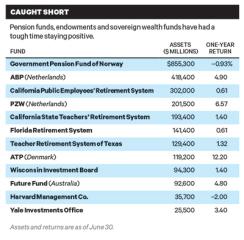

The 12 months ended June 30 weren’t kind to the world’s largest institutions, including pension funds and sovereign wealth funds. The California Public Employees’ Retirement System eked out a 0.61 percent return, while its Sacramento neighbor, the California State Teachers’ Retirement System (CalSTRS), gained just 1.4 percent. “The major asset classes didn’t return; they were flat to barely positive,” CalSTRS chief investment officer Christopher Ailman tells Institutional Investor .

Other contributors to $193.4 billion CalSTRS’ meager returns, he says, include the winding down of the equities bull market after more than five years and the failure of Abenomics — the stimulative economic policies of Japanese Prime Minister Shinzo Abe — to deliver as promised. “We didn’t get any growth out of Europe,” Ailman adds. Fixed income and private equity delivered little; the only healthy return was from real estate, which gained 13 percent.

An early investment in Danish utility Dong Energy paid off in a big way for Denmark’s ATP, enabling it to stand out from its peers. Three years ago the pension fund invested 3.6 billion kroner ($540 million) for a 3.66 percent stake in then-private Dong, which has a fast-growing renewable energy business. The utility’s $3.0 billion initial public offering in June, Europe’s largest so far this year, generated a book profit of 4 billion kroner for ATP and helped the 800 billion kroner fund gain 12.2 percent for the 12 months ended June 30, the only double-digit return on our list. Fund executives also cite positive returns in bonds, private equity and real estate.

The range of returns among institutions owes something to the fact that “they all have different goals, calculate with different currencies and have different risk profiles,” says Roger Urwin, global head of investment content for advisory firm Willis Towers Watson in Reigate, U.K., and a consultant to global pension funds. Across endowments, foundations and private and public pensions, funds with assets of more than $1 billion had a median one-year return of 1.51 percent through June 30, according to the Wilshire Trust Universe Comparison Service (TUCS) in Santa Monica, California.

Urwin points to unusually wide currency fluctuations from June 2015 to June 2016 as a major influence on returns. For example, a benchmark allocation of 60 percent to the MSCI All Country World Index and 40 percent to the Barclays Aggregate Bond Index denominated in U.S. dollars rose 0.7 percent during that period; in Japanese yen and British pounds, the same mix lost 9 percent and gained 11 percent, respectively.

Looking beyond currency swings, asset management had a tough year, particularly in hedge funds. The disconnect between equity prices and fundamentals driven by central banks’ suppression of interest rates was responsible, notes pension fund adviser Jay Love, partner and senior consultant in consulting firm Mercer’s Atlanta office.

U.S. corporate defined benefit pensions did better than other fund types thanks to their higher allocations to bonds. Wilshire TUCS estimates a median return of 2.64 percent for those with assets greater than $1 billion. (Because their fiscal year ends in March or December, they do not publish June numbers.)

The U.S. endowment world, which just started to announce returns as of June 30, had some of the weakest performance among prominent institutions. This poor showing was largely due to heavy investments in private equity and hedge funds, with almost nothing allocated to fixed income. Wilshire TUCS reports a median –1.11 percent return for endowment funds with more than $500 million in assets. Harvard Management Co., which runs the university’s $35.7 billion endowment, suffered an even bigger loss of –2.0 percent. The $25.5 billion Yale University endowment was once more a top performer in this group, pulling off a 3.4 percent gain.

Industry experts advise caution when reviewing the one-year performance of long-term investors. “The data is spectacularly noisy,” Willis Towers Watson’s Urwin says. “You have no hope of drawing inference.” •