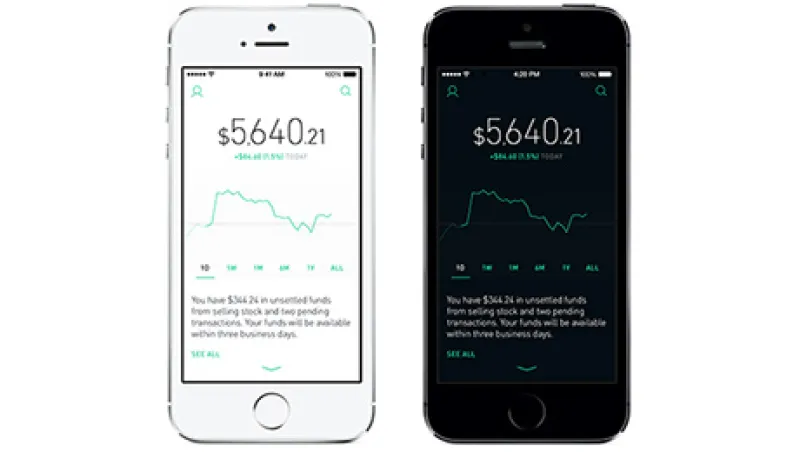

By any measure, Robinhood has been a runaway success since launching in December: 800,000 people have signed up for the brokerage app, which charges no commission and does not require users to have a minimum deposit to begin trading. Robinhood’s users have an average age of 26, and 25 percent of them are first-time investors, suggesting that the Palo Alto, California–based startup, which has raised $16 million in venture funding, is well on the way to achieving its stated mission to “democratize access to the financial markets.”

The response from the financial industry has been noticeably cooler, says co-founder Baiju Bhatt. “A lot of people in the industry take the view that the product is basically a toy,” explains the 29-year-old. “They say there’s no full suite of research tools on it” and that, as a result, Robinhood can never appeal to an institutional audience. But despite the lukewarm response and Robinhood’s focus on serving a portion of the population traditionally left out of participation in the markets — non–financially savvy, non-cash-rich millennials — the company has ambitions to play in the institutional world as well. After months of bringing customers online through a waiting list, the app this week opened its doors to every investor. In years to come, says Bhatt, Robinhood “should be the platform for execution — whether you’re a retail or institutional client.”

This is an ambitious claim: Onboarding almost 1 million first-time investors in a few months might be an impressive feat, but it’s a major step up to go from that to executing trades on behalf of Wall Street’s big institutions. There has been “a lot of naysaying” regarding the long-term financial viability of an app that remains committed to staying commission-free, says Bhatt’s co-founder, Vlad Tenev, 27. If Robinhood had charged commissions on the more than 500,000 trades that have been executed on the app to date, it would have already made $5 million. Naturally, the whole value proposition of the app is that it is free to trade there; the volumes recorded so far would never have materialized had Robinhood charged commissions. But that’s still a lot of money to forgo, and the app’s declared paths to revenue — mainly, through margin lending and what Bhatt calls “premium services” (basically, the opening up of the app’s software to other product developers) — are yet to be fully built and introduced.

With no revenue stream on the immediate horizon and Wall Street’s dismissiveness to contend with, how will Robinhood parlay its quick success with the millennial crowd into an enduring pitch to institutional market participants? One solution might be to offer research on top of the execution platform and charge customers for access to this content layer. That would certainly enhance the app’s desirability in the eyes of institutional financial clients, who — perhaps by dint of having been reared on the one-stop, all-you-can-eat buffet of the Bloomberg terminal — generally like their services to come bundled. But Bhatt and Tenev are adamant that despite the siren lure of the “content model,” they will not be adding research to their offering. “Research in the app would be a horrible experience,” says Bhatt. “We want to be a good place for people to execute once they’ve already educated themselves elsewhere.” He adds that Robinhood is exploring partnerships with external content sites to smooth the path between stock market research and analysis and trading on the app.

Indeed, bundling is exactly what Robinhood doesn’t want to do. Just as Google built its success by bucking the fashion of the late 1990s for omnibus search-and-services portals and remaining focused purely on search, Tenev says the key to Robinhood’s long-term success will be to stay “disciplined on being a first-rate execution venue above all else.” The efficiencies of equity market structure are a subject of endless debate, but in recent months the discussion has assumed renewed intensity. Various potentates of the public exchanges, including Nasdaq OMX CEO Robert Greifeld, Intercontinental Exchange chief Jeffrey Sprecher and BATS Global Markets head Joe Ratterman, have weighed in on the deficiencies of the maker-taker model, in which exchanges pay rebates to traders who supply liquidity to the market and charge fees to those who take it away; there’s even now a bill before Congress on the issue. All these suggestions are motivated by the idea that the equity market is both needlessly complex and riddled with conflicts between the buy and sell sides, brokers and the exchanges. However, a recent survey by TABB Group, a New York–based capital markets research firm, suggests that most market participants don’t see improvements to the maker-taker model as the best way to cure the equity market of these defects; rather, the answer might be in clarifying the Securities and Exchange Commission’s mandated requirement that brokers seek “best execution” for their clients’ orders.

Robinhood is already a participant on the margins of this market debate: Like many retail brokerages, it receives payment for its orders (in this case from Apex Clearing, a Dallas, Texas-based clearing firm). But payment for order flow remains “negligible, a couple of thousand dollars a month,” says Bhatt. And in any case, the app’s young founders think that from their small initial foothold in the retail investor market, they will be able to build a product with the required best-execution credentials to become central in institutional trading. Market data and trade execution for institutions suffer from “many of the same problems that consumer-oriented trading platforms prior to Robinhood had, namely, high cost and difficulty of integration,” says Tenev. “We see a big opportunity to bring turnkey market access for the institutional sector” through a service that would allow institutions to connect their own systems to Robinhood’s software.

This is a tough ask: Few tech companies have successfully pulled off the double act of appealing to consumer and enterprise markets simultaneously. Those that do, says Bhatt, are “very sexy,” citing Dropbox and Google as two examples. But it’s precisely by staying focused on improvements to the one thing they’ve already built — an execution platform — and avoiding the temptation to add ancillary, non-execution-focused tools that Bhatt and Tenev think they can bolster their pitch to the institutional world. Adding easy revenue generators might help the top line in the short term, but it will dilute attention on the core long-term objective of building a high-volume temple of best execution. The challenge is considerable, but given Robinhood’s early and rapid success in building its young retail user base, it would take a brave person to bet against them succeeding.

Follow Aaron Timms on Twitter at @aarontimms.