< The 2015 All-America Research Team

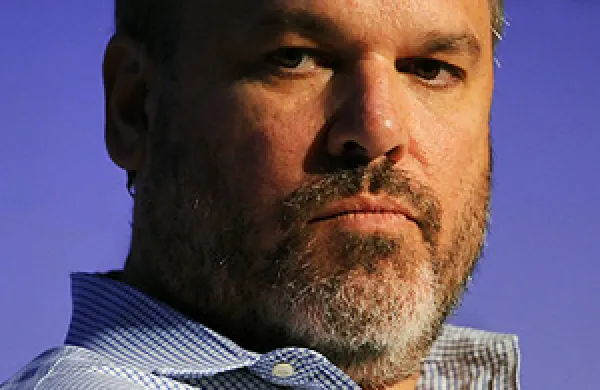

Robert Brackett

Sanford C.

Bernstein & Co.

First-Place Appearances: 3

Total Appearances: 4

Analyst Debut: 2012

Holding on to the No. 1 spot he first captured in 2013, Sanford C. Bernstein & Co. researcher Robert Brackett generates “unique analyses that are fully differentiated and logical,” one money manager observes. “His knowledge of the different shales and basins is incredible and encyclopedic.” For the 12 months through mid-September, the SIG Oil Exploration & Production Index plummeted 50.4 percent, compared with the broad market’s 2.6 percent drop. Brackett’s overall view of the industry is that “risk-reward is skewed to the upside,” despite the “extremely poor” sentiment surrounding the group, which he characterizes as “withering” and at levels last seen in 2009, after the recession and before the shale oil revolution. He discounts fears that Chinese demand is disappearing, pointing to data through June showing that nation’s call for gasoline is likely to continue to expand at an annual rate of near 10 percent. “On the demand side, we understand that everyone is worrying about China,” the analyst acknowledges, “but those fears haven’t yet materialized.” As for the supply side, Brackett notes that U.S. shale production is set to modestly decline in 2016, and longer-cycle international and offshore projects will not contribute as much output. “As long as demand will be healthy and non-OPEC supply will be flat to down, OPEC can start to take some market share,” he says, “and we can move back toward a balanced market.” Against this backdrop, the researcher is recommending shale oil producers Anadarko Petroleum Corp. of Woodlands, Texas, and Houston-based EOG Resources as “measured ways to play the recovery, given their combination of high-quality management teams, asset bases and balance sheets.” He pegs Anadarko at $96 and EOG at $97; the stocks respectively closed at $65.47 and $76.26 in mid-September. This year Brackett, 47, also captures third place on the Natural Gas roster, rising from runner-up.