might suggest that regulatory arbitrage is inevitable, with digital currency companies shopping around for the jurisdiction that will give them the easiest ride. Lawsky disagrees. “When other states or the federal government or the international community put out regs, I think it will be important that we look closely at them and decide how to meld them together to avoid regulatory arbitrage,” he says. The digital currency community hopes this will be the case. “I think the result of all this is we’ll see greater normalization of rules across states, not fragmentation,” says Circle’s Allaire. But to be fair, no one knows exactly what will happen.

BitLicense applies only to money transmitters; straight technology start-ups that simply build software products and do not take custody of customer funds fall outside the ambit of the regulations. But some of these start-ups are concerned over the precedent that BitLicense will set for the next wave of regulation in the sector. This is partly a concern over the way key concepts are defined and framed in the regulatory debate, but mostly it’s a cultural issue.

“We have a lot of business participating” in the conversation with regulators, says Alex Fowler, co-founder of Montreal- and San Francisco–based Blockstream, a new blockchain-applications start-up launched late last year by a number of developers instrumental in the early growth of Bitcoin. But engagement with the digital currency world’s core technical community — the scientists and researchers who built the technology — has been minimal, he adds. “If we’re not bringing the technical community into the discussion, it’s very likely policymakers will ask the wrong questions and we’ll see decisions that could really undermine the underlying technology,” Fowler says.

Digital currency is not the first industry to cry innovation in a bid for a lighter regulatory touch. The tactic is an old Wall Street special: Electronic brokerages, derivatives and now swap execution facilities have over the past two decades all been battlegrounds in the rhetorical war over where the regulatory keel should point between innovation and investor protection. “The conversation is somewhat hyperbolic on all sides,” says Richard Levin, a Denver-based partner and cryptocurrency expert at law firm Bryan Cave. “Digital currency won’t solve all the ills of the world, and regulation of it won’t cause Armageddon.” But as this new technology travels further toward the mainstream of financial services in the months and years ahead, don’t expect claims to the contrary to fall silent. •

Visit Aaron Timms’s blog and follow him on Twitter at @aarontimms.