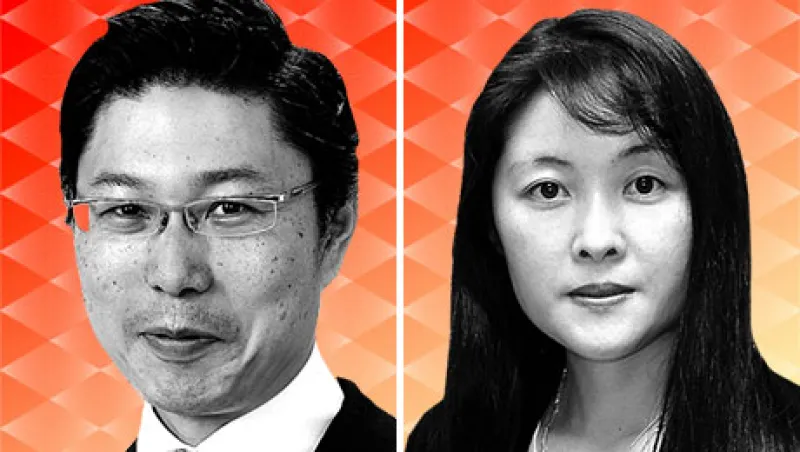

Institutional Investor’s All-Japan Research Team Hall of Fame, which pays tribute to those analysts who have earned at least ten sector-topping appearances, welcomes two new members this year: Shinsuke Iwasa of Mizuho Securities Group and Mariko Watanabe of UBS.

Iwasa captures the top spot in Broadcasting for a second straight year, but he began his career reporting on very different types of stocks. In 1995, after earning a bachelor’s degree in commerce and management at Tokyo’s Hitotsubashi University, Iwasa accepted a post at Nomura Research Institute. Two years later, when Nomura Securities Co. acquired the institute’s research operations, he was assigned to pick up coverage of pulp, paper and glass companies from someone who would have a profound influence on his career: Eiichi Katayama, the top-ranked analyst in the space at that time.

(Katayama, who now works at Bank of America Merrill Lynch and has been voted onto the All-Japan Research Team 16 times since 1995, is the reigning champ in the category of Electronics/Consumer.)

| Related Content2015 All-Japan Research TeamApril 6, 20152015 All-Japan Sales TeamApril 7, 2015Japan's Top Corporate Access Providers 2015April 8, 2015 |

That guidance must have been good. In 1999, Iwasa succeeded Katayama in first place in a sector that has become Technical Materials. He held the category’s top spot for three years before tumbling to runner-up, then disappearing from the roster altogether until 2007, when he returned at No. 1 in Broadcasting — the sector he has tracked ever since, even as he moved from Nomura to UBS to Mizuho.

Iwasa met another mentor, Shuichi Nishimura, soon after making the team. “Nishimura-san really supported me after I independently started to cover sectors and Katayama-san left the research department,” he says. “He gave me insightful advice on how to communicate with investors and corporate managements.”

Nishimura is also a veteran of the All-Japan Research Team, having appeared 21 times between 1996 and 2011 in Chemicals, Technical Materials and predecessor sectors.

At the Swiss bank Iwasa met a third analyst whom he credits with providing direction: Hitoshi Shin, who ranked every year from 2000 through 2011 in Electronics/Industrials.

“Shin-san was the head of the Japanese technology team when I joined UBS,” Iwasa explains. “He set an example of highly professional behavior and taught me to appreciate the quality of analysis and to offer insights on the future big picture of an industry. That was totally beyond my capabilities at that time.”

He appreciates the role these men have played in his professional life. “All three are so talented and insightful that I learned lots from them even in simple chats,” he says. “All of my conversations with them were intellectual but filled with humor.”

Iwasa’s current sector is a good fit, he says, because “I am personally interested in cinema, music, literature, pictures and so on.” However, he’s quick to add that covering these companies is a lot of work. “So many new things come out that I need to follow up on,” he points out.

Watanabe has also followed all kinds of stocks in her illustrious career — but has managed to do so without leaving her sector of choice, OTC & Small Companies. If offered the opportunity to change her coverage universe, she would decline. “I would continue to cover small caps, even if there were other choices,” the UBS analyst declares. Part of the reason is that small caps can be found in every industry, so she enjoys a broad view of the market.

After graduating from Yokohama National University in 1991 with a degree in business administration, Watanabe joined Kokusai Securities Co. (now a part of Mitsubishi UFJ Morgan Stanley Securities Co.) as an equity researcher.

“I was interested in working in the investment banking division, as I thought financial structures centered on indirect finance — bank loans — would change and shift to direct finance, but I was allocated to equity research,” she explains. “To be honest, I did not know much about the analyst’s job when I joined Kokusai.”

Watanabe proved to be a fast learner, though, and was soon in demand at other firms, including Dresdner Kleinwort Benson, Deutsche Morgan Grenfell (now parts of Commerzbank and Deutsche Bank, respectively) and HSBC Securities (Japan). She debuted on the All-Japan Research Team in 2003 on behalf of the latter firm, as a runner-up in OTC & Small Companies, and climbed to third place the following year. She was voted the sector’s best in 2005 and has held that position ever since, even as she moved to UBS, then Credit Suisse, then back to UBS.

What does she enjoy most about reporting on these names? “Watching a small company grow,” she responds. “For example, Fast Retailing Co. was small cap ten years ago.” Today it’s Japan’s leading specialty retail store, by annual sales, and one of the largest apparel retailers in the world.

The best part of the job, Watanabe adds, is helping to boost a client’s performance. The worst part? “When I made the client’s performance deteriorate,” she says. “A small-cap manager once told me the analyst’s job is to help managers make money and prevent them from losing money — and that’s what I try to do.”

Apparently she does it very well. “Her knowledge is encyclopedic, and she focuses with razor-like precision on the key factors that drive share prices,” attests one buy-side participant in this year’s survey.