Is it possible for an oligarch to invest outside Russia without running afoul of Western sanctions or incurring Vladimir Putin’s wrath? And can a Russian entrepreneur be successful abroad without the political clout he enjoys back home?

Mikhail Fridman is betting that the answer to those questions is yes. More than any other Russian business executive, he has moved billions of dollars into foreign ventures while skirting Putin’s dictate to invest at home. In recent months he has announced plans to invest as much as $16 billion in global telecommunications businesses. And in March he completed the purchase of Dea, a Hamburg-based oil and gas company, from the German utility RWE in a transaction that valued the company at €5.1 billion ($5.7 billion).

More remarkable still is Fridman’s ability to do business with foreign corporations and investors who have fought him bitterly in the past. The most prominent example is his March hiring of Lord Browne as executive chairman of L1 Energy, the investment vehicle that acquired Dea. Browne is a former chairman of BP, whose oil properties in Siberia were swiped by Fridman and then sold back to BP when it agreed to become his partner in Russia. In telecommunications — second in value only to oil among Fridman’s holdings — he continues to work with his Norwegian partner, Telenor Group, despite having spent more than a decade wrestling with the company over strategic and financial issues.

So why do his foreign partners continue to invest with Fridman? Because the gain can be worth the pain. BP received $18 billion in dividends from TNK-BP, its joint venture with Fridman and his Russian partners, over ten years before selling its stake in 2013 to Rosneft for $12.5 billion in cash and an 18.5 percent stake in the state-controlled oil giant. Not a bad return on BP’s $8 billion investment in 2003.

Fridman, 51, chairman of the Russian banking and retail consortium Alfa Group, is worth $15.3 billion, according to Forbes. Now he is trying to prove that he can be just as successful in the more competitive global arena as he was in the brass knuckles, politically connected environment of Russia.

“Many oligarchs have been unable to gain success in the West because their skillset back home was all about bribery, extortion and intimidation, as opposed to creating a better mousetrap, which is the way most Western businesspeople achieve success,” says William Browder, whose Hermitage Capital Management was once the largest foreign owner of Russian shares. He is also author of the bestseller Red Notice, which recounts how he was banned from Russia and how Russian officials used Hermitage for tax fraud and framed his lawyer and accountant, Sergei Magnitsky, who died in a Russian prison.

Many Russian tycoons are experiencing liquidity problems in the wake of the economic turmoil caused by falling oil prices and Western sanctions over Russia’s intervention in Ukraine. “Most oligarchs need assets that can be turned into cash quickly, and that precludes strategic investments abroad,” says Ian Hague, co-founder of Firebird Management, which manages several funds in Russia and Eastern Europe.

Fridman has no such problems. His offshore holding company, Luxembourg-based LetterOne Group, is flush with resources.

The group controls a private equity–style fund, LetterOne Technology, that has a controlling stake in Russian mobile operator VimpelCom as well as $15.6 billion in funds available for investment in international telecommunications businesses. Most of the money came from the sale of TNK-BP to Rosneft, which netted Fridman and his partner, German Khan, $14 billion. The executive is seeking to deploy that cash, bidding $2.8 billion in March to buy an additional 13.76 percent stake in the Turkish mobile operator Turkcell (it already owns 13.22 percent). The bid needs approval by the Turkish government, and it’s unclear whether Ankara will endorse the bid.

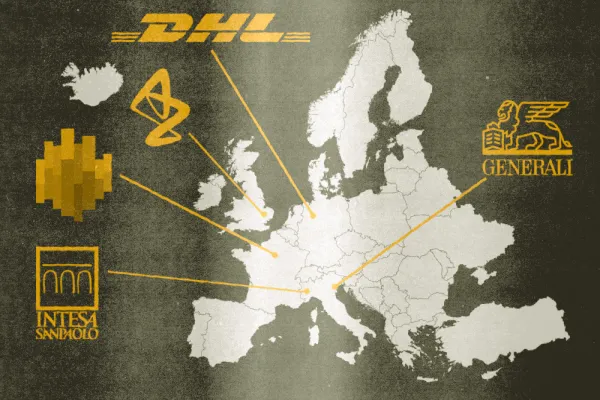

LetterOne Technology says it aims to invest in telecom and Internet businesses in Europe and the U.S. “But until we know what telecom investments they will be making, it is hard to judge their strategy,” says Alexander Kazbegi, a Moscow-based analyst at Renaissance Capital. LetterOne Technology’s chief executive, Alexey Reznikovich, spent the past decade overseeing Fridman’s telecom investments, which include a 48 percent voting stake in VimpelCom, which has interests in Ukraine, Algeria, Italy, Turkey and other countries. Telenor has a 43 percent voting share in VimpelCom.

LetterOne Group’s other vehicle, L1 Energy, had no trouble financing its purchase of Dea in March, but the deal has run afoul of the political tensions between Moscow and the West over Ukraine. Notwithstanding the appointment of the politically well-connected Browne as L1 Energy’s chief, the U.K. government last month ordered the company to sell Dea’s North Sea oil and gas fields, arguing that further Western sanctions on Russia could affect the company and force the shutdown of those fields. Fridman has been given up to six months to sell the assets.

Fridman has a long track record of hurdling obstacles. While studying in the 1980s at the Moscow Institute of Steel and Alloys, he earned money as a window washer for state office buildings and as co-owner of a discotheque — private ventures that were officially illegal in the Soviet Union. Later, while employed as an engineer in a state electrical machinery factory, Fridman started a private courier service, an apartment rental agency for foreigners and a company that sold used computers.

His business mentor was his grandmother, who peddled kitchenware in the Ukrainian city of Lviv, where Fridman was born and raised. “When I first got started, I went to her for advice,” he recalled in a 2003 interview with Institutional Investor. “She told me, ‘Never have dealings with the Reds.’”

To this day, Fridman has steered clear of investing in Russian state ventures. His grandmother also urged Fridman to focus on deals that offered the largest potential returns. “So we looked for really big businesses, like banking and oil,” said Fridman. That first led him to use the profits from his sundry small businesses for a required $100,000 fee to establish a bank — Alfa-Bank — in 1991, shortly after the collapse of the Soviet Union. The bank became the core of his Alfa Group, with holdings in oil, telecoms and supermarkets, among other ventures.

Fridman’s great leap forward came in 1999 when he persuaded a sympathetic Russian judge to declare the bankruptcy of a Siberian oil firm partly owned by BP and then allow Fridman to purchase the assets cheaply for his own company, TNK. BP sued, to no avail. Asked about the maneuver four years later, Fridman explained, “Our bankruptcy laws can be contradictory — even our judges don’t always understand them.”

By then, Fridman had made amends with Lord Browne, convincing him that greater bounties beckoned. At a June 2003 ceremony in London attended by Putin, BP and TNK signed a 50-50 joint venture, TNK-BP, to produce oil and gas, mostly from the Siberian fields once partially owned by the British company.

Although Fridman can claim a Midas touch in oil and gas, his telecom investments have proved a roller coaster ride for both himself and his partner, Telenor. Their stakes in VimpelCom quadrupled in value between 1996 and 2004 as the company’s share price soared to $122.23 a share. But the stock is currently (May 4) trading at only $5.37.

The biggest problem dates back to Fridman’s decision to have VimpelCom acquire Orascom Telecom assets in 2010 from Egyptian magnate Naguib Sawiris. The $6 billion cash-and-stock deal was opposed by Telenor as too costly and dilutive of its voting rights in VimpelCom. One of the larger Orascom assets acquired from Sawiris was a mobile phone unit in Algeria, where the company was in a lengthy dispute with the government over back-tax bills and currency deals. “VimpelCom was confident they could fix that quickly, but it took them four years of negotiations, by which time they were way behind the competition,” says Renaissance Capital’s Kazbegi.

As part of the Orascom deal, VimpelCom also inherited Italian mobile operator Wind Telecomunicazioni, which is heavily indebted and faces a tough competitive situation in Italy. VimpelCom is negotiating to sell Wind to Hutchison Telecom, a subsidiary of Hong Kong billionaire Li Ka-shing’s Hutchison Whampoa.

Meanwhile, the disputes between Fridman and Telenor continue. In December Telenor president and CEO Jon Fredrik Baksaas resigned from the supervisory board of VimpelCom because the company had come under investigation on corruption charges involving its operations in Uzbekistan. “Telenor has zero tolerance for corruption,” said Baksaas.

Thus far, Fridman has managed to avoid provoking the biggest potential threat to his foreign investments: the Kremlin. Putin has complained that oligarchs should display more patriotism in the face of Western sanctions by bringing their riches home. But with few examples of successful foreign ventures by Russian entrepreneurs, Fridman can argue that his acquisitions will put Russia on the map abroad. “Finding good investments outside Russia makes for a stronger case than repatriating capital,” says Kazbegi.