Ever since the February 2011 uprising that ended president Hosni Mubarak’s 30-year rule, Egypt’s economy has been in tatters. By the end of that year, the Egyptian EGX 30 Price Return Index dropped some 36.5 percent and capital flight slashed the central bank’s foreign reserves by two thirds, to $12 billion. Political turmoil, including the 2012 election of Islamist Mohamed Morsi as president and his toppling a year later in a bloody coup after months of protest, has put a chill over the economy, driving unemployment above 13 percent.

“The market believes that Egypt has gone backwards a little bit from being an emerging-market country to more of a frontier country, as a result of the revolution and the detachment from international capital markets for several years,” says L. Bryan Carter, head of fixed income strategy at Boston-based Acadian Asset Management and lead portfolio manager for the emerging-markets debt strategy. “This is a misconception.”

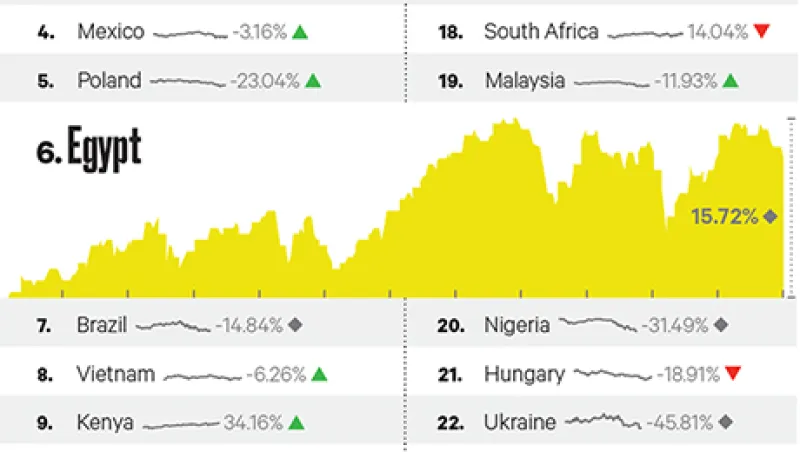

Investors increasingly see Egypt as a growth opportunity. The EGX index has risen 20 percent since former Defense minister Abdel Fattah al-Sisi overwhelmingly won the May 2014 presidential election. The country is more stable and secure than it’s been in the last five years, experts agree, boosting hopes of an economic resurgence.

The administration has taken advantage of the decline in global energy prices to reduce expensive subsidies on fuel and natural gas. Al-Sisi is trying to rein in a budget deficit that’s on track to exceed 10 percent of gross domestic economy for a fourth straight year and to galvanize investment from abroad to finance long-term capital projects like the Suez Canal expansion, due for completion in August.

“Having this power extend from his popularity has allowed al-Sisi to pass on very tough, corrective economic decisions that have done a lot of social harm,” says Ahmed Abou El-Saad, chairman of Cairo-based Rasmala Egypt Asset Management. “No one was able to do that before.” El-Saad expects GDP growth to reach 3.6 percent by this June and 4.5 percent by June 2016, broadly in line with the International Monetary Fund’s forecast.

Despite signs of economic progress, security remains a challenge. Al-Sisi has reduced but not eliminated political risk, says Hani Sabra, head of Eurasia Group’s Middle East and North Africa practice. Hundreds of Egyptian security force members have been killed battling ISIS-affiliated militants in Sinai and in western Egypt, and a deadly clash between soccer fans and security forces at a Cairo stadium on February 8 left at least 25 dead. The gruesome killing of Egyptian Coptic Christians by ISIS in neighboring Libya the following week prompted Egypt to bomb ISIS targets there. “ISIS-affiliated groups have no chance of destabilizing the state,” asserts Sabra. Yet jihadist groups stretch the security forces thin and increase the costs of maintaining order, while a violent attack could slow the tourism sector and even spook some foreign investors, he adds.

Some investors expect more unrest on the streets of Cairo and assign some probability to another revolution, reckons Acadian’s Carter, but he believes that fear is overblown. Eurasia Group’s Sabra agrees: “The security situation will probably get slightly worse, but I don’t think it’s going to impact the positive economic reform dynamics.”

There is still cause for investor concern in Egypt, according to industry experts. After a wave of divestment in 2011 depleted the country’s currency reserves, the government imposed capital controls and some foreign investors were stuck with their Egyptian positions, says El-Saad. Boston-based Carter, who went to Egypt last year, finds that perception is outdated. “The new authorities are very committed to ensuring that investors feel welcomed into Egypt and are at the head of the queue for getting out of Egypt when they want,” he says. The reserves have since picked up to some $16 billion, and the central bank established a repatriation mechanism late last year to boost confidence and ensure investors can get their money back.

All eyes are on the landmark Egypt Economic Development Conference taking place in Sharm El-Sheikh next month. The forum will promote a four-year development and investment program designed to attract billions of dollars in foreign investment for sustainable growth. “This will be a solid milestone,” claims Rasmala’s El-Saad.

Several members of the Gulf Cooperation Council have already pumped billions of dollars into Egypt’s economy through aid packages. Many Middle Easterners feel a strong affinity to Cairo, long considered the capital of the Arab world, as “the mecca of culture and finance”, according to Acadian’s Carter.

“Egypt is really exciting from a growth perspective — it’s a classic case of the peace dividend,” concludes Acadian’s Carter. “In this world where Europe is in a rut, Japan has disappointed, China is slowing and many emerging markets aren’t picking up, it’s exciting to find a country that is truly accelerating from a growth standpoint.”